Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

October 6, 2021

October 6, 2021

I continue to lean towards the idea that the next GBPUSD dip is a buying opportunity. Of course, we need the dip! There is a lot in the way for possible resistance up to about 1.3670. The underside of the line off of the July and August lows is now (along with short term VWAP resistance…see 2 charts down), the year open is 1.3655, and the March and April lows are 1.3670. The short term wave count is shown below and 1.3530 remains initial support.

October 6, 2021

October 1, 2021

October 1, 2021

Silver turned up sharply today after dipping below the September 2020 low. Support is reinforced by channel support down here as well. Simply, the combination of well-defined support and extreme pessimism (numerous headlines include ‘plunge’) suggest that it’s time to turn bullish. I’m like the long side now. The first test is about 22.88.

October 1, 2021

September 28, 2021

September 28, 2021

I’m bigger picture bullish USDJPY but this is a good spot for a slight pullback. Price is testing 111.00, which is daily reversal resistance and the March high. This is also the center line from the channel that originates at the April low. Proposed support is 110.40s and then 109.90s.

9/23 – USDJPY has broken out. If the breakout is ‘for real’, then 110.00 should provide support. A measured objective for the triangle is the 161.8% expansion of the widest part of the triangle, which is wave B. That calculation yields 114.21. However, the extreme coil in USDJPY suggests that a more aggressive target is appropriate…I’m thinking a 118 handle (see below).

September 28, 2021

June 24, 2021

June 24, 2021

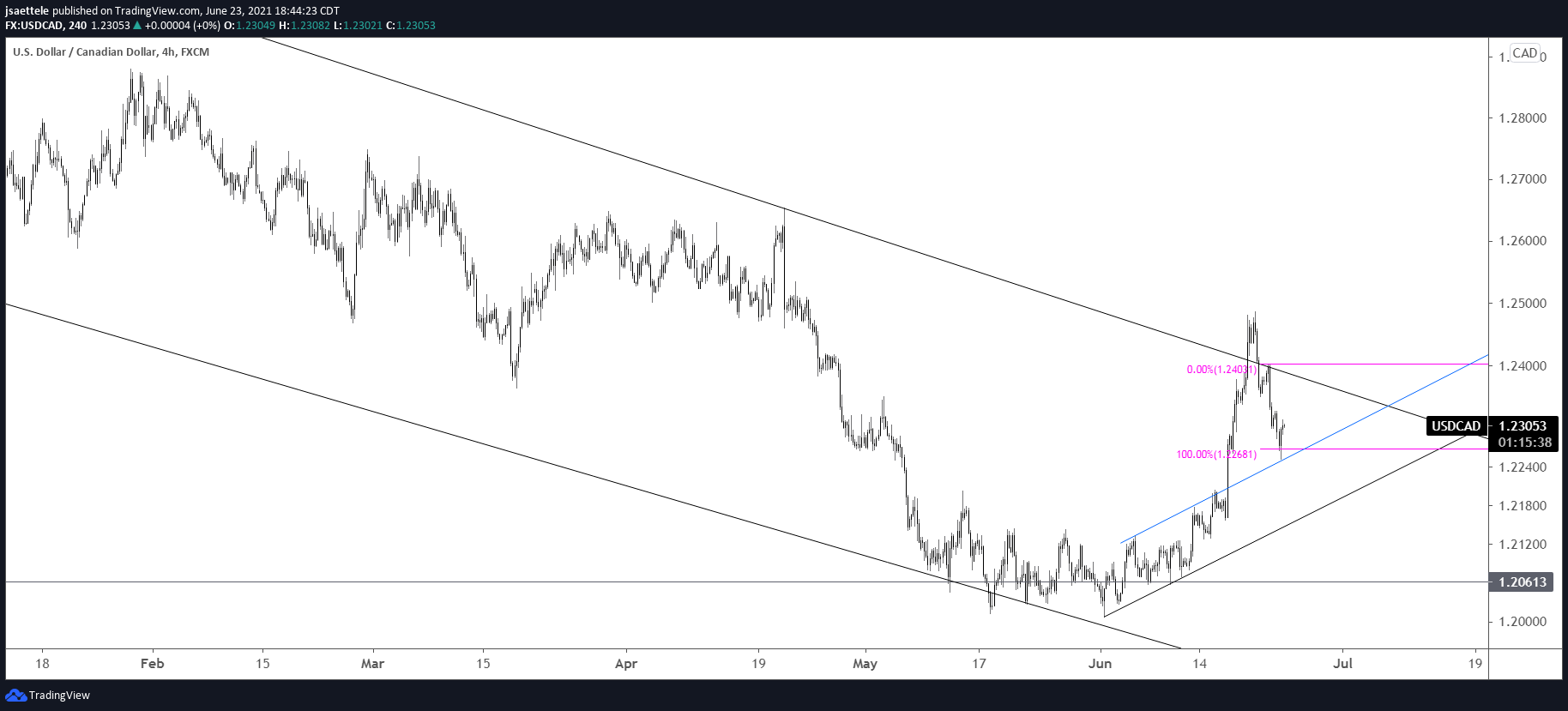

USDCAD nailed support and reversed higher today. Time to be bullish again! Ironically, less words are required when the market adheres to one’s analytical method. ‘Feel the flow’…it’s working. Upside focus is open for now.

June 24, 2021

June 23, 2021

June 23, 2021

BTCUSD reversed higher today from the year open price of 29007. The reversal was accompanied by high volume (J Spike Volume). This is the second such signal since 2018 (note the December 2018 signal which is circled). Given the reversal from the month open, I’m bullish against today’s low. 42000-44000 is proposed resistance again.

June 23, 2021

June 19, 2021

June 19, 2021

It was pure risk-off in FX today as Yen was the only major that strengthened against the USD. I ‘like’ downside in Yen crosses generally, especially given the volume reversal today (see futures chart below…bullish Yen reversals since 2014 are highlighted). Price action from the April low takes the form of a wedge. The lower wedge barrier is about 109.50. The high volume level from FOMC is now proposed resistance at 110.50.

June 19, 2021

June 11, 2021

June 11, 2021

109.20 is the breakdown level in USDJPY now but there is a well-defined bearish fork in place and today’s high at 109.80 is at a well-defined horizontal level. As such, I’m bearish against today’s high and looking towards 108.34 initially.

June 11, 2021

June 8, 2021

June 8, 2021

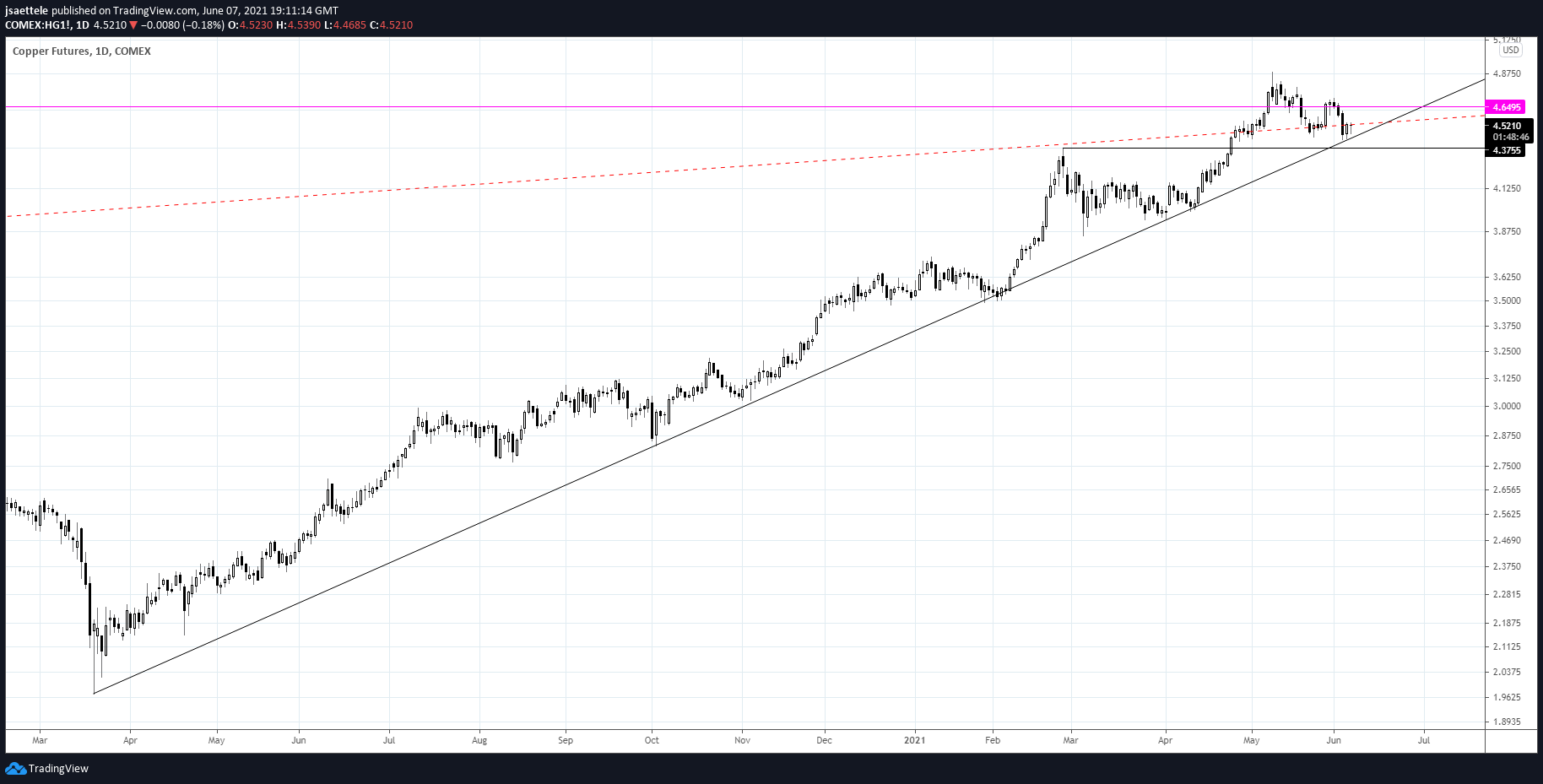

Copper is at 14+ month trendline support. A break below would indicate a significant behavior change and usher in the largest decline since the rally started in March 2020. The long term picture is below.

5/24 – After trading to an all time high 2 weeks ago, copper put in a weekly reversal candle. Price followed through on the downside last week as well. This raises the specter of a massive failure after the move above the 2011 high. A close up view is below.

June 8, 2021

May 21, 2021

May 21, 2021

EURJPY action since the October low has taken the form of a wedge. The rally stalled this week after taking out the September 2018 high but I’m wondering if we get a final spike into 134.30, which is both the 61.8% retrace of the decline from the 2014 high and 2 equal legs up from the 2020 low. A close-up view is below.

May 21, 2021