Market Update 10/5 – Has the USD Turned?

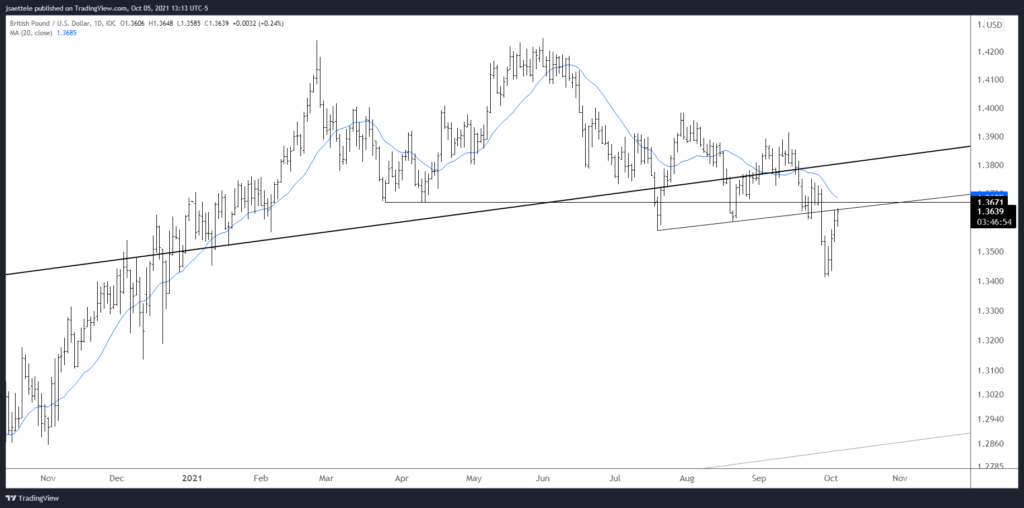

GBPUSD DAILY

I continue to lean towards the idea that the next GBPUSD dip is a buying opportunity. Of course, we need the dip! There is a lot in the way for possible resistance up to about 1.3670. The underside of the line off of the July and August lows is now (along with short term VWAP resistance…see 2 charts down), the year open is 1.3655, and the March and April lows are 1.3670. The short term wave count is shown below and 1.3530 remains initial support.

10/4 – Cable is into 1.3600 but the rally from the low is impulsive (5 waves). The implication is that price pulls back in corrective fashion before resuming higher. In other words, a false breakdown setup is in play. Proposed support is 1.3500/30.

GBPUSD HOURLY

BRITISH POUND FUTURES HOURLY

EURUSD DAILY

EURUSD has been trading around the key 1.1600 for the last week. Unlike other GBP, AUD, and NZD however, near term action is not constructive. That is not to say that price can’t resume higher following Friday’s small range reversal but a clean near term bullish setup is not (not yet at least) in play.

9/29 – With USDOLLAR and DXY testing key levels, it’s no surprise that EURUSD is also testing a key level. Again, 1.1600 is the November (election) 2020 low, 2 equal legs down from the January high, and channel support. Also, the 200 week average is just below (see below). The level is extremely well-defined by this chart looks insanely bearish. Wait and see what happens here. If we break lower then the underside of the channel would become resistance near 1.1600. If we bounce then the first level to pay attention to is 1.1660s.

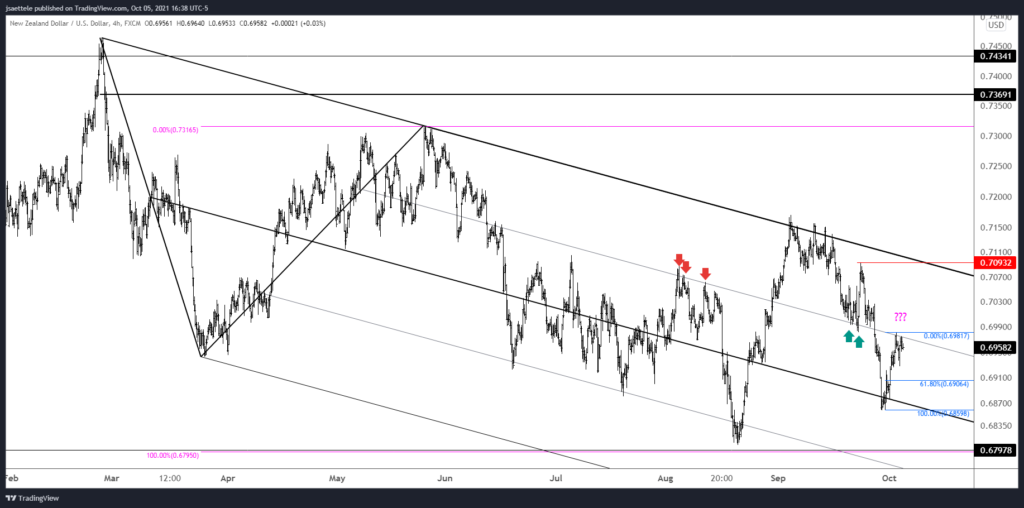

NZDUSD DAILY

No change to NZDUSD (still looking to buy a dip…probably near .6906), but I wanted to make sure that this chart is front and center before RBNZ. Price is pressing into the parallel that was previously resistance and support so a pullback now makes sense.

10/4 – Kiwi is in a situation similar to GBPUSD. That is, the rally from last week’s low is in 5 waves so expectation is for a 3 wave (corrective) pullback before additional strength. Proposed support is .6906/27. Also, don’t forget that NZDUSD has come into long term neckline support and the drop from February could be a bullish wedge (see below). Finally, seasonal tendencies have turned up (see 2 charts down).

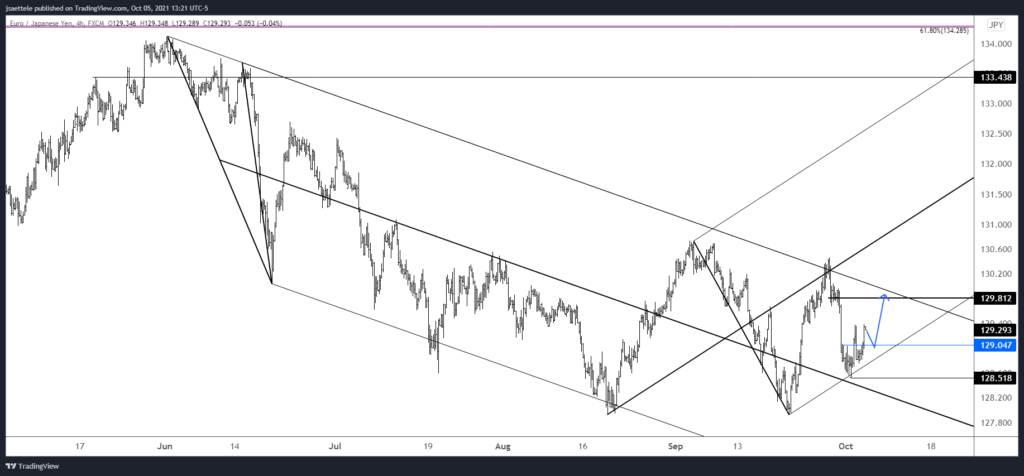

EURJPY 4 HOUR

EURJPY bottomed right at 128.60 last week. With the short term bullish fork in play, I’m willing to take a shot on the long side. Risk is small and there is a possible double bottom with August and September lows. 129.80 is possible resistance. Watch for support near 129.05 (former resistance).

9/30 – EURJPY has pulled back, albeit deeper than expected. Still, the August and September lows constitute a possible double bottom and the rally from 9/22 is impulsive. As such, watch for support near 128.60.