Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

May 18, 2021

May 18, 2021

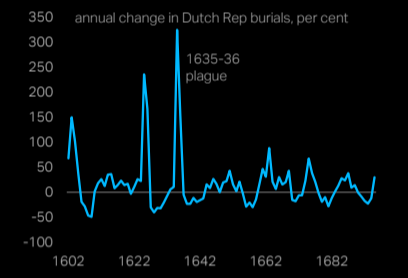

The Dutch Tulip bubble also occurred during a pandemic. One popular narrative for tulip price behavior blames excitable Dutch merchants who had nothing better to do than sit around in taverns bidding up the price of exotic flowers (global trade was effectively in “lockdown” then)…sound familiar?

BTCUSD closed right at the noted 44000 level today. Big spot! I lean towards the downside following completion of the massive top that has been forming since February. The next downside level of interest is 32000 (or so).

May 18, 2021

May 5, 2021

May 5, 2021

Kiwi has traded in a textbook fashion over the last week or so. Resistance at the channel high…hard break of the center line…center line acting as resistance…and finally the lower channel line holding.

May 5, 2021

April 29, 2021

April 29, 2021

USDJPY did indeed pull back from 109.00. My near term view is that the drop is a 4th wave within a 5 wave rally from the 4/23 low. Ideal is support is 108.52/55. This is the 38.2% retrace of proposed wave 3 and the 4/20 high.

April 29, 2021

March 17, 2021

March 17, 2021

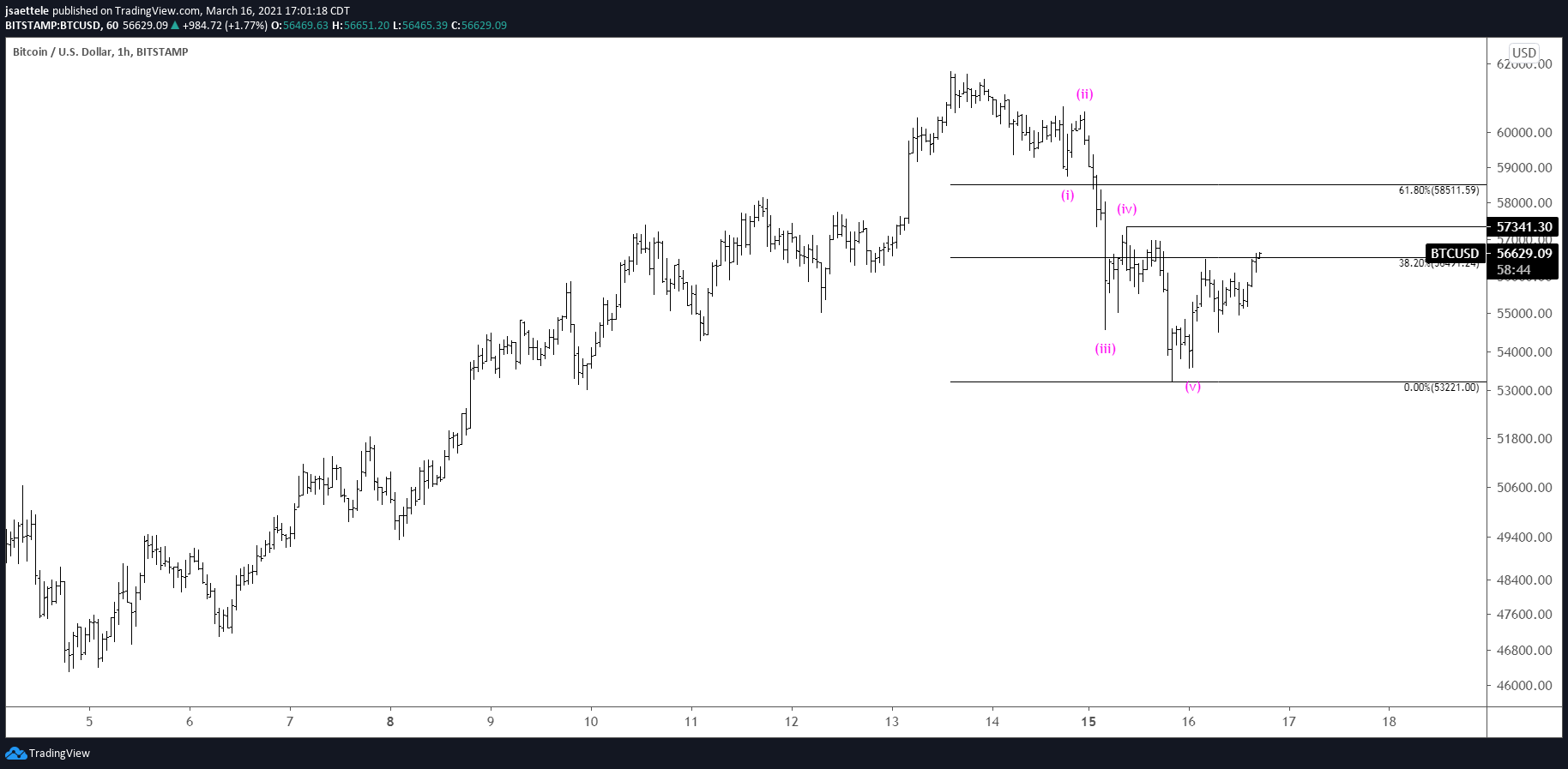

BTCUSD has dropped in 5 waves from the high made over the weekend. The implication is that this rally ends with a lower high before at least one more leg lower. The 2 levels to keep in mind for resistance are the former 4th wave high at 57,341 and the 61.8% retrace at 58,511.

March 17, 2021

March 3, 2021

March 3, 2021

GBPUSD completed its 5 wave drop today and focus is on identifying the end of a 3 wave corrective bounce. The ideal zone for the corrective top is 1.4050-1.4100. A small pullback followed by a rally into that zone is what I’m looking for.

March 3, 2021

March 2, 2021

March 2, 2021

BTCUSD bounced sharply today with stocks and commodity currencies…still all the same trade. Price could turn down right here, which is VWAP from the high and possible channel resistance. At minimum, risk is well-defined for those looking to position for downside in BTCUSD.

March 2, 2021

January 26, 2021

January 26, 2021

daBTCUSD bounced just before 28000 and turned down today at 34888…right at noted VWAP resistance. Resistance registered where it needed to in order to maintain that price has topped and is headed lower. Don’t forget about the 2 bar weekly volume reversal that registered last week.

January 26, 2021

January 22, 2021

January 22, 2021

BTCUSD has turned down sharply following last week’s 2 bar weekly volume reversal. If you want to play in this sandbox, then pay attention to 35000 for resistance and 28000 for the next bounce level. The latter level is a spike low and VWAP from the November low. The former level is defined by VWAP from the high and 2021 VWAP.

January 22, 2021

January 19, 2021

January 19, 2021

BTCUSD made a 2 bar weekly volume reversal last week. TradeStation historical is limited but this is the 2nd 2 bar weekly volume reversal since 2019. The 2019 signal identified an important top. Bitcoin news mentions have also gone parabolic (see below). This isn’t a surprise but it’s comforting to see the data. In other words, the speculative excess isn’t anecdotal.

January 19, 2021