Market Update: January 25

BTCUSD 4 HOUR

daBTCUSD bounced just before 28000 and turned down today at 34888…right at noted VWAP resistance. Resistance registered where it needed to in order to maintain that price has topped and is headed lower. Don’t forget about the 2 bar weekly volume reversal that registered last week.

1/21 – BTCUSD has turned down sharply following last week’s 2 bar weekly volume reversal. If you want to play in this sandbox, then pay attention to 35000 for resistance and 28000 for the next bounce level. The latter level is a spike low and VWAP from the November low. The former level is defined by VWAP from the high and 2021 VWAP.

USDCAD DAILY

USDCAD is testing the line that connects the March and September highs. This line provided resistance in November, December, and January so a break above would indicate an important behavior change. If price pulls back a bit then watch for support near 1.2684. If price accelerates higher from the current level then look to buy a pull back into the top side of the current resistance line (see hourly chart below).

USDCAD HOURLY

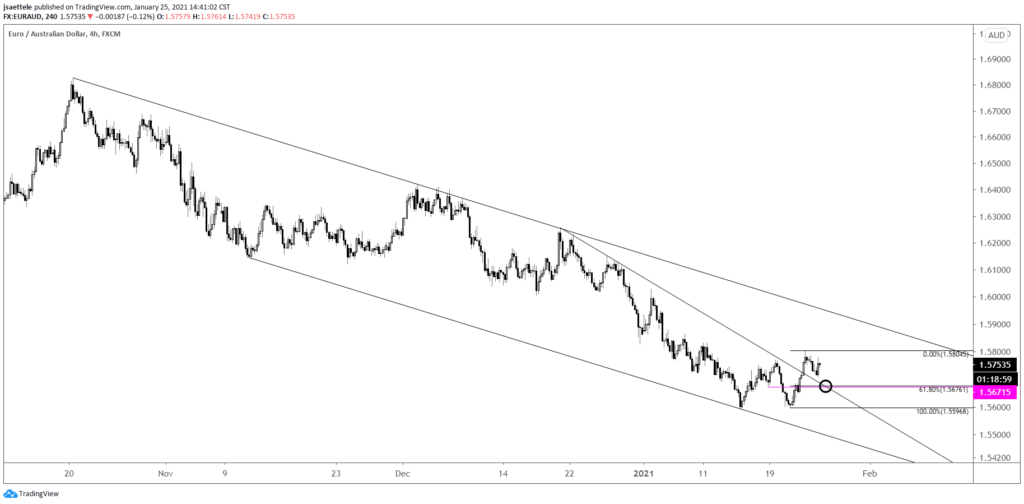

EURAUD 4 HOUR

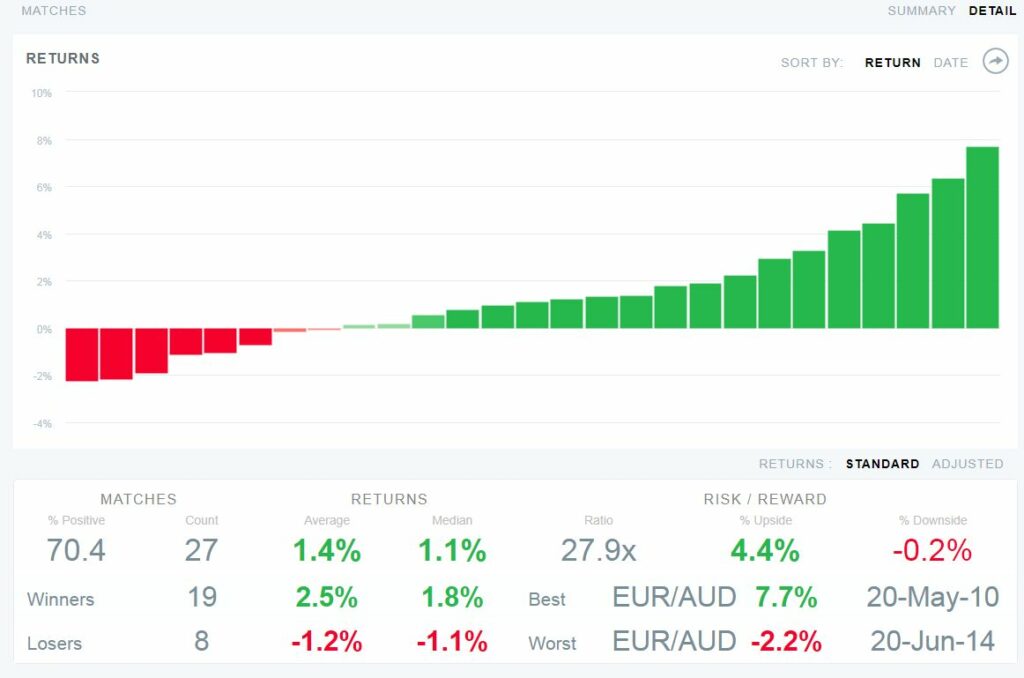

Has EURAUD turned the corner? Price has turned up from the confluence of 9 year channel support (see daily chart below) and the lower parallel of a 3 month bearish channel. Near term, the top side of the trendline from the 12/21 high is proposed support near 1.5670. The level is reinforced by the 61.8% retrace of the rally from the low at 1.5676. EidoSearch metrics are also bullish. There are 27 pattern ‘matches’ for the last 3 months of price action. In 19 of those instances, price was up the next month by an average of 2.5%. The stats are below.

1/13 – EURAUD is sitting just above a 9 year trendline. The line off of the 2012 and 2017 lows is about 1.5650. I’m focusing on this level for support. Any reversal evidence down there would warrant a long position.

EURAUD DAILY

EURAUD EIDOSEARCH (3 MONTH LOOKBACK WITH 1 MONTH FORWARD RESULTS)