Market Update 2/3 – EURUSD Breakout

Market Update 2/2 – SPX into Resistance

February 3, 2022Market Update 2/7 – Major USD ETF Signal

February 7, 2022

EURUSD DAILY

EURUSD has broken out and upside focus is squarely on 1.1660s. This is the 200 day average and August low. 1.1355/80s is well-defined for support now. The zone was resistance in December and is also the top side of the former resistance line that was just broken.

2/2 – EURUSD has reached the noted 1.1310 and is due for a pause. Support at this point is probably 1.1230s (month open is 1.1235). A breakout occurs above 1.1380 (trendline and former resistance). ECB is tomorrow.

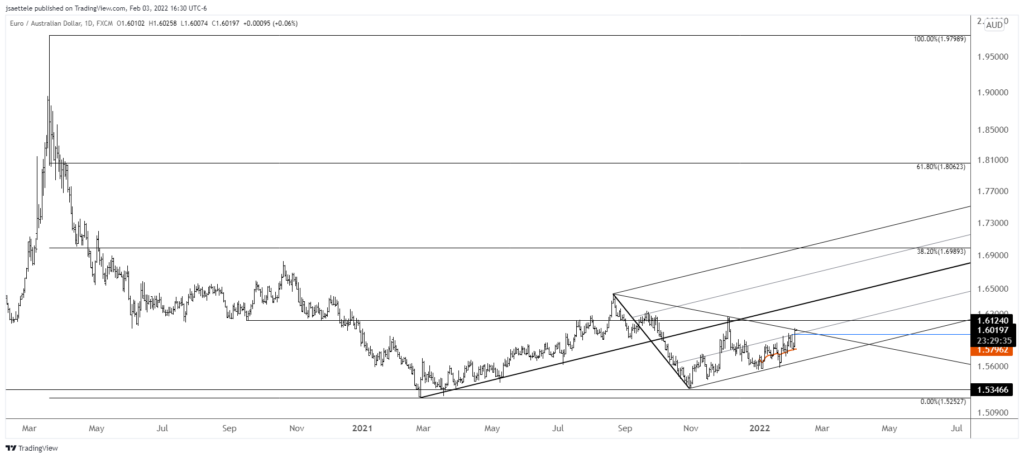

EURAUD DAILY

EURAUD is testing the line that extends off of the August and December highs. Price is just above the 25 line of the fork that originates at the 2021 low. This line was resistance in late 2021 and early this year so upside is now favored. The next level of interest is the median line near 1.6320. The upper parallel is an eventual objective near 1.7000. Watch for support near 1.5965.

1/27 – EURAUD is respecting the bullish fork that originates at the February 2021 low. The median line was resistance in December and the lower parallel was support last week. Even the 25 line was provided resistance earlier this week. The point is that price is adhering to the structure, which should allow for a precise entry on the long side. I like the long side now but will look to enter on either a drop back to the lower parallel near 1.5650 or a breakout above the line off of the August and December highs. That is currently about 1.6030.

EURJPY DAILY

EURJPY is on the verge of taking out the January high. Near term focus is parallel resistance and 2 equal legs up from the December low at 132.46. Watch for support near 131.00.

EURGBP DAILY

EURGBP is on the verge of carving a weekly bullish reversal. Simply, price has respected clear range levels since 2016 and is reversing higher from support now. The first level to pay attention to on the upside is .8520. A break above there targets the well-defined horizontal at .8725.