Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

April 7, 2021

April 7, 2021

GBPJPY topped just before 153.85 (high was 153.41). The cross made a J-Spike in the process. The drop is impulsive in nature and the proposed resistance zone is 152.30/70. The downside level of interest is the 3/24 low at 148.53.

April 7, 2021

April 2, 2021

April 2, 2021

The copper/gold ratio is churning at 8 year trendline resistance. A pullback/consolidation of gains over the last year (the ratio bottomed in April 2020) ‘makes sense’ from this level. This is an important ratio to watch for clues on interest rates (Gundlach often references this ratio) and trends in inflationary/deflationary assets (notice the deflationary crash into the 2009 low and recent inflationary rally for example). I prefer to look at the 30 year bond rate rather than the 10 year note because the long end is more indicative of inflation. The copper/gold ratio and U.S. 30 year bond yield are shown in the chart below. So…pullback in the ratio from resistance…and pullback in rates (also from resistance…see 2 charts down)…which may mean a deeper pullback in the ‘inflation trade’. In FX, this would mean higher USD (already underway), lower commodity currencies (getting started), and lower Yen crosses (waiting on the turn).

April 2, 2021

April 1, 2021

April 1, 2021

Action in PMs is interesting following today’s turns higher in gold and silver. Silver turned up from beneath the early March low but gold never broke the early March low. This non-confirmation is typical at turns. I’m watching gold with a closer eye right now due to the trendline from the January high (the 2021 trendline). A break above would indicate a behavior change and shift focus to the center line of the channel from the August 2020 high near 1780.

April 1, 2021

March 31, 2021

March 31, 2021

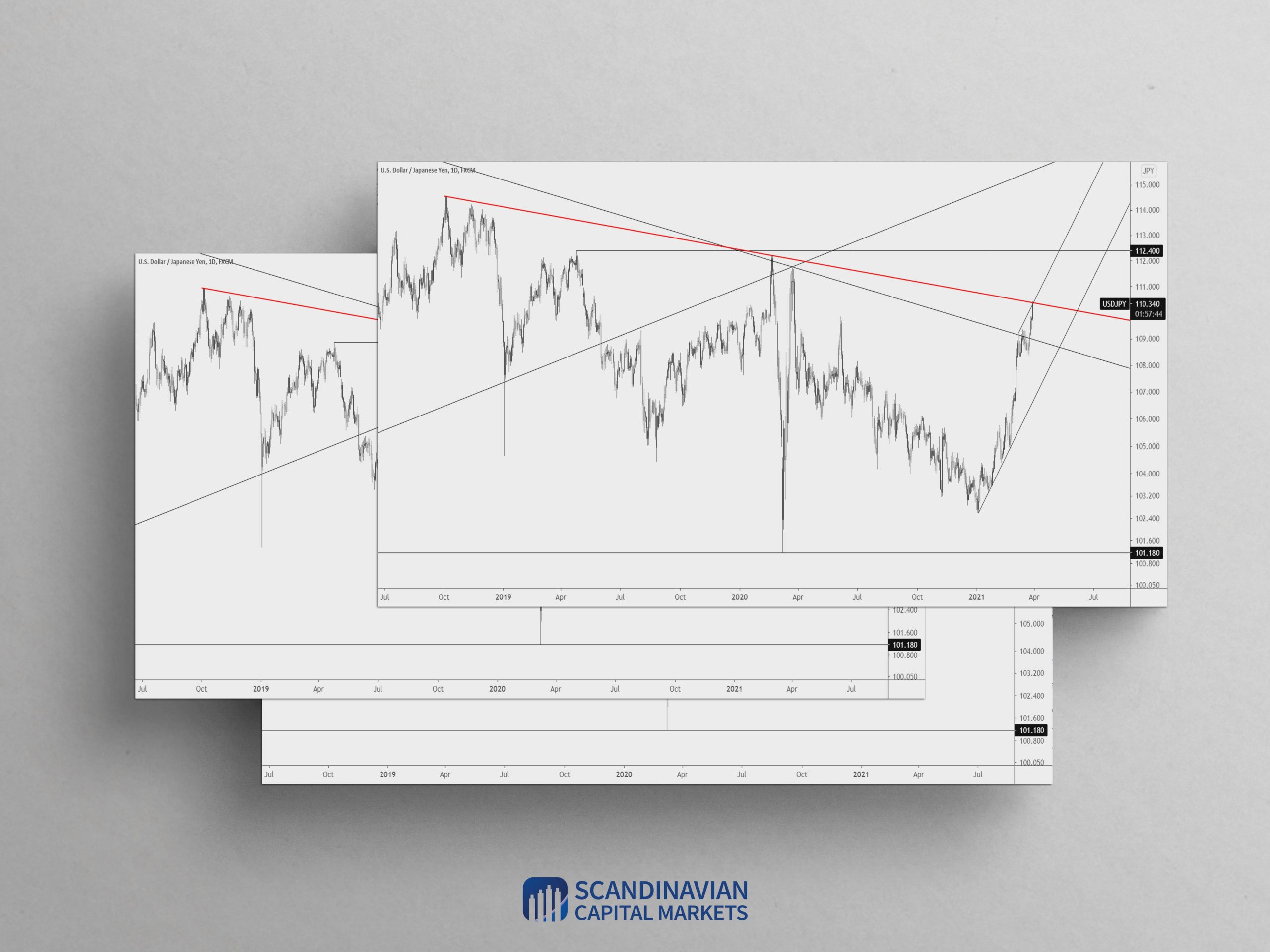

USDJPY continues to rip higher but price has reached an interesting level. The level in question is the line that extends off of the 2018 and 2020 highs. Seasonal tendencies also top this week. This trendline/seasonal combination makes for a great opportunity to fade the move but we need price to suggest that some sort of a top is in place. An intraday volume reversal for example would suffice.

March 31, 2021

March 24, 2021

March 24, 2021

The break above the median line in USDOLLAR is significant! The top side of this line should provide support now near 11810. The September low at 11867 is possible resistance for a pullback/pause but general focus is on the parallel that was resistance in Q4 2020 (then reassess). That line is about 12030. The long term view is shown below for context.

March 24, 2021

March 16, 2021

March 16, 2021

EURUSD may be working on a 3 wave rally from the 3/9 low. Proposed support for wave B is just under 1.1900…1.1887/99 is daily reversal support, the 61.8% retrace of the rally from the low, and 2 equal legs down from the 3/11 high. If this interpretation is correct, then price will rally into 1.2050/90 (month open is 1.2070 as well).

March 16, 2021

March 10, 2021

March 10, 2021

USDJPY nailed resistance and reversed (high today was 109.23). Simply, I am looking lower until roughly 107.00 (the next decision point?). Proposed resistance is now 108.80ish.

March 10, 2021

March 4, 2021

March 4, 2021

A well-defined base has formed in USDOLLAR since mid-February. Zooming into price action since the 2/25 low reveals an impulsive advance followed by a drop and today’s bounce. I’m of the mind that the drop and bounce compose waves A and B of a 3 wave pullback. Ideal support for the end of the pullback is 11634/51.

March 4, 2021

March 1, 2021

March 1, 2021

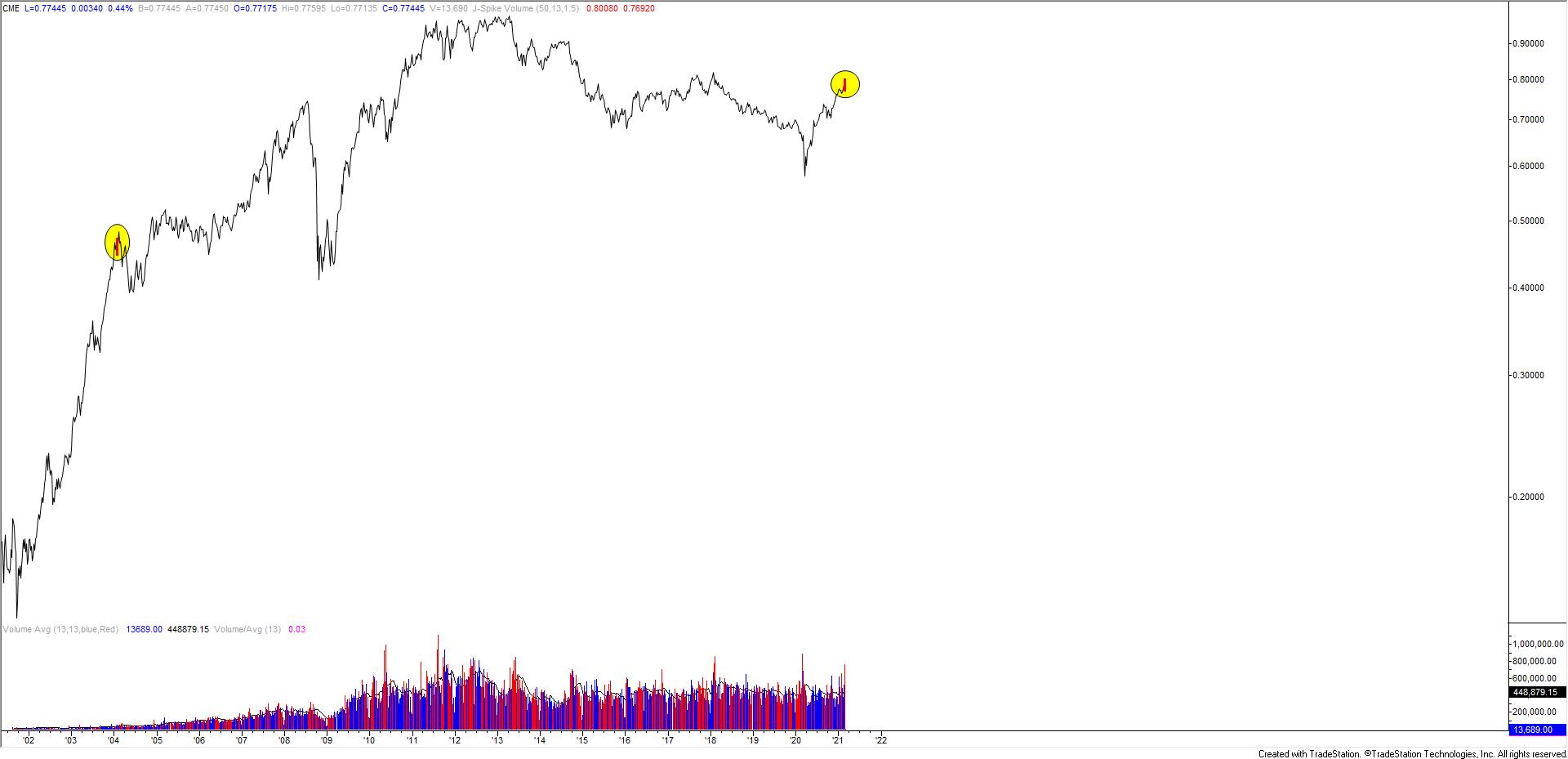

AUDUSD followed through on its daily reversal last week and ended up with a weekly volume reversal. The only other weekly volume reversal occurred at the January 2004 high. Price is bouncing from the 50 day average in early week trading. Proposed resistance is .7887, which is the 61.8% retrace of the decline and the center line of the Schiff fork from the March low (see below chart). The next downside level of interest is the lower parallel. That is currently near .7500.

March 1, 2021