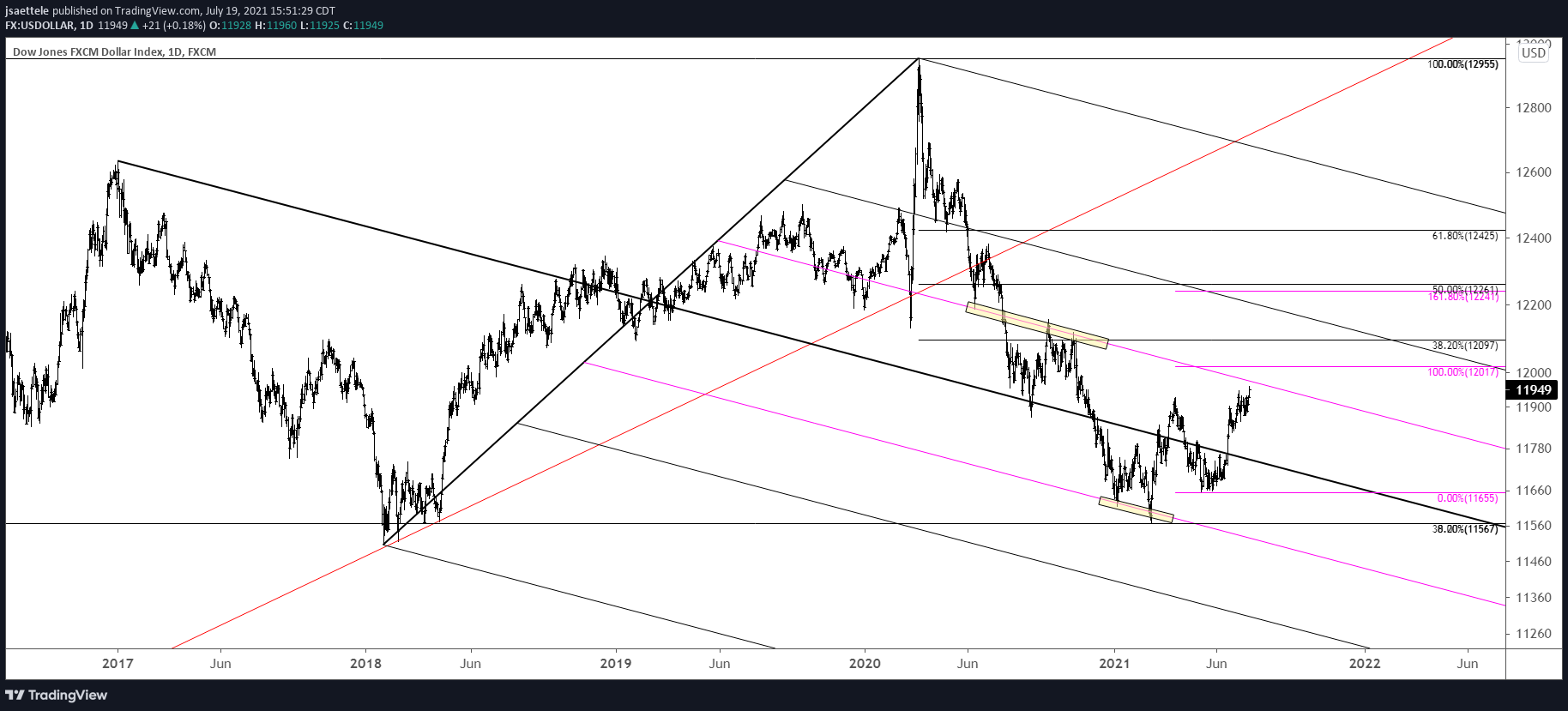

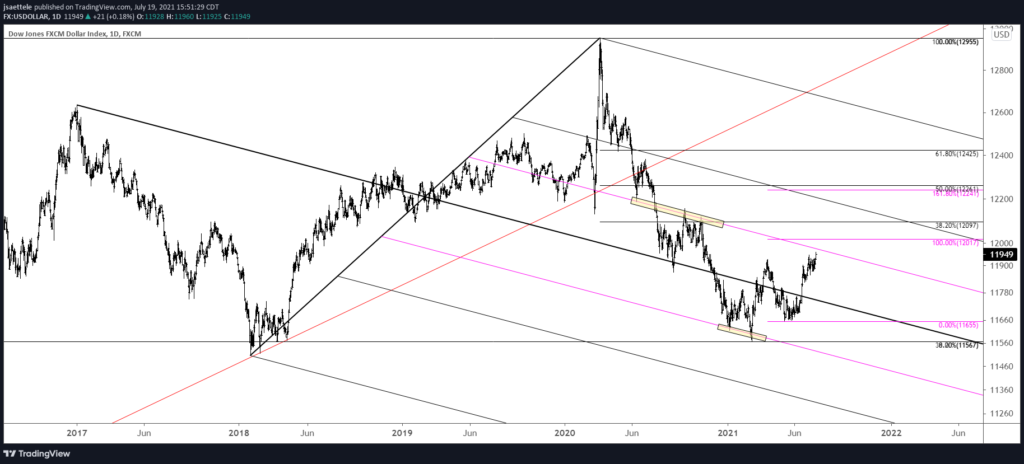

Market Update 7/19 – Big Test for USD Bulls

USDOLLAR DAILY

We got the leg up in USDOLLAR and price has entered the a possible resistance zone. My ‘base case’ is that price does pull back before resuming higher. Keep it general for now regarding USDOLLAR.

7/14 – I’m torn on USDOLLAR here. The count above makes a compelling Elliott case for another leg up with action since the high as a 4th wave triangle. The upside zone is still 11980-12017. The line in the sand for this count is 11856. If that gives way, then I’ll lean towards a deeper drop towards 11804. Non-USD crosses might be the way to go right now without much of a view on immediate USD direction. More on that at the end of today’s post.

NASDAQ FUTURES 4 HOUR

Nasdaq did indeed break before furiously rallying at the end of the day. A bearish fork is in play which offers points of reference to trade from the short side. Watch for resistance near the 25 line (price bounced from the 75 line), which is 14667-14708 (in line with former lows). The big downside test is 14060.

7/15 – Nothing to add regarding NQ. Just be aware that price closed right at the short term trendline today. I’d love to see a tag and reversal off of that upper channel line near 15100 but if price breaks tomorrow then it’s ‘proper’ to operate from the short side.

NASDAQ FUTURES HOURLY

AUDUSD DAILY

AUDUSD has broken the critical .7415 level (September high, 23.6% retrace from March 2020, and 2 legs down from the high). This level is now proposed resistance. Barring a ‘bear trap’, downside potential is significant. Specifically, there is a slope confluence near .6800.

AUDUSD 4 HOUR

NZDUSD 4 HOUR

NZDUSD focus is STILL on .6750-.6800. The month open is .6985, which serves as a point of reference to short with a relatively tight stop against Friday’s high.

7/13 – Kiwi continues to play out beautifully. .7000 has provided resistance the last 3 days and focus remains on .6750-.6800. RBNZ is tonight (Wednesday in New Zealand) so it’s possible that we get a flush into .6800 or so before a rebound. For us, this sets up a possible opportunity to flip from short to long.

USDCAD DAILY

USDCAD has eyes for a 1.30 handle. The April high at 1.2654 is proposed support now. Notice how the 25 line from the bullish fork intersects this level over the next few days. Support at that level would ‘make sense’ given that price turned down from the 75 line today (see 4 hour chart below).

7/15 – The initial BoC reaction was wrong. Price spike lower and immediately reversed. After all that, nothing has changed. Upside focus remains 1.2650 and 1.2720/30. Support should be about 1.2560 now. This is the center line of the channel from the low. This center line has been resistance and support for most of July.

USDCAD 4 HOUR

USDJPY 4 HOUR

USDJPY turned down from noted resistance on Friday and focus remains on 108.57. Resistance should be 109.70/80 now.

7/15 – I still favor shorting USDJPY into 110.30/40. In fact, a short term channel has been confirmed with the tag of the center line today. The upper parallel is in line with proposed resistance.