Market Update 11/4 – Is USDSEK the ‘Tell’?

USDSEK DAILY

I have not been ‘in tune’ with USD moves for the better part of the last month. During periods of uncertainty, I find it helpful to go back to the basics. USDSEK is often a ‘tell’ for general USD trends and pivots. Here are several objective technical observations;

USDSEK is holding the 200 day midpoint (similar to the 200 day average)…this is bullish.

The decline from the 8/20 high is in 2 equal legs…this is characteristics of a corrective decline within a larger advance…bullish

Daily RSI registered ‘overbought’ readings at price highs over the last year and RSI readings at price lows have been above 30…this is also bullish.

In summary, the weight of evidence is USDSEK bullish and therefore generally USD bullish (notably against European FX). At least that’s where my mind is at the moment.

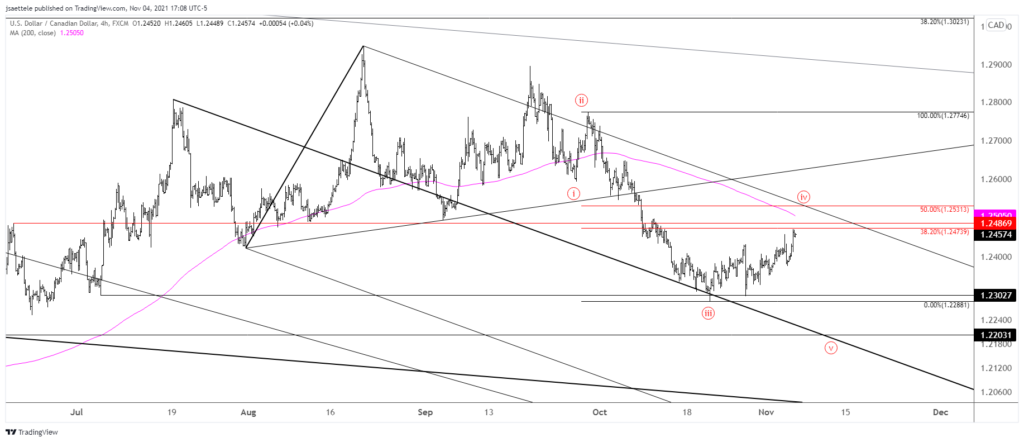

USDCAD 4 HOUR

It took a while but USDCAD is into proposed 4th wave resistance. Be on alert for reversal evidence between here and 1.2530. This could occur with a spike on Canadian and U.S. jobs numbers tomorrow.

10/26 – No change to USDCAD but I’m re-posting the chart because BoC is tomorrow. I continues to favor the scenario in which the bounce from 10/21 is a 4th wave. Ideal resistance is 1.2470/90 (38.2% retrace of well-defined pivot since June).

AUDUSD HOURLY

The AUDUSD wave count remains the same despite today’s drop. With price testing the well-defined .7385 pivot, I’m thinking rally attempt in order to correct the decline from the late October high. Eventual resistance is .7480.

11/3 – AUDUSD didn’t quiet make it to .7400 before rebounding today. Unlike NZDUSD, the drop from the top can be counted as an impulse. As such, I’m wondering if Aussie bounces but fails near .7500 (61.8%) while NZDUSD makes a new high. This would set up a non-confirmation and reversal setup…something that would be expected in a confusing market.

EURAUD HOURLY

I love this EURAUD chart. Strength from the low is clearly impulsive. The labels are not shown but the count jumps off of the screen! With a 5 wave rally visible, I favor a pullback (in line with an AUDUSD bounce) into proposed 1.5460 or so support before another leg higher. Eventual upside is near 1.5900 (see below).

EURAUD DAILY