Market Update 6/8 – TLT Breakout (U.S. Bond Yield Breakdown)

TLT DAILY

TLT gapped higher through the median line today. This is typical price behavior around a median line. Focus is higher towards 148.90 (give or take). Remember, higher TLT means lower rates. This can (not always) correlate with risk aversion and lower Yen crosses in FX.

5/25 – After pulling back from the early April high, TLT found support at the 61.8% retrace of the rally. Price is again at the median line from the channel that originates at the March 2020 high. Markets tend to exhibit heightened volatility around median lines. I’m on the lookout for a surge higher. I’ll address implications for FX and equities if we get a strong TLT (bond) move.

GBPUSD 4 HOUR

It was awfully quiet in G7 FX today. The EURUSD range was .24%. That’s the lowest since 2/15, when the daily range was .23%. Prior to that,the lowest range was .20% on 2/17/20…right before COVID dominated the narrative for a time. Even so, don’t forget about the GBPUSD volume reversal on 6/1. That’s still the high. Near term, the channel is now about 1.4050. I’m targeting there for now.

6/1 – Pound futures made a daily volume reversal today. The signals shown are at least one year high/lows with at least 1.5 x the 20 day average volume. Those are some timely signals. Price is testing the center line of the channel from the April low (see spot chart below). In the event of a bounce, resistance is 1.4210. Near term downside focus is the lower parallel, currently near 1.4005.

USDJPY 4 HOUR

Absolutely no change regarding USDJPY comments other than noting that proposed resistance is barely higher at the 61.8% retrace of the drop. That level is 109.89. The breakdown level is about 109.10.

6/7 – USDJPY failed at the line off of the 2018 and 2020 highs again last week. A break below 109.00 would suggest that a top is in place. Proposed resistance is the high volume level from NFP at 109.75.

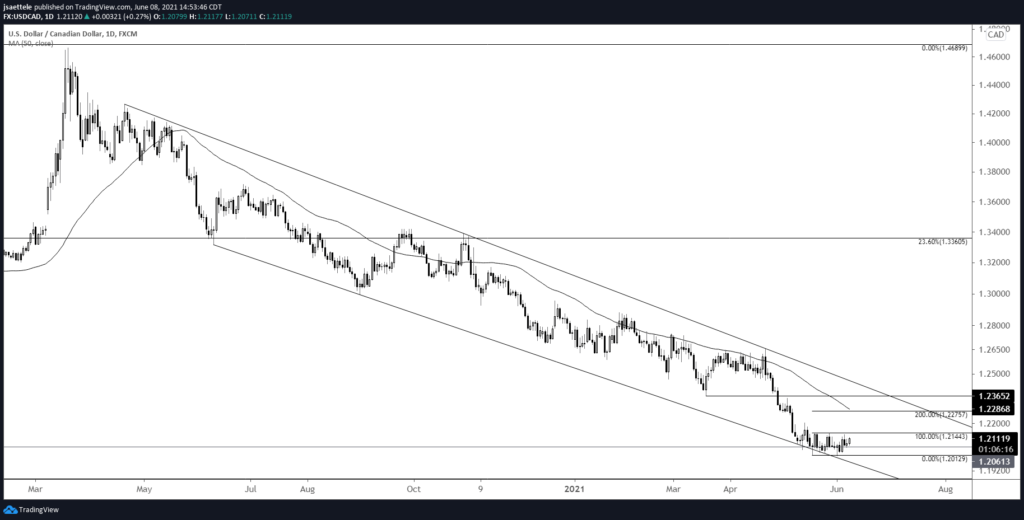

USDCAD DAILY

USDCAD has flat-lined for about a month in what could be a low volatility base from 6 year lows. The bullish trigger is 1.2144, in which case the near term objective would be 1.2275 followed by trendline resistance near 1.2400/50. BoC is tomorrow. I’ll reassess the situation after the event and plot an entry if price action dictates.