GBP/USD Sinks Amid Bleak Economic Outlook

The British pound fell to its lowest levels against the US dollar since April 7th in early trading on Thursday. Grim GDP data resulting from the coronavirus weighed on sterling, while the dollar was lifted by dismissive comments on negative interest rates by Federal Reserve chairman Jerome Powell.

The UK Office for National Statistics (ONS) reported on Wednesday that gross domestic product contracted by 5.8% month-on-month in March. The figure marks the worst contraction since monthly record keeping began in 1997. Jonathan Athow of the ONS stated: “With the arrival of the pandemic nearly every aspect of the economy was hit in March, dragging growth to a record monthly fall.” Analysts had expected an even worse contraction of 7.9%.

Last Thursday, the Bank of England (BOE) said it expects GDP to fall by 14% over 2020, which would mark the biggest drop since 1706. BOE governor Andrew Bailey stated; “The scale of the shock and the measures necessary to protect public health mean a significant loss of economic output has been inevitable in the near term.” On a brighter note, he added growth could rapidly recover next year.

While the BOE Monetary Policy Committee voted to keep interest rates at a historic low of 0.1% last Thursday, more easing may be coming. BOE deputy governor Ben Broadbent told CNBC on Tuesday that “it is quite possible that more monetary easing will be needed over time.” Rising speculation over the possibility that the BOE will cut interest rates below zero is adding pressure to sterling.

Meanwhile, the US dollar strengthened on Wednesday after Fed chair Jerome Powell lowered expectations of negative interest rates in the United States. In a webinar hosted by the Peterson Institute for International Economics he said; “The evidence on the effectiveness of negative rates is very mixed” adding “this is not something that we’re looking at.”

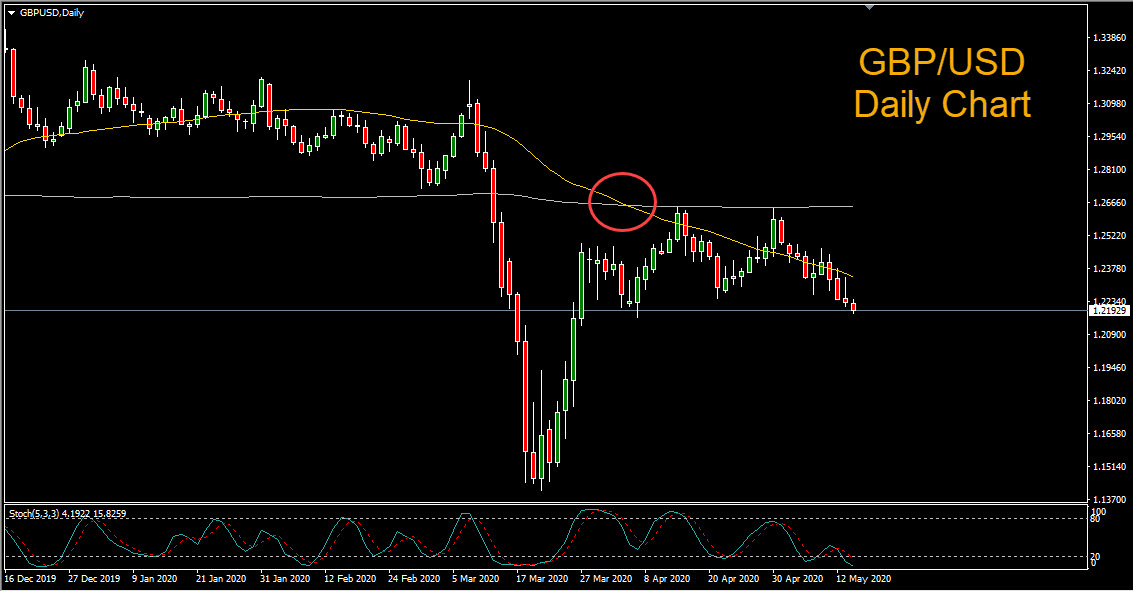

We can see on the GBP/USD daily chart that a bearish ‘death cross’ pattern (50 period moving average crossing below the 200 period moving average) formed in early April. Price ran into the 200 period SMA like a brick wall twice before reversing lower and forming a double top. Key support lies at the prior low of 1.2161.