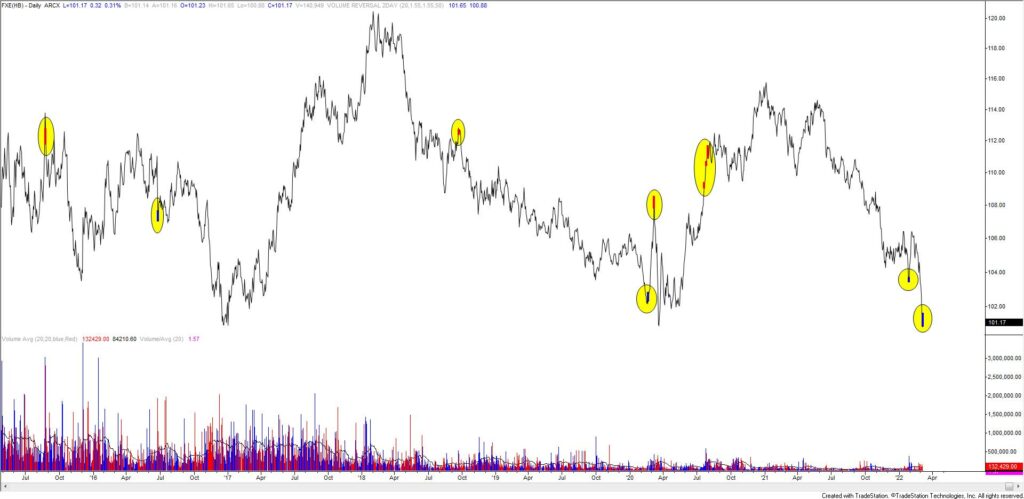

Market Update 3/8 – Euro Reversal Signal

FXE DAILY

FXE (euro ETF) completed a 2 day volume reversal today. This means that the prior day was a high volume down day and today was a high volume up day. Previous instances are highlighted. Most signals have been reliable. Near term, the important test remains the upper parallel from the short term fork, now near 1.1040. If EURUSD is going to recover then I’d think that 1.0885 provides support.

3/7 – EURUSD has cut through everything that I thought would provide support and price has now reached the line off of the 2017 and 2020 lows. If this doesn’t hold then I guess there is nothing until the March 2020 low at 1.0636. Near term (see below), price has responded to the lower parallel of the fork from the 2/10 high. The important test on the upside (if price bounces of course) is about 1.1060. Finally, daily RSI is below 23. Previous instances over the last 5 years are shown 2 charts down.

EURUSD HOURLY

AUDUSD DAILY

AUDUSD followed through on Monday’s reversal but price is fast approaching the well-defined .7220s. There isn’t much change to yesterday’s comments other than noting that .7350 is now proposed resistance.

3/7 – AUDUSD reached .7420s (trendline from 2021 highs) and reversed sharply lower today. The action probably caps Aussie for a while. .7280s is a possible bounce level although bigger support isn’t until the channel center line (blue line…which was former resistance) near .7220. Proposed resistance is now .7375.

NZDUSD 4 HOUR

.6850 held as resistance in NZDUSD. This level remains resistance. I favor selling into that level and targeting trendline support near .6700. In the interim, price could bounce near .6770.

3/7 – Kiwi reversed from the line that connects the December 2019 and September 2020 highs. This line was support in August/September 2021 and resistance in January. It’s clearly important. The 200 day average is also just above today’s high. Focus is lower towards the trendline from the low near .6700. Proposed resistance is .6850/70.

EURCAD DAILY

EURCAD has reversed sharply higher after slipping under the 2017 low. Despite the recent plunge, weekly RSI remains above 30 and sports divergence with the price lows. This is constructive. Price tagged the January low today so a pullback may be in order. Watch for support near 1.3950 (see hourly chart below). Upside focus is the uncovered close from 2/25 at 1.4314.

EURCAD HOURLY