Market Update 2/7 – Major USD ETF Signal

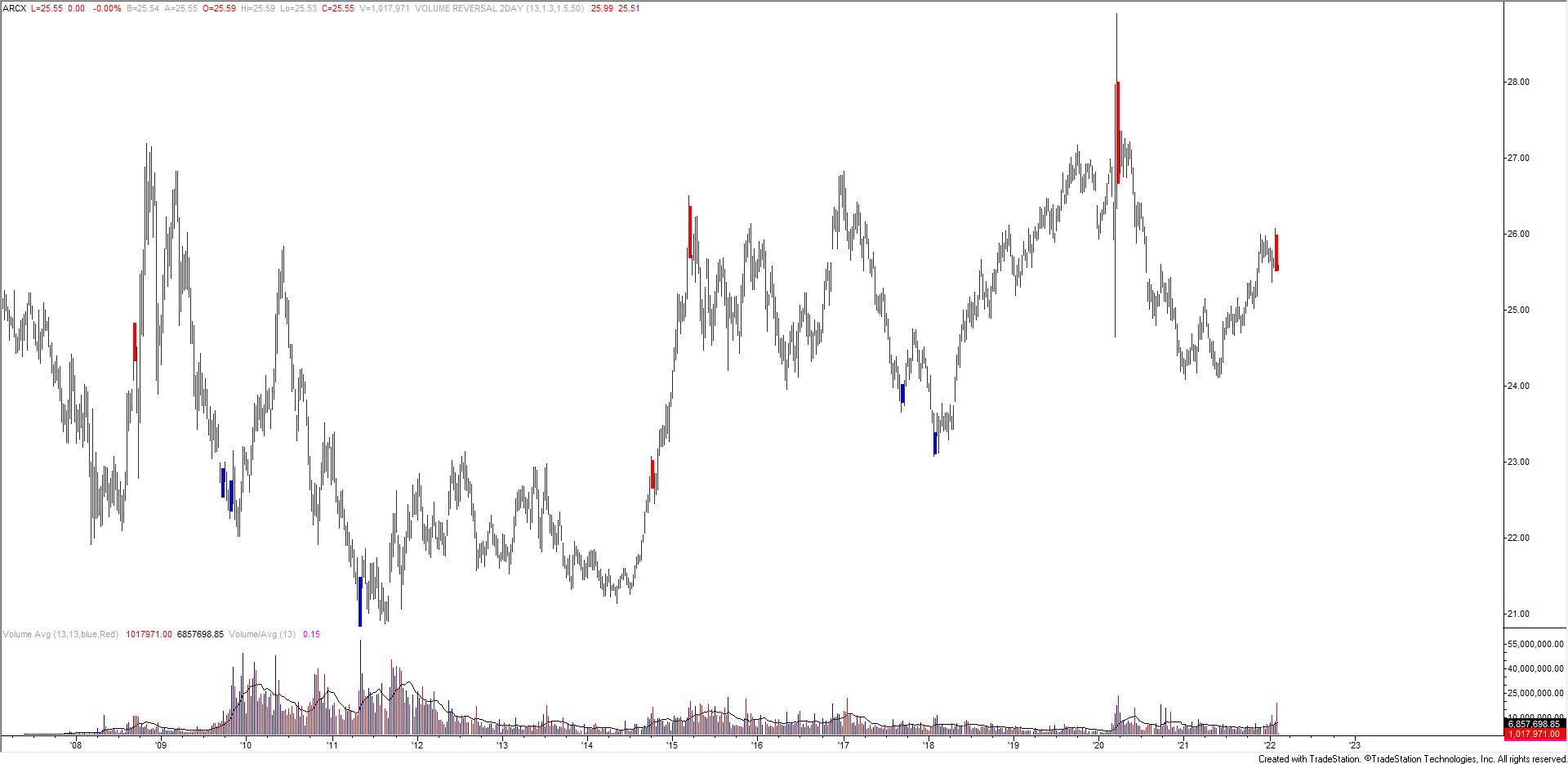

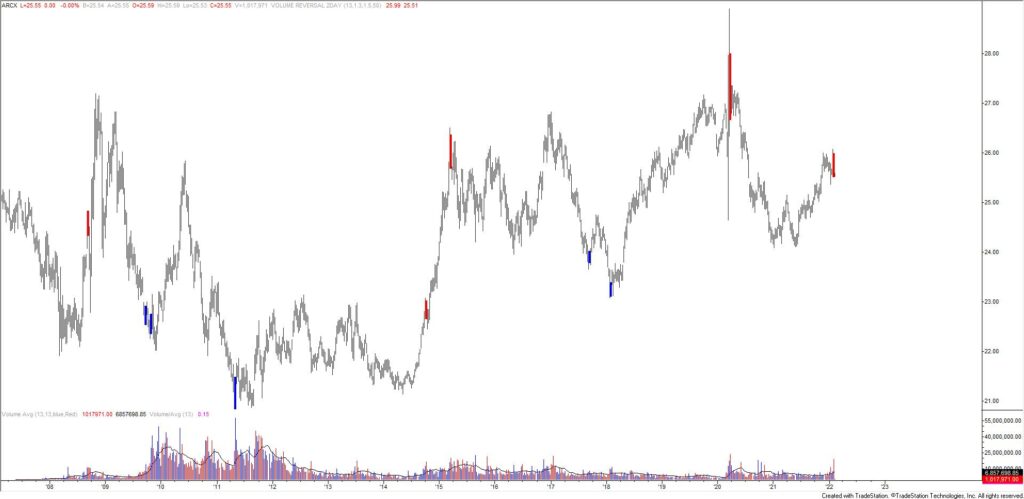

UUP WEEKLY

UUP (USD ETF) completed a weekly volume reversal last week! Most signals since inception of the ETF have been identified important turns in the ETF and therefore the USD in general.

SPOT GOLD 4 HOUR

Gold has recovered and has reached the bottom of the proposed resistance zone. As a reminder, the 61.8% retrace is 1826 and the well-defined horizontal is 1830. If gold is building energy for a larger advance then 1814/15 should provide support.

2/2 – Gold is clawing back after getting destroyed last week. 1822/30 sticks out as resistance. The bottom of the zone is defined by 2 equal legs up from the low. The top of the zone is defined by a clear horizontal. The 61.8% retrace is in the middle of the zone at 1826.

EURUSD 4 HOUR

EURUSD took a breather today following last week’s surge. Again, former resistance at 1.1380s is ideal support now. The year open reinforces the level as support at 1.1373. I’m looking for this level to hold as support and for price to resume higher towards 1.1660s.

2/3 – EURUSD has broken out and upside focus is squarely on 1.1660s. This is the 200 day average and August low. 1.1355/80s is well-defined for support now. The zone was resistance in December and is also the top side of the former resistance line that was just broken.

GBPUSD 4 HOUR

GBPUSD has indeed pulled back and the drop from last week’s high is in 5 waves. As such, watch for resistance near 1.3575 (61.8% of the 5 wave drop). A level to keep in mind for possible support is the 61.8% retrace of the rally from the December low at 1.3460.

2/2 -GBPUSD is nearing the 61.8% retrace of the decline from the January high at 1.3600 so respect potential for a pullback. I’m ‘thinking’ that the top side of the short term former resistance line (blue line) is in line for support near 1.3480/90 on BoE tomorrow.

USDJPY DAILY

USDJPY continues to press against the upper parallel of the channel from the March 2020 low. Also, don’t forget about the long term 61.8% retrace at 115.52. I’m looking for price to roll over. Weakness below 2022 VWAP at 114.80 would serve as the trigger for a short.

2/2 – The USDJPY decline from last week’s high is in 5 waves so respect bounce potential into 115.05 or so before another leg lower.

AUDUSD HOURLY

The AUDUSD rally from the January low is in 5 waves and price pulled back in 3 waves last week (extended c wave). As such, my working assumption is that a 3rd or C wave within a bullish cycle from the January low is underway. Minimum upside focus is where the rally from the January low would consist of 2 equal waves at .7252 but potential is far greater given the longer term reversal evidence (explained in 1/31 text). Watch for support near .7090.

1/31 – Aussie futures made a daily volume reversal today (2 bar reversal). The chart speaks for itself…most signals have worked out well and some have worked out incredibly well. Given the massive level that AUDUSD is trading on (November 2020 low and December low), I’m inclined to ‘believe’ this reversal. The rally is unfolding in an impulsive manner so focus is on buying a small pullback…probably at .7010/20 (see below).

USDCAD 4 HOUR

USDCAD has rolled over after finding resistance near 1.2760. Focus is lower towards the trendline that originates at the June 2021 low near 1.2515. This is near the double top objective at 1.2504. Proposed resistance is 1.2700/15.

2/1 – The USDCAD rally from 1/19 channels in a corrective manner. I’m watching for either a break below the channel or resistance near the median line in the 1.2760s.