Sterling Traders Brace for Volatile Month Ahead

The British Pound weakened against its major rivals amid reports that Brexit talks are stalling and as the specter of a ‘no-deal’ Brexit reared its head again.

On Wednesday, the UK’s chief negotiator Sir David Frost said that the EU needs to change its position in order to reach an agreement with the UK in trade talks. Speaking to the Future Relationship with the European Union Committee he stated: “If you’re asking do we think the EU needs to evolve its position to reach an agreement? Yes, we do.”

In a letter to Westminster leaders, EU chief Brexit negotiator Michel Barnier confirmed that the European Union is “open” to delaying the UK’s full departure from the bloc for up to two years. He said: “Such an extension of up to one or two years can be agreed jointly by the two parties” adding that “the European Union has always said that we remain open on this matter.”

However, Sir David Frost rebuffed the offer, stating: “That is the firm policy of the Government, that we will not extend the transition period and if asked we would not agree to it.” The end of June is the deadline by which the UK and EU can formally agree to extend negotiations. The Times newspaper reported on Thursday that British Prime Minister Boris Johnson will resume Brexit talks in Brussels in the coming month.

Meanwhile, Bank of England Governor Andrew Bailey expressed his views on Wednesday in an opinion piece for The Guardian newspaper. He touched on the prospect of negative rates, stating: “We have signalled that we stand ready to do more within the framework of policies we have used to date. And, in view of the risks we face, it is, of course, right that we consider what further options, such as cutting interest rates into unprecedented territory, might be available in the future. But it is also important that we consider very carefully the issues that such choices would give rise to.” The next Bank of England meeting is scheduled for June 18th.

Adding to the gloom, the United Kingdom has the worst COVID-19 death toll in Europe and the second worst globally. According to data from Johns Hopkins University, the UK has suffered 37,542 fatalities while the United States has now reached 100,442.

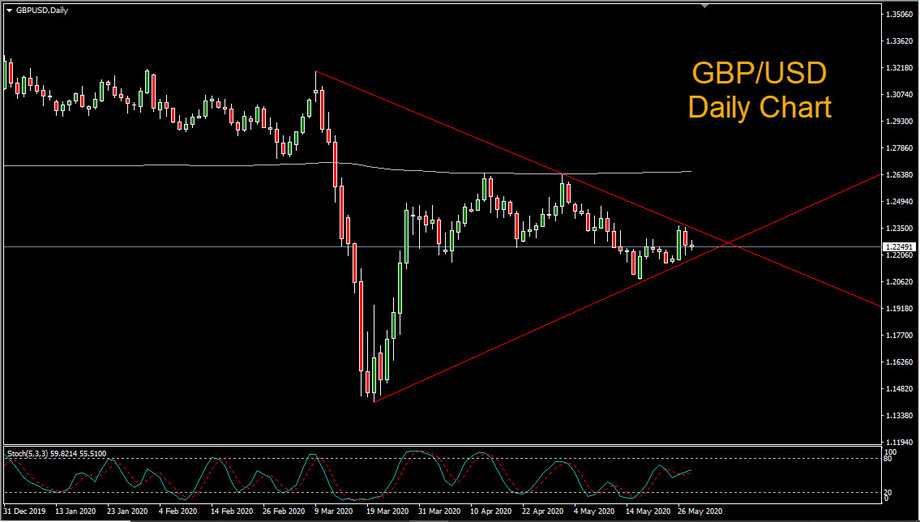

Looking at the GBP/USD daily chart we can see that pressure is building up within a symmetrical triangle pattern. Price slammed into the 200-period simple moving average (SMA) twice, forming a double top before reversing lower.