Market Update 7/29 – GBPUSD Reversal Watch

SPOT SILVER DAILY

Silver has traded into resistance from former support, a trendline confluence and the 200 day average. I like the short side against today’s high (risk is tight). Downside focus is unclear but I’ll simply note that the trend has been lower since May (sideways since August 2020) and that I view this rally as an opportunity to short.

7/20 – Silver has broken the line off of the November and March lows as well as the 200 day average. The underside of the line and former lows are proposed resistance at 25.55/71. A bounce into there would present a bearish opportunity. Downside focus would be near range lows from September and November just under 22.

DXY 4 HOUR

DXY is fast approaching the noted 91.50/75 proposed support. The zone is reinforced by VWAP from the May low, which is currently 91.63 (see below). Bottom line, be on alert for an upside reversal from just under the market. I’ll note 92.30 as possible short term resistance now (short term median line).

7/28 – DXY traded up to 93.19 one week ago and reversed. In other words, price is following ‘the script’. A short term bearish fork is in play and price is at the median line now. This is important because median line acceleration (in this case lower) is a possibility. Focus is towards 91.50/75. Again, this could happen quickly.

U.S. DOLLAR INDEX FUTURES HOURLY

EURUSD 4 HOUR

EURUSD is basically the exact opposite as DXY. Proposed resistance remains 1.1950/90. VWAP from the May high is currently 1.1960 in futures (see below), which equates to about 1.1950 in spot (spot currently trades at a 10 pip discount to futures). If price pulls back before reaching this zone then watch for 1.1830/47 support.

7/27 – Focus remains higher for EURUSD following today’s hold. In fact, price pulled back to noted support and immediately turned higher. FOMC is tomorrow. The only reason I mention that is because of the potential for increased volatility. Even if you told me what Powell would say tomorrow, it wouldn’t matter. Only the reaction matters! Bottom line, price has held support (for now at least) so I’m looking higher towards the well-defined 1.1950/90 zone.

EURO FUTURES HOURLY

GBPUSD 4 HOUR

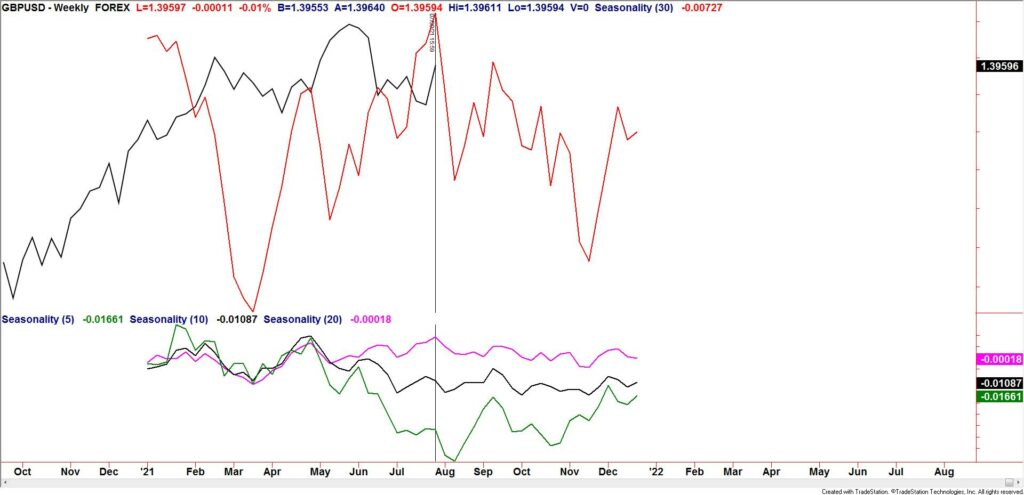

GBPUSD hasn’t quite reached 1.4000 (high today was 1.3982) but the upper parallel was reached. I am on reversal watch in Cable right now…especially given bearish seasonal tendencies over the next few weeks (see below).

7/28 – Cable is testing the early July high. This is possible resistance but I lean towards a run at 1.4000 before attempting to fade strength. This view is partly based on the DXY view.

GBPUSD WEEKLY SEASONALITY

GBPJPY DAILY

GBPJPY printed 153.44 today before rolling over and finishing the day with a doji. This is the exact type of price action one wants to see if looking for a turn. I’m now near term bearish. Downside potential is unclear although I’ll note the 7/8 and 7/22 lows at 150.60s/70s as a general zone of interest.

7/28 – GBPJPY has rallied 5 of 6 days since the ‘constructive’ view was put forth but pay attention to 153.40/50. This is a clear horizontal level of importance and the 50 day average. IF (big IF) a head and shoulders top is developing since early April THEN price should turn down from the noted level. Wait and see.