Market Update – July 22

BLOOMBERG HEADLINE

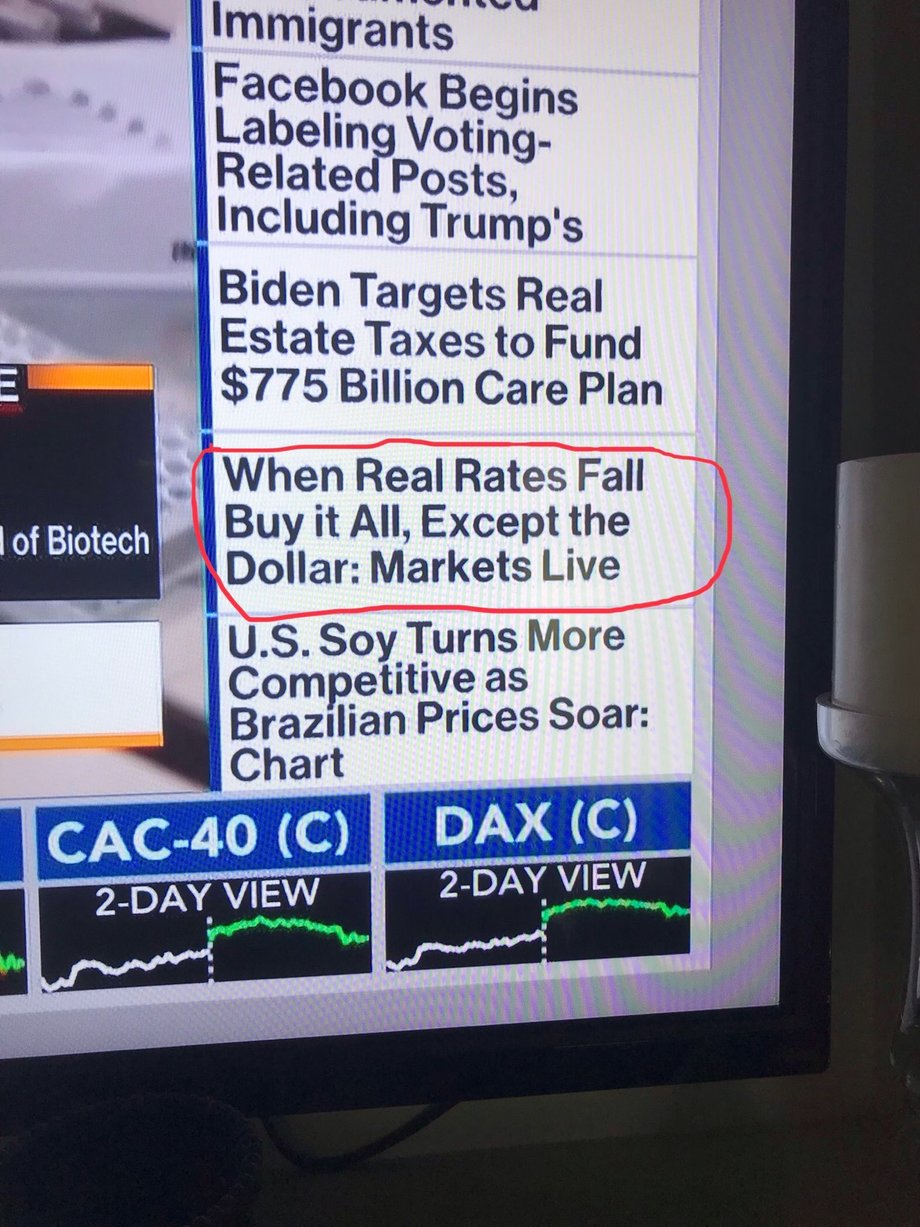

This is a picture of the TV in my living room earlier today. I keep Bloomberg on throughout the day for background noise and the scrolling headlines on the right of the screen are the same headlines that are published on the app. The headline circled in red would not appear if the short USD trade weren’t extremely crowded, at least on a short term basis. Sentiment is ripe for a reversal.

EURUSD DAILY

EURUSD took out the March high (DXY didn’t take out its March low) and treating the entire rally from the March low as an impulse makes sense because waves 3-5 equal 161.8% of wave 1 at 1.1555 (which is also the November 2017 low) and the rally channels perfectly. I’m on alert for a reversal.

AUDUSD WEEKLY

AUDUSD has reached the 61.8% retrace of the decline from the 2018 high at .7131. This level is bolstered by the May and December 2016 lows. I’m on alert for a reversal either now or from the upper parallel of the channel from the 2011 high / 200 week average at .7230/60.

NZDUSD WEEKLY

The fork from the 1985 low in NZDUSD is a thing of beauty. Price is pressing against the 25 line now, which was support on numerous occasions since August 2015. It would ‘make sense’ for former support to provide resistance, at least temporarily. If the rally blows through here, then the 61.8% retrace of the decline from the 2017 high at .6760 is the next level to pay attention to.

USDCAD WEEKLY

USDCAD has reached the 75 line within the channel from the 2007 low. This level has been decent support/resistance since January 2015, most recently in June. As is the case with other USD crosses, a reaction here would ‘make sense’. Notice that none of these are trade setups just yet. I need a trigger first (volume reversal preferably) but it’s comforting to know that USD crosses are at levels (mostly parallels) that have inspired previous reactions.

USDNOK WEEKLY

I love this USDNOK chart. Price has reached the trendline from the September 2018 low. If price slips a bit further, then the Elliott channel from the 2013 low comes into play near 8.92. Again, big level in a USD cross! Also, the decline from the March high is clearly in 5 waves.