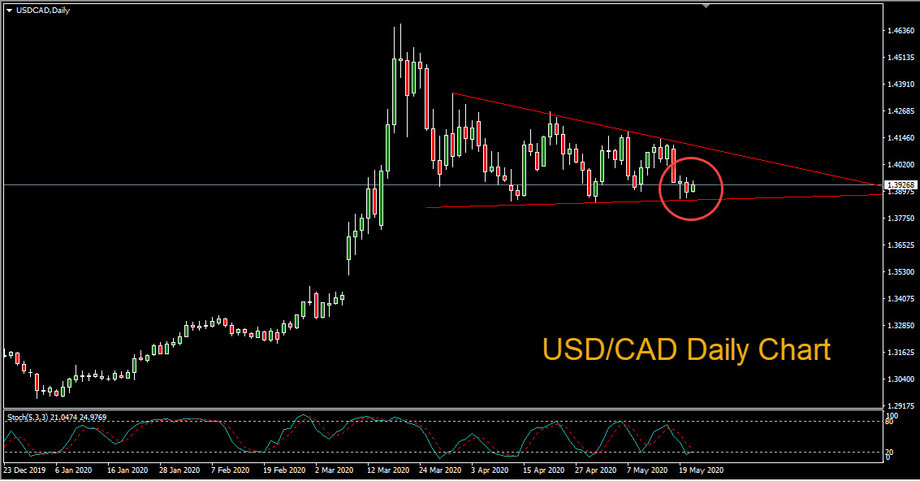

As Crude Finds its Footing, Traders Eye Descending Triangle in USD/CAD

USD/CAD fell to trendline support on Wednesday, as the Canadian dollar was boosted by rising crude oil prices and hopes of a global economic recovery. Equities, crude oil and the risk sensitive Australian dollar also benefited from rising investor confidence.

Meanwhile, investors shrugged off Wednesday’s weak inflation numbers from Canada. Statistics Canada reported that the consumer price index (CPI) for April fell 0.2 per cent compared with the prior year, marking the first year-over-year decline since September 2009.

The Canadian dollar has a positive correlation with crude oil, since it is one of the world’s leading oil producing nations. The price of oil was lifted on Wednesday by signs of rising demand and a drawdown in U.S. crude inventories. Wednesday’s EIA Inventory Report showed that crude inventories declined by 5 million barrels.

In addition, April’s OPEC+ agreement to cut 9.7 million barrels a day in oil through the end of June has helped to contain the glut of supply amid falling demand caused by the coronavirus pandemic.

Data from Johns Hopkins University indicates that coronavirus COVID-19 global cases have risen to 5,014,943 with 328,462 fatalities. The Health Ministry of Brazil reported 888 new deaths and almost 20,000 new infections in a single day, as the pandemic spreads in South America.

Risk appetite was dampened on Wednesday after President Trump pointedly criticized China in a tweet saying:

“Some wacko in China just released a statement blaming everybody other than China for the Virus which has now killed hundreds of thousands of people. Please explain to this dope that it was the “incompetence of China”, and nothing else, that did this mass Worldwide killing!”

Looking at the USD/CAD daily chart we can see that a descending triangle pattern has formed. A breakout to the downside could embolden the bears and potential support lies at the 50% Fibonacci retracement level of 1.3803.