Market Update 2/1 – USD Reversal Continues

ETHUSD 4 HOUR

ETHUSD is approaching a possible resistance zone. The bottom of the zone is defined by the 1/10 low and 2022 VWAP at 2926. The top of the zone is the underside of the line that connects lows in November and December. That is about 3140. VWAP from the May 2021 high is in the middle of the zone at 3040. This average has been key resistance and support over the last 7 months.

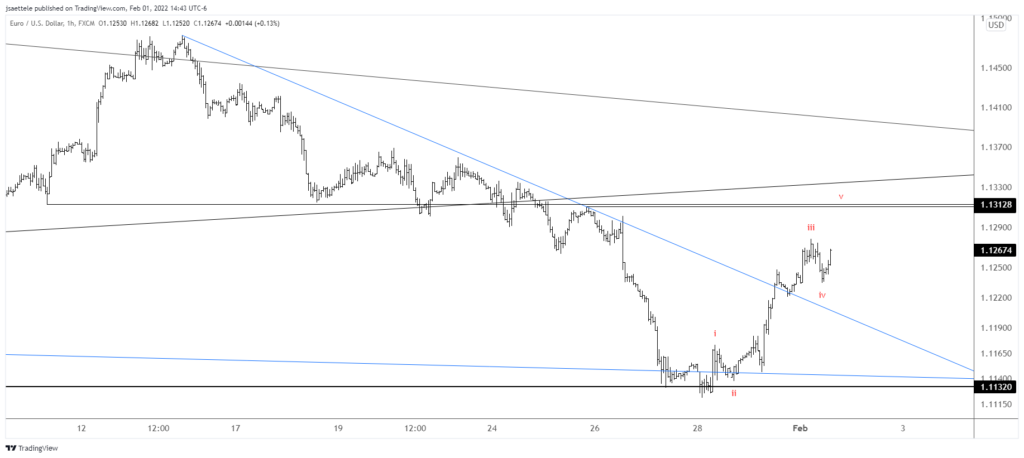

EURUSD HOURLY

EURUSD is unfolding in a clear impulsive manner. A small 5th wave may be underway now towards 1.1310 or so. Eventually, the top side of the trendline that originates at the January high (blue line) will be in line for support…maybe near 1.1200.

1/31 – EURUSD rebounded from the noted weekly reversal support level. My gut is that a low is in place but I’d like to see the current rally stretch into an impulse before I plot an entry. I’ll update the short term picture as price action dictates. 1.1180 is possible short term support.

GBPUSD 4 HOUR

1.3375 held beautifully for GBPUSD. Price is testing short term trendline resistance now so respect pullback potential with support at 1.3430/40. Bigger picture, I’ll note that the daily RSI profile is bullish (see below). This means that the recent pivot high price occurred with RSI above 70 and the most recent pivot low occurred with RSI above 30 (near 40).

1/26 – Pay attention to 1.3375-1.3410 in GBPUSD for support. The zone is defined by the 12/16 high, 61.8% retrace of the rally from December, and September low. The bottom of the zone also intersects with the lower parallel of the short term bearish fork (see 4 hour chart below).

GBPUSD DAILY

USDCAD 4 HOUR

The USDCAD rally from 1/19 channels in a corrective manner. I’m watching for either a break below the channel or resistance near the median line in the 1.2760s.

NZDUSD DAILY

Kiwi has ripped higher from the top side of the line that extends off of the 2017 and 2018 highs. Also, the drop from the 2021 high consists of 2 equal waves. From an Elliott perspective, the decline consists of 2 legs and each leg is in 3 waves. This is a complex correction sometimes known as a ‘double 3’. Watch for support near .6590.