Market Update 12/16 – What’s Up with the Nasdaq?

SPOT GOLD 4 HOUR

Gold followed through on its reversal from Wednesday which increases confidence in near term upside. 1834 remains the near term objective. 1770/80 is now proposed support (as opposed to 1770).

12/15 – After weeks of basically nothing (same as major FX), gold finally went for the 1759 tag and reversed sharply higher. I’m bullish and looking towards 1834, which is the center line and resistance from July-September. Support should be the high volume from today near 1770.

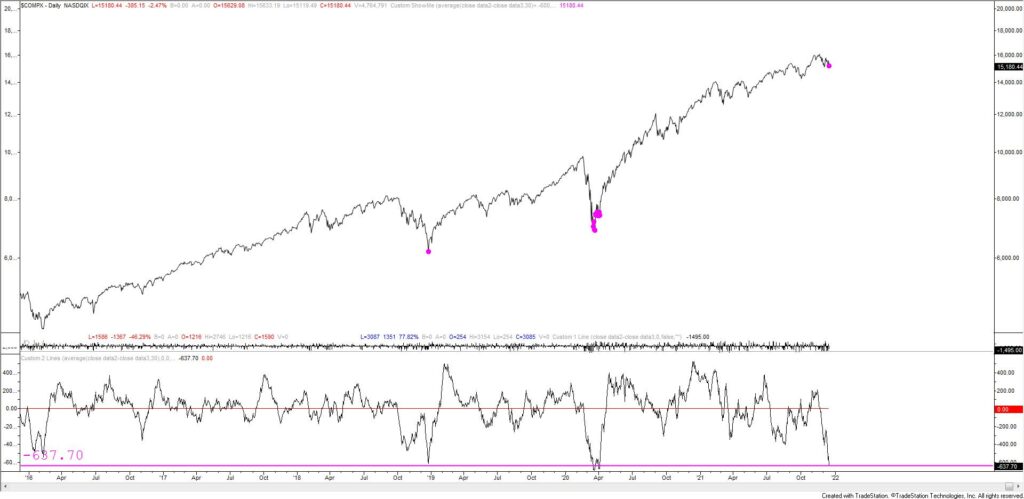

NASDAQ COMPOSITE AND 30 DAY A-D LINE DAILY

The equity ‘market’ has felt odd recently. A look beneath the surface confirms this suspicion. The 30 day Nasdaq advance-decline line is plotted below the composite index. The AD line closed at -637 today. The magenta dots indicate readings of -600 or lower. Previous readings this occurred at the Dec 2018 low and for several weeks in March-April 2020 (the first reading was 3/18/20). Prior to the last few years, readings this low occurred in October-November 2008 and during the 2000-2001 decline! Those periods are shown in the charts below. So, the A-D line is ‘oversold’ yet the QQQ closed a bit more than 5% off of the all time high today. All of the prior ‘extreme’ AD readings occurred after for more meaningful declines. The only takeaway I have is that if the index continues to decline but the A-D line improves then look out below because the next low won’t be until the next extreme A-D reading.

NASDAQ COMPOSITE AND 30 DAY A-D LINE DAILY (2008)

NASDAQ COMPOSITE AND 30 DAY A-D LINE DAILY (2000-2001)

S&P 500 WEEKLY

The SPX channel from the 2009 low is a thing of beauty. The market has pressed against the channel for prolonged periods of time, notably in 2014-2015 but eventually each tag of the upper channel line resolves with a drop to the center line. Depending on time, that’s 15%-20% lower.

ETHUSD 4 HOUR

Watch for resistance now near 4177. If the market reacts there then I’ll look at the short side towards the noted 3000.

12/13 – ETHUSD has solidly broken the trendline from the March 2020 low so focus is lower. Immediate downside is about 3000. This is VWAP from the May high, which was support in September. It’s also the lower parallel of a short term fork. Proposed resistance is 3917.

GBPUSD 4 HOUR

No change to Cable strategy other than noting that proposed support is now 1.3278 (former resistance). Immediate focus remains 1.3412.

12/15 – Cable low in place? There isn’t much to add to comments from 11/30 other than noting that VWAP from the March 2020 low has also provided support for the last few weeks. Upside focus is 1.3412, which is the median line of the structure from the year long channel and September low. Proposed support is the high volume level from today at 1.3238 and 61.8% of today’s range at 1.3211. BoE is tomorrow.