Market Update 5/3 – USDJPY Channel Still Nailing Turns

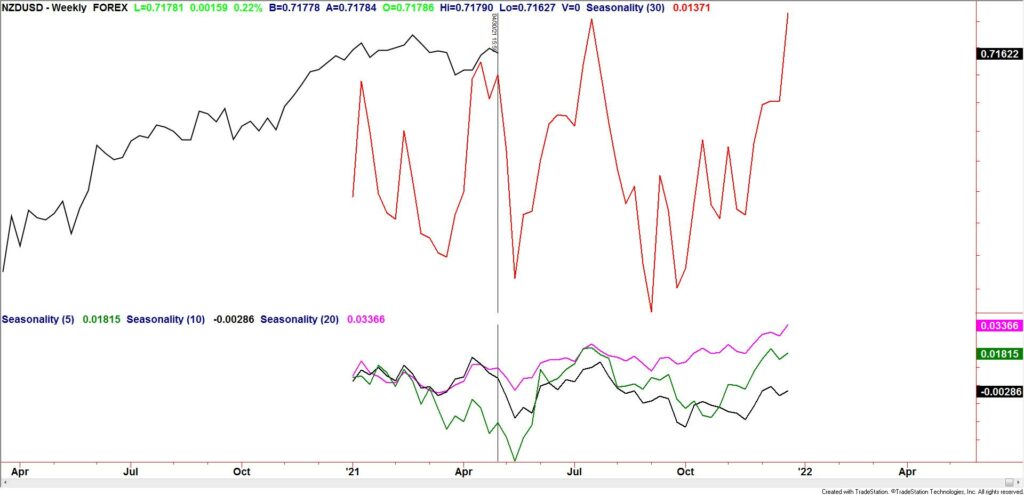

DXY HOURLY

DXY turned sharply higher on Friday but gave back a good portion of those gains today. The rally counts in 5 waves (impulsive) which suggests at least one more leg up while price remains above Friday’s high. 90.79 is proposed support if price slips a bit lower. Also, seasonal tendencies are bullish through most of May (see below).

4/19 – The sharp USD drop on Monday makes me neutral at best for now. I had wanted to see USDOLLAR hold the median line from the multiyear structure in order to stay constructive (see below). That said, DXY has reached VWAP from the January low and USDOLLAR has reached the 3/18 low. The 61.8% retrace for USDOLLAR is slightly lower at 11705. Keep an eye on these levels for possible support.

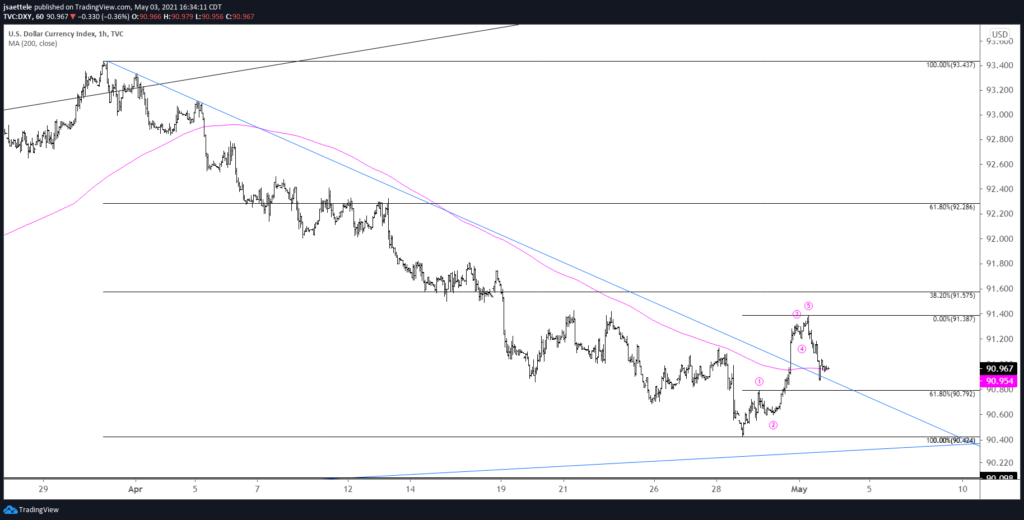

DXY WEEKLY SEASONALITY

EURUSD HOURLY

EURUSD is in the exact opposite position as DXY. Price turned sharply lower on Friday but gave back a good portion of those losses today. The decline counts in 5 waves (impulsive) which suggests at least one more leg down while price remains below Friday’s high. 1.2100 is proposed resistance if reached.

4/26 – EURUSD reached the line that extends off of the January and February highs today before putting in a doji. The level is defended by the 61.8% retrace of the decline from the January high as well. This is a great level for a pullback in order to correct the impulsive advance from the 3/31 low. I’m looking lower towards 1.1950 or so for now.

USDJPY 4 HOUR

What a beauty! USDJPY nailed resistance and reversed immediately. It’s best to play the range within the channel until price breaks the channel. The lower channel line is 108.15/30.

5/2 – USDJPY strength has extended and is nearing the level that I was originally keeping in mind for resistance. That level is 109.62/75. This is former channel resistance turned resistance turned resistance again, the 61.8% retrace of the drop from 3/31 and the 4/13 high. Trading wise, I prefer EURJPY short (more on that below).

NZDUSD HOURLY

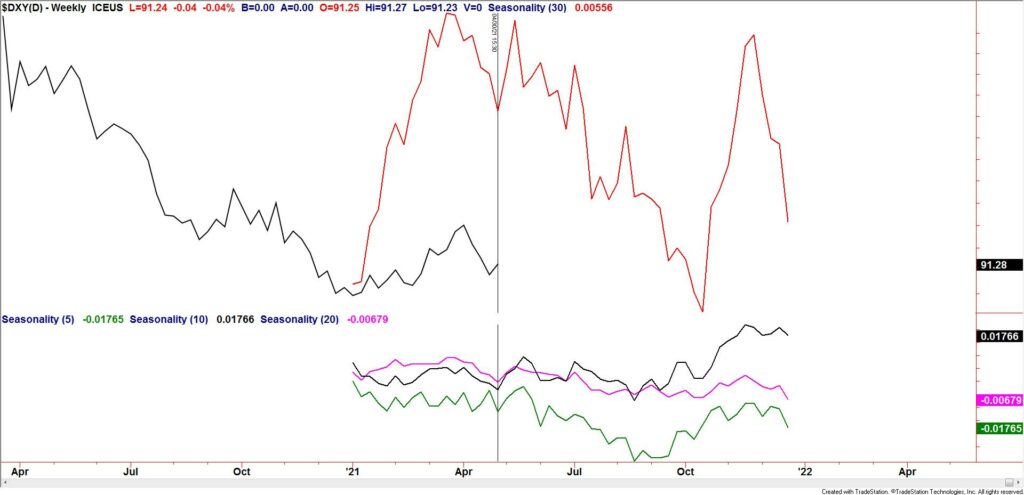

NZDUSD has traded into proposed resistance from the short term channel center line at .7200. This line was support for several days in mid-late April. Former support turned resistance? We’ll see. Downside focus remains the lower channel line near .7120. A break below there would suggest something more bearish. Seasonal tendencies are bearish for most of May (see below).

5/2 – NZDUSD has turned lower as expected and downside focus remains on short term channel support. That is about .7110 on Monday and increases roughly 7 pips per day. .7200 is now proposed resistance.

NZDUSD WEEKLY SEASONALITY