Market Update – September 15

WYCKOFF DISTRIBUTION SCHEMATIC

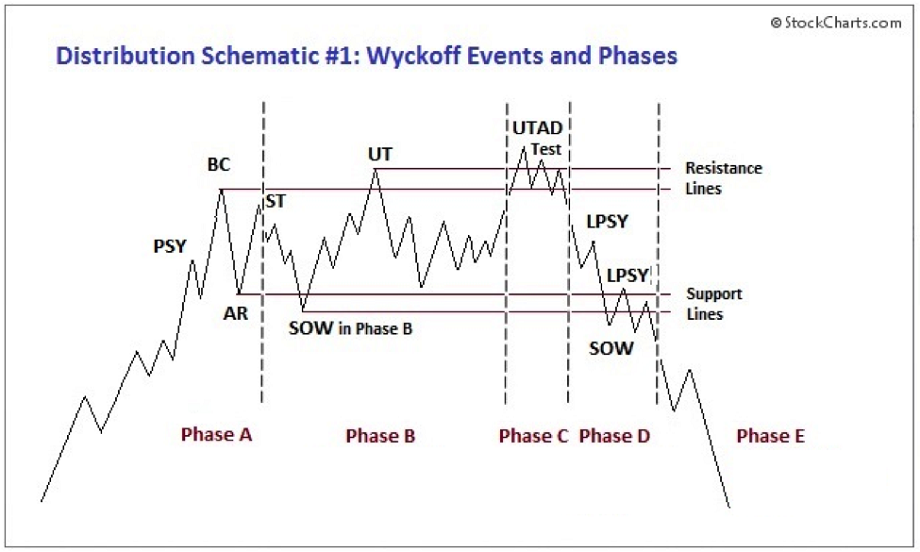

The last 2 trading days have been awfully quiet so now is a good time for some educational yet applicable content. I have copies of Wyckoff schematics hanging on the wall in my office. Google Richard Wyckoff if you are not familiar with his work. I was looking at the distribution schematic today (the chart above) and realized that I could have been looking at EURUSD. I’m showing a Euro futures chart (see below) because volume must be incorporated when analyzing a market from a Wyckoff perspective. Volume on SOW (sign of weakness) days are highlighted with yellow circles. Notice how volume expanded into the BC (buying climax) and decreased on the ST (secondary test). A drop below 1.1750 is required in order to complete the distribution.

BC—buying climax. Marked increases in volume and price spread. The force of buying reaches a climax, with heavy or urgent buying by the public being filled by professional interests at prices near a top.

AR—automatic reaction.

ST—secondary test.

SOW—sign of weakness. Indicates a change of character in the price action: supply is now dominant.

LPSY—last point of supply. LPSYs represent exhaustion of demand and the last waves of large operators’ distribution before markdown begins in earnest.

UTAD—upthrust after distribution. Analogous to springs and shakeouts

EURO FUTURES DAILY

USDJPY DAILY

USDJPY continues to drift lower with the 25 line from the channel off of the March high providing resistance and action since 7/31 may be a bearish triangle that leads to the next downside move. Weakness below 105.10 would increase confidence in that outcome. In the meantime, pay attention to 106.00 for resistance.

NZDUSD HOURLY

I’m still on the mind that NZDUSD put in a more important on 9/2 and that the rally from 9/9 will end up as corrective. With price failing to stay under .6709, keep .6749 in mind for resistance. This is the 78.6% retrace of the decline from 9/2 and intersects the upper parallel of a short term bearish fork during early U.S. trading on Tuesday.