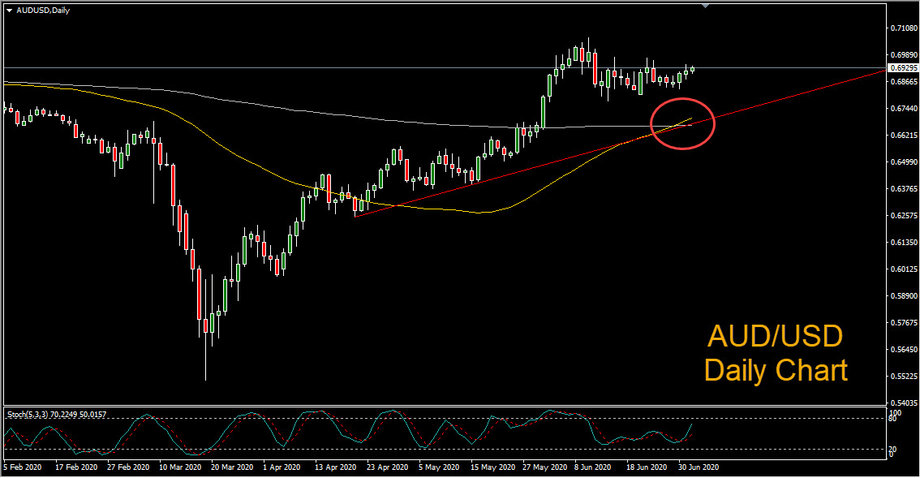

Golden Cross Forms in AUD/USD

A bullish golden cross (50-period SMA crossing above the 200-period SMA) has formed on the AUD/USD daily chart. The Aussie has been supported by upbeat Chinese and Australian data, while the US dollar lost some of its safe haven appeal amid positive US and European economic news.

US manufacturing rebounded sharply in June according to data released on Wednesday. The ISM Manufacturing index recorded a 52.6 reading in June, beating 49.5 expected by analysts. Readings over 50 indicate more companies are expanding rather than contracting. The news fueled hopes of a faster than expected economic recovery in the US.

Upbeat vaccine news also helped to boost risk appetite among investors. A COVID-19 vaccine developed by BioNTech and Pfizer has reportedly shown promising results in early-stage human trials. In a clinical study, 24 individuals who received two doses of the vaccine had “significantly elevated” antibodies within four weeks of their first injection.

However, new cases of COVID-19 continue to soar in the US. According to data from Johns Hopkins University, the US recorded 52,000 new cases on Wednesday – a daily record. In an interview with Fox Business on Wednesday, President Trump reiterated his hope that the virus will simply disappear. He stated: “I think we’re gonna be very good with the coronavirus. I think that at some point that’s going to, sort of, just disappear – I hope.”

Investors now turn their attention to the all important US employment report, due for release later on Thursday. Analysts expect that the US added 3 million jobs and that the unemployment rate fell to 12.4% in June from 13.3% in May. The data is set to be released on Thursday, rather than the usual first Friday of the month, due to the Independence Day holiday on July 4th.

Looking at the AUD/USD daily chart we can see that the 200-period SMA and trendline support lies below. Meanwhile, bulls eye the recent high of 0.7067 for a potential breakout to the upside.