Similar Posts

Market Update 9/29 – Huge Levels in DXY and EURUSD

NQ is nearing the trendline from the November low. This is also the center line of the channel from the September low (the upper parallel was resistance so it would be ‘natural’ for price to react to the center line) and the 38.2% retrace of the rally from the May low (14641.50). Bottom line, this is an important test for NQ and a break below would indicate an important behavior change.

Market Update – May 7

BoE is tomorrow and it looks like the bounce to 1.2484 is the extent of the corrective bounce in wave 2 of C. Proposed resistance is now 1.2405/20, which is a well-defined horizontal level and the neckline of a short term head and shoulders.

Market Update: November 2

USDOLLAR traded into the center line of the channel from the September low today and immediately pulled back. Proposed support is 12050 or so. The top of the channel intersects where the rally would consist of 2 equal legs at 12268 on 11/18. The 38.2% retrace of the decline from the March high is just above there at 12283 and the 200 day average is currently 12284 (see below). So, a slight pullback and then higher? It certainly ‘fits’ with general seasonality and election seasonality.

Market Update 11/8 – Metals Near Pullback Levels

Gold is closing in on the noted level from the line that extends off of the 2020 and May highs and resistance since July near 1834. I’m ‘thinking’ pullback initially from the well-defined level but will be tracking for support beginning near 1800 since I’m of the mind that the broader trend is higher.

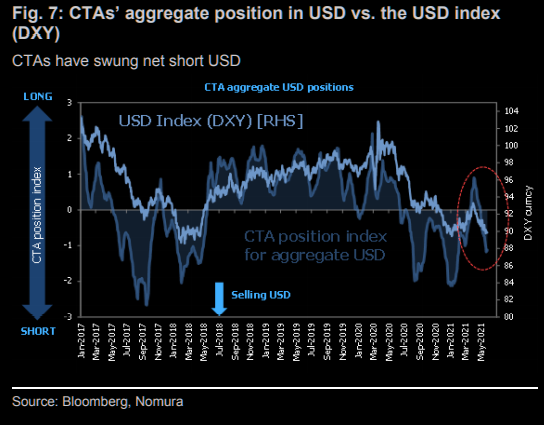

Market Update 5/25 – CTAs Chasing USD Shorts Again

Not surprisingly, CTAs are chasing USD shorts again. Of course, this tends to happen just before a turn (then they chase the USD higher).

Market Update: January 31

Near term AUDUSD focus remans .7550s and the lower parallel of the Schiff fork from the March low. This line crosses the September high at .7413 early next week. Risk on shorts is Friday’s high at .7704. Strength above there would face possible resistance from the median line again near .7740.