Market Update 3/15 – EURUSD 1.1000ish is Big into FOMC

ASHR DAILY CLOSES

ASHR tracks an index of the 300 largest and most liquid Chinese shares traded on the Shanghai and Shenzhen exchanges. The fund holds physical China A-shares. A 2 bar daily volume reversal triggered today. Previous bullish reversals are highlighted. This is also a well-defined support level from former highs in 2019 and 2020 and the line that extends off of the 2019 and 2020 lows (closing prices). A bullish ASHR could act as a tailwind for commodity FX, notably AUDUSD.

EURUSD 4 HOUR

It’s been a little over a week since EURUSD made the low at 1.0806…right on the trendline from the 2017 low. The pullback from the 3/10 high appears in 3 waves and price has held the 61.8% retrace of the rally from the low…so far. I want to see strength above 1.1011 (high volume level) before committing to the long side with initial focus at 1.1215/30, which is 2022 VWAP, the month open, and 2 legs up from the low. FOMC is tomorrow so hopefully we get clarity regarding broader reversal prospects after tomorrow!

3/10 – EURUSD nailed the noted levels, spiking into 1.1120 on ECB and trading at 1.0980 as I type. I’m ‘thinking’ that EURUSD finds a higher low between here and 1.0926/40. Of course, if this week’s low doesn’t hold then a full on crash from a 5 year triangle is possible (see long term chart below). In fact, the 3 legged triangle reminds me of the USDCHF pattern from 2008-2010 (see 2 charts down). Keep an open mind.

Do you make a profit trading EURUSD?

Try our funded trader program and get up to $1,000,000 in funding.

Learn more

AUDUSD 4 HOUR

The AUDUSD drop is in exactly 2 equal legs. Price has also held the short term trendline, the decline channels in corrective form, and Aussie is trading around 2022 VWAP. This is a great place for a turn higher. Short term channel resistance is possible resistance near .7290.

3/14 – AUDUSD was slammed today as China fell apart. There are 2 levels to be aware of for support, .7173 and roughly .7100. The first level is where the decline would consist of 2 equal legs. The lower level is the lower parallel from the fork that originates at the December low. The long side sets up well from a seasonal perspective as tendencies turn up after this week (see below).

NZDUSD 4 HOUR

NZDUSD may have also bottomed today. Like Aussie, the Kiwi decline channels in a corrective manner. Price also held the 2/10 high at .6733. Short term channel resistance is about .6830. I’ll be looking to trade a breakout above that level if it occurs.

3/14 – NZDUSD levels are actually better defined than AUDUSD in my opinion for support. Price has already reached 2 equal legs down at .6746 and the well-defined .6700 is just below. This is defended by the trendline from the lows and 2022 VWAP at .6719. Bottom line, .6700/50 is a big zone and well-defined for support. I’m looking for Kiwi to turn up and begin another leg higher within the bull cycle from the January low.

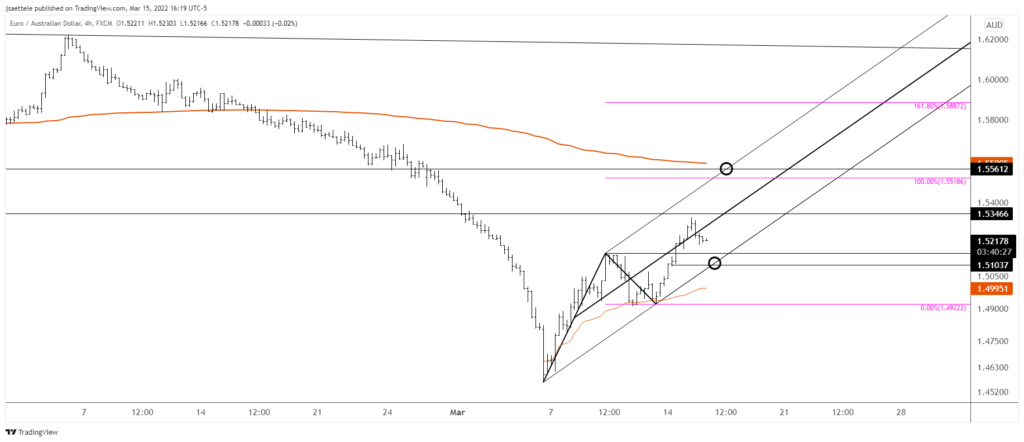

EURAUD 4 HOUR

EURAUD put in a weekly reversal last week (see the chart below). I’m not sure if the short term channel shown is valid but keep an eye on it for support along the lower parallel near 1.5100. If price holds the channel then look higher towards 1.5520-1.5600. This is 2 equal legs up, the December low, and 2022 VWAP. This zone intersects the upper parallel from the channel over the next few days.

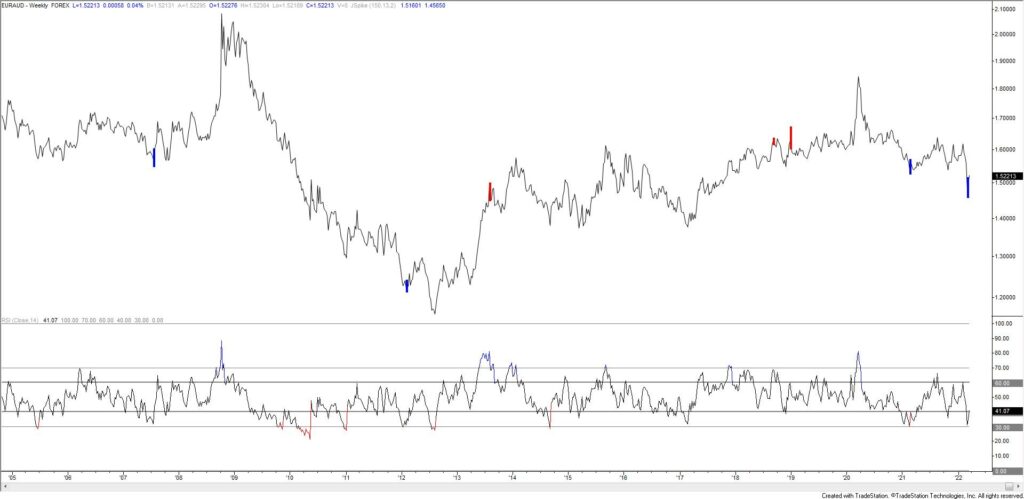

EURAUD WEEKLY