Market Update 4/27 – Extreme Momentum Readings in GBPUSD

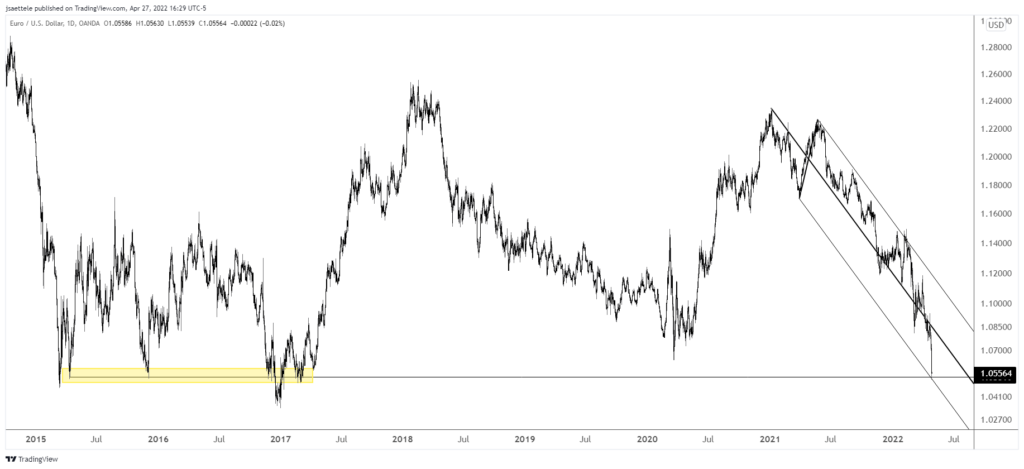

EURUSD DAILY

I have USD strength fatigue. I can point out how ‘extreme’ the move is or the myriad headlines that indicate ‘extreme’ sentiment but it hasn’t mattered…yet. Today’s low is right at the lower parallel of the bearish fork that originates at the 2021 high. This is clearly an important horizontal level too (note the highlighted zone on the left side of the chart). EURUSD is set up for a violent reversal in my opinion…an up day would be a good start.

GBPUSD DAILY

GBPUSD is nearing the 61.8% retrace of the rally from the 2020 low at 1.2495. The top side of the trendline that originates at the 2015 high (blue line) is just below this level near 1.2415. The next 3 charts highlight when daily RSI is below 21 over the last 20 years. All instances led to at least interim lows EXCEPT during the financial crisis. So, unless this is the financial crisis, we should be on the lookout for a reversal.

Do you make a profit trading GBP/USD?

Try our funded trader program and get up to $1,000,000 in funding.

Learn more

GBPUSD DAILY

GBPUSD DAILY

GBPUSD DAILY

USDMXN DAILY

USDMXN has reached and reacted to noted resistance from the underside of former trendline support and the 200 day average. Today’s high is also right at the year open price (20.51). I favor the downside from the current level.

4/14 – USDMXN reversed sharply higher today in what could be the start of a move into 20.40 resistance. That level includes the 50 and 200 day averages along with the underside of former trendline support.Market