Why Buy-Side Firms Need a Custom FX Price Feed

Tight spreads are important, so is deep liquidity, but there are considerably more characteristics to be considered when imagining the perfect FX liquidity price feed. In the largest and most liquid market, there are naturally dozens of execution venues and many more market-making players selling into these venues. Competition and diversity are great, but market fragmentation leads to complexity.

Many brokers roar about their vast network of liquidity providers in an effort to convince prospective clients they will get the highest quality of execution. Aggregating a dozen or more feeds is fine for price discovery, but price only touches on the surface of good execution. There are so many aspects to be balanced and so often overlooked.

What use is a gold mine or an oil well if you don’t know how to refine the product and distribute it? The same argument could be made for having more quotes. In this article, we’ll look at the challenges in the market, what you need a customised price feed, what to consider when choosing a forex liquidity provider and how Scandinavian Capital Markets can build a custom FX price feed for your business.

How the wholesale forex execution market became so fragmented

Historically, banks controlled the wholesale FX execution space. However, after a series of regulatory and industry reforms that followed the 2008 financial crisis and more recently the Swiss Franc fiasco, legacy institutions pushed for more capital from clients meanwhile drastically decreasing the amount of leverage they offer. Banks removed a lot of small and medium-size buy-side firms from their client roster.

This move from the banks created a new segment of underserved buy-side firms. Meanwhile, technology-enabled new sell-side players to enter the market and seize this market share the banks disposed of. FIX API has made interoperability easily achievable, and technology has made distribution scalable and cost-efficient.

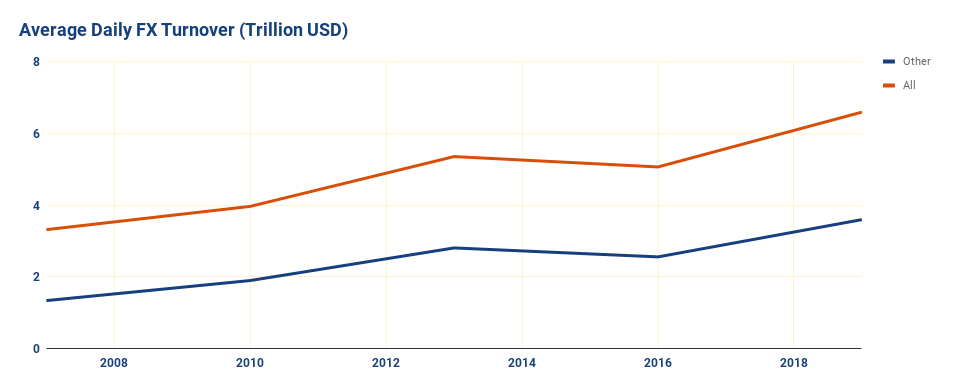

This transformation of the FX trading industry is highlighted by recently published statistics from the Bank for International Settlements. In the chart below, you can see the proportion of daily FX turnover that is conducted by other financial institutions (defined as commercial banks, investment banks, securities dealers and securities brokers which do not report to the Bank for International Settlements). The average daily turnover reached 3.6 trillion USD, which contributed 55% of the global daily turnover in 2019. Banks are no longer the major players in the FX market.

More recently, retail brokers have been pivoting to the wholesale execution space. The transition is primarily due to European regulatory changes requiring them to withdraw many of their most appealing factors towards retail clients. To them, it seems like low hanging fruit since they have the infrastructure in place, but oftentimes they lack the institutional mindset. A lot of retail brokers offer feeds with a mentality influenced by MiFID 2 best execution rules.

Higher up the food chain, institutional liquidity providers configure feeds according to what they think their clients want and provide a one size fits all product offering and layer individual client requests layered into the same price feed. Unfortunately, this approach adulterates the characteristics and has a knock-on effect for all customers.

Pumping out more quotes consumes more IT resources and bandwidth leading to performance issues. The more quotes being distributed will increase the chance of trading on stale prices and increase order rejections.

Customising and optimising a price feed is complicated and time-consuming. On the other hand, it’s not genius to offer a service that doesn’t allow your customers to prosper and gives them a reason to seek out new providers.

Who needs a custom FX liquidity feed?

Is your trading strategy and objective the same as every other firm? Obviously not. Then why should you expect optimum performance on the same feed as everyone else?

A firm that is hedging currency exposures may care less about entry price and care more about the depth and carry costs when they roll positions over.

A high-frequency trading strategy that opens hundreds of small tickets in the London and New York session will care less about swaps but will be far more about having a thin top of book pricing.

An intraday strategy that is placing swing trades and holds positions across multiple trading sessions will care about a well-rounded feed that offers consistency in all areas.

These are just a few basic examples of how buy-side clients can have different requirements and how they would not all thrive on the same price feed. Demands can get far more specific, and as you can see, it’s far more complicated than merely receiving a deep book and tight spreads at the top of the book.

Our strengths as an FX liquidity provider

At Scandinavian Capital Markets, one of our core competencies in the area of designing custom FX price feeds. This know-how comes from our experience as a wealth management firm. Prior to becoming an FX broker for professional, HNW and institutional traders, we were in the shoes many of our clients are. Many trading desks could not understand the needs of our business, or they simply didn’t care.

We are one of the firms that have embraced technology to connect a fragmented FX marketplace and deliver an al-a-carte menu of characteristics that can be baked into a price feed that allows our clients to get what they need as opposed to what they can.

Because Scandinavian Capital Markets is a broker to multiple high turnover FX businesses, we are in a unique position to hold relationships, deploy capital with many execution venues and sell-side firms. We thoroughly understand the strengths and weaknesses of each liquidity provider in our portfolio.

How we approach custom FX feeds

Our job is to understand every client’s expectations and deliver what they need. We listen, we advise, and we’re honest about what we can and can’t do.

The very first step is to get introduced to one of our experienced relationship managers. As opposed to trying to sell to you, we sit back and listen to what you need. This approach allows us to pinpoint how exactly we can build a price feed that gives you the execution quality you’re not getting from other providers.

We’ll look at some of the following requirements;

- What currency pairs are you trading?

- How long do you hold your positions for?

- What time of the day or week are you most active?

- What are your transaction cost expectations?

- How do you trade; manually, with pending orders, with hosted algos?

Having a reliable price feed is an ongoing effort. Conditions change frequently; therefore, we continuously monitor and regularly evaluate your price feed to ensure that we’re hitting the targets. Your relationship manager will listen and suggest how to improve the feed whenever something changes, whether it’s the market, your strategy or the providers.

If you’re interested in hearing more about our custom FX price feed solutions, reach out to one of our relationship managers to know more.