How Will the FX Market React to Returning Coronavirus Lockdowns

The prospect of another wave of Coronavirus lockdowns in most developed economies seems more likely by the day, how can this affect the FX market?

The prospect of another wave of Coronavirus lockdowns in most developed economies seems more likely by the day, how can this affect the FX market?

Many asset managers and proprietary trading firms seeking Forex platforms for hedge funds overlook the option of using a white label retail FX platform.

To determine if gold is a bubble, we need to understand the demand for gold, what an asset bubble is and the current renewed interest in gold.

The US dollar advanced against major currencies in early trading on Thursday. A positive economic outlook from the Federal Reserve and a shift to tolerating higher inflation boosted Treasury yields, in turn supporting the greenback.

GBP/USD fell to its lowest levels since July 28th on Wednesday, extending losses from the recent yearly high made on September 1st. The same day, the UK government published its Internal Market bill, outlining a plan to breach the pledges in the EU Withdrawal Agreement.

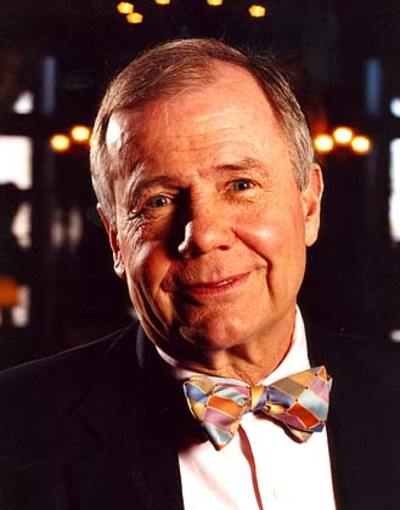

We caught up with investing legend and global adventurer Jim Rogers to learn about his views on today’s markets.

GBP/USD extended its losses in early trading on Monday, after sliding for three consecutive days last week. News that UK Prime Minister Boris Johnson is ready to allow negotiations to fail rather than compromise on certain Brexit principles has driven stering lower.

Bitcoin sold off sharply on Thursday, testing the key 10,000 level as the US stock market experienced a major rout the same day.

The Australian dollar climbed to its highest levels against the greenback since December of 2018 in early trading on Friday. The Aussie has been lifted by recent positive Sino-U.S. trade developments and better than expected economic data.