Calculating forex risk and reward

Forex trading, at its core, is a delicate dance of balancing risk against potential reward. While the allure of substantial profits often captures the spotlight, the unsung hero of sustained success in the forex market is robust risk management. Every seasoned trader knows that understanding and implementing a calculated risk vs reward strategy can mean the difference between long-term success and short-lived gains.

However, there are nuances to this practice that many beginners and even some experienced traders overlook. It’s not merely about setting arbitrary profit and loss targets; it’s about understanding the intricate interplay between position size, stop loss distance and profit target. This guide sheds light on these aspects, clarifying why a one-size-fits-all approach might not always serve traders well and emphasising the vital role of technical analysis in these decisions.

In the quest to maximise profits and minimise losses, there are three pivotal aspects every trader must consider: take profit targets, stop loss levels, and position size.

Take profit target

Your take profit target is the predetermined price level at which you intend to close your position to capture profit. More often than not, this is derived from rigorous technical analysis.

Imagine you’re analysing the EUR/USD currency pair, and based on your analysis, you forecast that the price will rise to 1.10500 from its current rate of 1.09900. This becomes your take profit target.

Stop loss level

Now you’ve defined your target; you need to determine how much you’re willing to risk to reach the target. A common misconception is that a trader should set their stop loss based purely on a predefined risk-to-reward ratio, like 1:3. If you aim for 60 pips profit (per the example above), you’ll accept a 20 pip potential loss. However, this method can be flawed.

The market does not move in straight lines. There are often retracements or pullbacks, and your prediction may take longer than expected to pay out. If your stop loss isn’t set with technical analysis in mind, a mere retracement could hit your stop loss, exiting your trade prematurely, even if your initial analysis was correct.

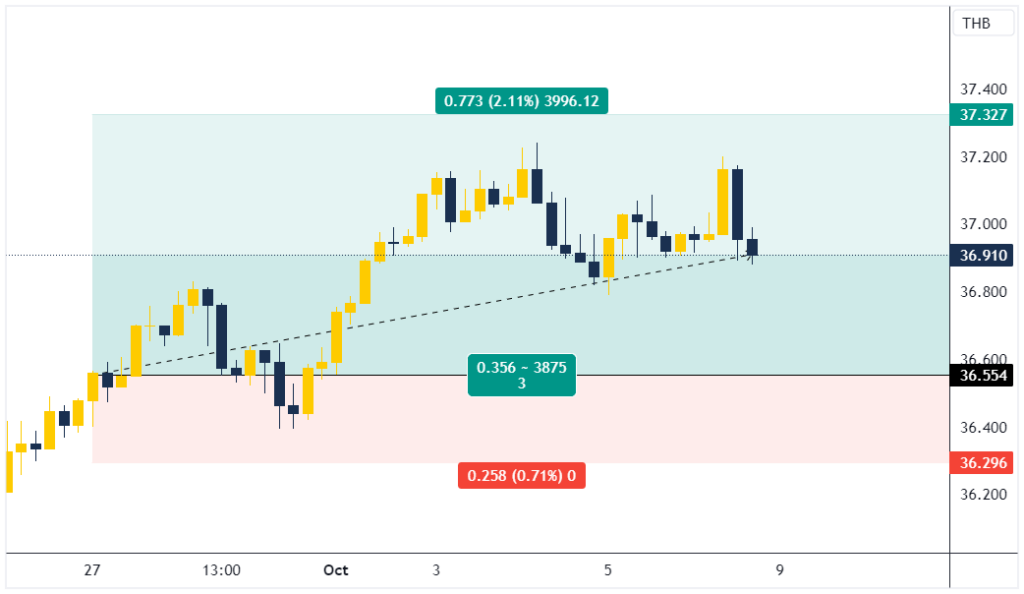

Instead of fixating on a desired target and using an arbitrary ratio to determine the stop loss, you should seek opportunities that fit your risk-to-reward profile rather than making them fit. That’s why many traders use risk-to-reward indicators, a feature which MT4 sadly lacks. The image below shows the position protection tool from TradingView.

Position size calculation

Position size determines how much you can gain or lose for every pip movement in the market. Position size configuration allows you to keep risk in check while giving your setup enough room to breathe in the event of any retracements.

Too many traders fixate on a specific lot size, generally associated with their account size, without considering the broader picture. You can maintain a consistent risk profile by adjusting the position size according to the distance of your stop loss and your desired risk amount.

Suppose you don’t want to risk more than $100 on your EUR/USD trade. If your stop loss is 20 pips away (from 1.09900 to 1.09700), you will adjust your position size so that every pip movement equals roughly $5 ($100 ÷ 20 pips = $5). This way, if the market hits your stop loss, you only lose your predetermined risk amount of $100.

How to calculate risk-reward

Instead of trying to trade every signal you find, you need to filter opportunities that don’t fall in your risk-reward profile.

Suppose you are trading the EUR/USD currency pair. After conducting your analysis, you enter a long position at 1.1000. You’ve set a take profit target at 1.1100 and a stop loss at 1.0950.

Step 1: Calculate the potential risk

Determine the difference between your entry point and your stop loss level:

Risk = entry price – stop loss price

= 1.1000 – 1.0950

= 0.0050 or 50 pips

Step 2: Calculate the potential reward

Determine the difference between your take profit target and your entry point:

Reward = take profit price – entry price

= 1.1100 – 1.1000

= 0.0100 or 100 pips

Step 3: Calculate the risk-to-reward ratio

This is calculated by dividing the potential reward by the potential risk:

Risk-to-reward ratio = potential reward ÷ potential risk

= 100 pips ÷ 50 pips

= 2

This gives a risk-to-reward ratio of 1:2. In this scenario, you risk 50 pips to potentially gain 100 pips. Put another way, for every pip of risk, you’re targeting 2 pips in potential reward.

Knowing and consciously deciding on a risk-to-reward ratio before entering a trade can significantly aid consistent risk management. In the example above, even if you were right only half the time (50% win rate), a 1:2 risk-to-reward ratio would still result in a net profit. This underlines the importance of focusing on the frequency of winning trades and the relationship between the average win and the average loss.

Summary of risk to reward strategy

At the heart of adept risk management in forex is the understanding that the potential risk and reward per pip are symmetrically balanced, courtesy of the position size. Whether the price rises or falls, the financial implications for each pip movement remain consistent. This equilibrium underscores the importance of identifying trade setups that organically align with your desired risk-to-reward profile rather than forcefully tweaking parameters to fit a predetermined ratio.

It’s an easy pitfall to mould a trade to match desired numbers, but true proficiency lies in identifying genuine market opportunities where the risk-to-reward dynamics are innately favourable. Through mastery in technical analysis and the discipline to await the perfect setup, traders are poised to navigate the forex market’s complexities. In essence, it’s not about chasing every potential opportunity but waiting for the right one, where the balance of risk and reward naturally aligns with your strategy.