How to calculate risk and reward in MT4

MetaTrader 4 (MT4) is one of the most widely-used forex trading platforms, renowned for its user-friendly interface, customizability, and expansive collection of trading tools. However, compared to more modern platforms like cTrader and TradingView, it falls short in several aspects, particularly concerning risk and reward calculation tools.

Using the Fibonacci tool to calculate risk-to-reward in MT4

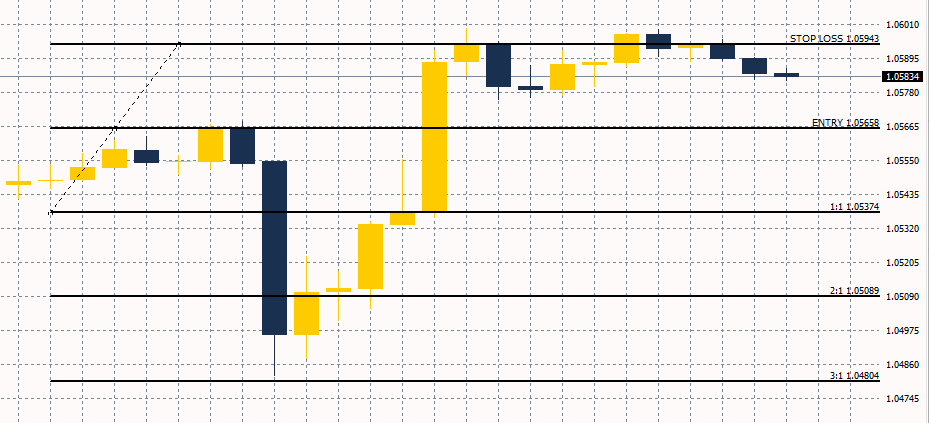

The Fibonacci tool in MetaTrader 4 is primarily designed to identify potential retracement and extension levels. However, with some creativity, it can also be used as a makeshift risk-to-reward ratio tool. Here’s how to use the Fibonacci tool to make a risk-to-reward indicator, as shown below, on MT4.

1. Find the Fibonacci tool: Open MT4 and make sure the chart of the currency pair you want to analyse is displayed. Click on the “Insert” tab in the toolbar at the top row, then choose “Fibonacci” and select “Retracement.”

2. Draw Fibonacci levels: If you plan to calculate risk and reward for a long position, click on the chart and drag it up. Otherwise, if you plan to calculate for a short position, click on the chart and drag it down. Don’t worry too much about the placement of the Fibonacci yet, as this can be adjusted later.

3. Adjust the Fibonacci levels for risk-to-reward ratios: Right-click on the Fibonacci retracement you’ve drawn and select “Fibo properties” from the context menu. In the “Fibo Levels” tab, you will see default Fibonacci levels like 0.0, 23.6, 38.2, etc. We will replace these with our desired risk-to-reward levels. Remove the default levels and add the risk-to-reward levels you want to use. For instance:

| Level | Description |

| -1 | STOP LOSS |

| 0 | ENTRY LEVEL |

| 1 | 1:1 |

| 2 | 1:2 |

| 3 | 1:3 |

Using the customised Fibonacci tool: Suppose you’re considering a long trade. Place the 0.00 level where you plan to enter the trade and the -1.00 (or your designated risk level) where you plan to set your stop loss. Then, levels 1, 2 and 3 will indicate where your take profit targets would be for 1:1, 1:2 or 1:3 risk-to-reward ratios. For short trades, the process is the same but inverted.

MT4 risk and reward calculation drawbacks

While MT4 remains supreme in the forex trading community, its limitations, particularly in risk management tools, become evident when compared to platforms like cTrader and TradingView. For traders who prioritise advanced risk management tools that are integrated seamlessly into the trading interface, these newer platforms offer a more holistic and user-friendly experience. As the trading world continues to evolve, the tools and platforms that traders rely on should evolve in tandem.

Lack of intuitive risk-to-reward tools

Unlike platforms such as TradingView, which boasts a built-in long/short position tool allowing traders to quickly set entry, stop loss, and take profit levels, along with visually seeing the risk-to-reward ratios, MT4 lacks such intuitive tools. Traders on MT4 often resort to makeshift solutions, like manipulating the Fibonacci retracement tool, which is not the most comfortable tool for this purpose.

No integrated position size calculator

Modern platforms like cTrader incorporate position size calculations based on the trader’s specific risk parameters within the order window. MT4 lacks this feature, requiring traders to use external calculators or scripts to determine the appropriate position size based on risk preferences.

Lack of advanced visualisation

With platforms like cTrader, traders can instantly see potential profit and loss amounts in both pips and monetary terms as they adjust stop loss and take profit levels. MT4 does not offer such real-time visual feedback, making the process less fluid.

Limited price alert functionality

While MT4 offers price alerts, platforms like TradingView provide more flexibility, allowing traders to set alerts based on many conditions, including when certain risk-to-reward ratios are achieved.

Obsolescence

MT4’s development has stagnated in adding new features or refining existing ones. Newer platforms continue to innovate and roll out features that cater to the evolving needs of traders. The difference becomes especially noticeable in areas like risk management tools, where these platforms have a more modern approach.

Summary

By adjusting and tailoring Fibonacci levels to reflect desired risk-to-reward ratios, you can quickly gauge potential trade setups and ensure their strategies align with risk management principles. While the MT4 Fibonacci tool isn’t designed as a risk-to-reward tool, it can serve as a practical visual aid with the right customisations. For many traders, this method will be much easier than installing custom third-party indicators or bots for making similar visualisations.