Guide to cryptocurrency hedging with CFDs

Cryptocurrency hedging is a useful technique to stabilise your crypto portfolio from frequent price volatility. Opening a trading account with Scandinavian Capital Markets gives you access to dozens of crypto CFD trading instruments, ideal for hedging Bitcoin, Ethereum and many other popular cryptocurrencies.

There are many ways of trading cryptocurrencies. The classic way to trade cryptocurrencies that most are familiar with is to buy the cryptocurrencies on an exchange. Recent years have shown a massive increase in crypto trading popularity, with people around the world looking for opportunities to make profits in the crypto market.

As such, many new exchanges, platforms, and instruments have emerged to meet the demand and provide investors with different methods to get exposure to the cryptocurrency markets.

Most, if not all, cryptocurrencies are known for their high volatility. The price of many cryptocurrencies swings violently, with prices moving several percent in a matter of minutes. While volatility creates trading opportunities for scalpers and intraday traders, it’s less desirable for position traders and long term investors.

Due to the inherently high volatility of the crypto markets, many traders are looking for methods to somehow limit their risks. One great strategy that crypto HODLers can adopt to protect the drawdowns on their crypto portfolio is a hedging strategy.

This article explores the main advantages of hedging cryptocurrencies, specifically using CFDs.

Cryptocurrency hedging strategy – How does it work?

Before we get into the details of the cryptocurrency hedging strategy, let’s first present the concept of hedging and how it generally works. In the world of investing, hedging is a useful practice that every trader should know.

No matter which assets you are trading, it can be a great solution for portfolio protection. Hedging, in simple terms, is a risk management strategy, which investors adopt to avoid losses by taking an opposite position of one that already exists. For example, if you have a buy position for 1 BTC and then open a sell position for 1 BTC, your positions are hedged, and exposure is eliminated.

You won’t incur any further losses from the moment the positions become hedged, except for the fees and commissions required for the transactions because the short position hedges the long position. Therefore, there is no exposure to the market. However, hedging also prevents any profit-making opportunities, which is understandable because the purpose of a hedging strategy is protection.

Because hedging requires shorting, a hedging strategy will typically revolve around using derivatives, such as options, futures and, in our case, CFDs. When investors use a hedging strategy, they are simply trying to avoid or minimise losses.

Of course, hedging cannot help investors prevent losses altogether. Still, hedging can be an additional form of protection for investors, which can cut down the losses and maintain the stability of their trading portfolio.

Crypto hedging example

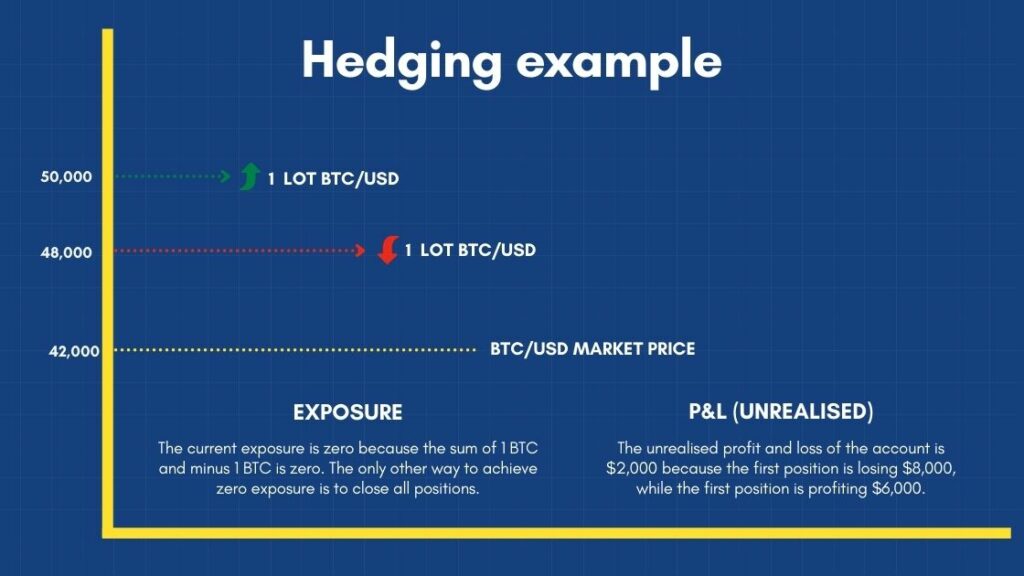

The main idea behind a cryptocurrency hedging strategy is that one position covers the other. Let’s follow this example of hedging to make things clearer. Say that you are a crypto investor who owns one Bitcoin, and you paid $50,000; you have a long position for 1 BTC.

Let’s say that there is an event impacting the market; for example, China clamping down on Bitcoin mining, which leads to the depreciation of Bitcoin.

In such situations, crypto traders are known to overreact and start panic selling. The price of BTC/USD falls to $48,000, and you’re suffering a drawdown of $2,000; based on previous experience, you expect the price to continue falling.

However, you still believe in the long term value of Bitcoin despite this small slump and don’t want to sell your BTC holdings. Therefore, you can protect your position without selling your BTC investment by simply opening a short BTC/USD position to cover any further downside.

Suppose you open a short position for one lot of BTC/USD (1 Bitcoin) at $48,000, and the price continues to fall to $42,000, and you decide the bearish trend has ended. In that case, you earn $6,000 to offset your $8,000 drawdown. So far, you’ve still only lost $2,000. The profits made from the short position compensate for the losses you suffered from the long position.

Therefore, you get to HODL your crypto assets while maintaining the stability of your funds and trading portfolio.

Hedging is a powerful tool to support portfolio stability

Many traders hedge cryptocurrencies to reduce or avoid crypto trading risks. Anyone from portfolio managers to individual investors and corporations can take advantage of cryptocurrency hedging strategy as it reduces the exposure to risks.

Although the main idea of hedging cryptocurrencies is to manage risk, a situation that could negatively impact your portfolio could be used as an advantage. Referring back to the previous example, suppose the price of BTC reached $55,000 after falling to $42,000. In that case, your hedge wasn’t necessary, and you’d have profited $5,000 from the original long position and $6,000 from the short position.

However, although hedging can help you gain additional profit if you’re lucky, it’s not always the case. Hedging cryptocurrencies, or any other assets, means reduced profits. So, investors use hedging not to make profits but rather to limit or reduce the losses they would have experienced by doing nothing.

How to hedge Bitcoin?

As mentioned above, hedging is used in almost any financial market, and it is common for Bitcoin traders to take advantage of hedging. This should not come as a surprise, as cryptocurrencies are infamous for their high price volatility. The prices of these assets are changing rapidly, and hedging can be essential to avoid experiencing considerable losses in this market.

To hedge Bitcoin, you’ll need to understand the mechanics of trading derivatives, including shorting and leverage. If you decide to hedge Bitcoin against volatility, you should practice this strategy carefully using a demo trading account.

Cryptocurrency derivatives: CFDs and futures

Although other instruments exist, CFDs and futures contracts are the most common derivatives used to hedge cryptocurrencies. Both allow you to open long or short positions using leverage. You don’t need to own the underlying cryptocurrency and just provide margin, which could be in a different currency to the one you’re hedging.

Many regulated brokers are available in the market, offering traders the opportunity to trade crypto CFDs in their platforms alongside forex currency pairs. There are numerous advantages of trading cryptocurrency CFDs with a regulated broker.

One of the most common ways of hedging cryptocurrencies is by using CFDs. A CFD, which is short for contract for difference, is a very popular instrument for crypto trading. These types of assets offer traders the opportunity to make profits from the price movements in the cryptocurrency market without buying or selling the underlying cryptocurrency.

Futures are similar instruments, and they also offer traders the opportunity to hedge cryptocurrency positions. However, while futures can be traded on regulated exchanges, such as CME and CBOE via futures and options brokers, the most common way to trade cryptocurrency futures contracts is to use unregulated exchanges such as Bitmex or Binance.

One of the main differences between futures and CFDs for trading cryptocurrencies is that futures have expiry dates that need to be managed, whereas CFDs do not expire.

How to hedge Bitcoin by shorting

Short selling has negative connotations, which primarily stem from the movie The Big Short, the evil hedge funds shorting GME and AMC stocks and HODLers who believe that crypto only goes in one direction – to the moon.

Short selling is necessary to hedge against long (buy) positions and is a common risk management tool used by traders and investors. Shorting can be used to profit from a bear market. The idea behind short selling is opening a sell position when you believe an asset’s price will fall. If the price does fall, you make some profit. In a hedging strategy that profit is used to offset losses from long positions.

While CFDs and futures contracts are some of the most popular ways of hedging cryptocurrencies, they are certainly not the only option you have.

Many crypto exchanges offer short selling and margin trading. Short selling and leverage go hand-in-hand because to sell something you don’t own or don’t want to sell requires borrowing funds. Among those crypto exchanges are popular exchanges like Binance and Kraken, which allow crypto traders to use leverage to open short positions.

Short selling is a great option for crypto traders as it can protect you from any drawdown from long positions. This type of trading usually adds some complexity to the crypto trading market, which traders should remember.

Conclusion

To hedge Bitcoin risk sounds like a dream come true for many traders. It is one of the best techniques for crypto investors to navigate the risks associated with this market. While hedging does not offer complete protection from the dangers of the crypto market, it can reduce the impact of these risks.

As we have discussed throughout this guide, there are many ways you can hedge cryptocurrencies. One of the best solutions crypto investors have are CFDs; these instruments are regulated and offered by licensed brokers.

The brokers offering crypto CFDs are mainly those with plenty of experience in the financial markets, offering traders numerous advantages, including reliable payment solutions, reasonable leverage, and the opportunity to trade with flexible positions sizes.

All in all, hedging is an excellent strategy that traders can use to protect their crypto portfolio from drawdown. This strategy is not a money-making scheme to make huge profits but to minimise the exposure to the risks.

Cryptocurrency hedging with Scandinavian Capital Markets

Scandinavian Capital Markets is an international forex broker with Scandinavian roots. We offer the award-winning cTrader platform loaded with more than fifty cryptocurrency CFDs with leverage of up to 1:5. You can go long or short on the dozens of cryptocurrencies offered to implement a robust hedging strategy with a regulated broker.

We offer trading accounts denominated in US dollars, euros and other fiat currencies, reliable payment methods and flexible position sizes. You can trade micro-lots, for example, 0.01 BTC, 0.01 ETH, giving you better control over your trades.