Benefits of Gold-i Multiple Allocation Manager Pro for Metatrader 4

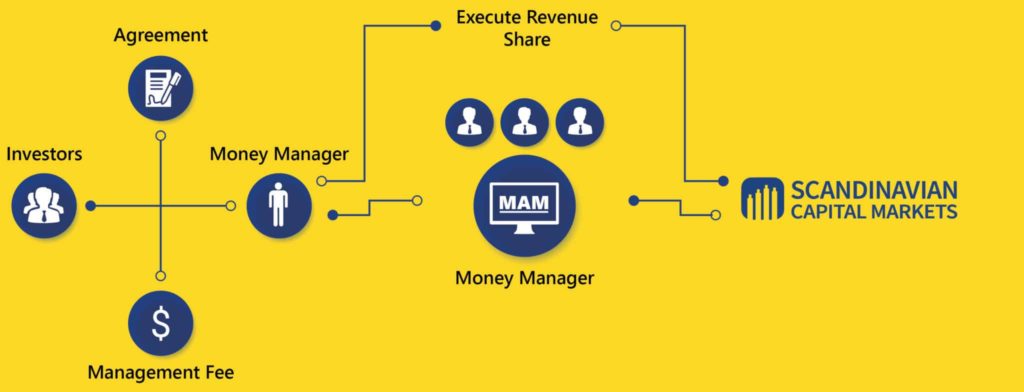

Trading today as a retail trader can be challenging. This is why many retail traders seek to have their money managed by a professional money manager. Up until recently there have been limited options for money managers to manage multiple accounts at once. Often times it required them to login individually to each account in order to place trades. As you can imagine trying to manage multiple accounts for clients in this manner can be downright impossible. The Gold-i Multiple Account Manager makes directing managing investor accounts much easier. Traders can manage accounts for multiple clients and assets from one platform and master account.

Highlights

The Gold-i MAM makes it easy to manage multiple accounts. With the simple installation, money managers can quickly get up and running. The plugin creates a one-stop-shop for managing multiple accounts with single block order entry. The Gold-i MAM includes:

- Single screen order management between master and sub-accounts

- Ability to quickly add new sub-accounts

- Single block order entry

- Customizable allocation methods

- Commission configuration that can be passed to sub-accounts

For traders that want to manage multiple accounts or money managers, the MAM tool is ideal for seamless execution.

Getting started with Gold-i MAM

Scandinavian Capital Markets offers the Gold-i MAM combined with the popular MT4 platform. When a new money manager is onboarded Scandinavian Capital Markets provides them with a MT4 client terminal, Gold-i Multi Account Management Software, and Master Account login details. Installation is a straightforward process. Unlike other MAM software available on the market, the Gold-i MAM does not require any license files to be downloaded or installed. The money manager simply installs the MT4 client terminal and logins into the account using the Master Account login details provided. This is the exact same process as someone logging into a normal MT4 trading account.

Then, in order to control the investor accounts the money manager would install the Scandinavian Capital Markets branded Gold-i MAM software, and login to that software using the Master Account login details. By default though when a customer is onboarded under the MAM they automatically join the MAM and receive trades based on their equity proportional to the overall equity of the MAM. So, it is possible for a money manager to get started trading the MAM without installing the Gold-I MAM software.

Using the Platform

The sleek platform offers an easy way to setup and manage your investor accounts in one screen.

Down the left-hand side, you’ll be able to see the Master Account Details including:

- Login number

- Name

- Deposit Currency

- Balance

- Client Group

- Active/Inactive Users

- Allocation Rules

You’ll notice the window splits into three areas.

Top: In the top area you’ll be able to see the list of all the sub-accounts. This will display configuration options including exclusion type, risk multiplier, account leverage, balance, equity, and margin..

-

Exclusion type – This is used when you want to add or remove an investor from the MAM. With the Gold-i MAM it is possible to temporarily remove a person from a MAM, and add then back in at a later time. Usually, a money manager does this if an investor has specifically requested that they not take part in certain pairs/trades.

-

Risk Multiplier – Some investors prefer to take more or less risk relative to the equity in their account. The risk multiplier provides a simple way for money manager to control the risk each investor takes per trade.

Middle: Here, you can track your current open orders under the master account. You can toggle the expansion of the screen, pull in the latest orders, as well as configure which columns to display.

Bottom: The final section provides you a complete breakdown of a Master Account order. Money Managers can quickly identify how much an investor has received of an open order in this window. .

By bringing all the order management to one screen, users can quickly navigate trades. The split sections make it easy to track and execute orders across multiple accounts.

Defining Allocations

Gold-i MAM contains modules that allow users to define allocations in two ways: Master Account Allocation and Cash allocation. Both follow the same basic concepts.

Equity: Master accounts distributes trade volume across the sub-accounts based on the account’s percentage of its total equity in the master account. The lots within a trade are then divided between the accounts. Any residual lots will travel from highest to lowest equity sub-accounts.

Even: Even’s method distributes the trade evenly regardless of size. Residual lots will be allocated in order of the first account on the list working down.

Balance: The balance method distributes shares based on the sub-accounts percentage of the master account. Residual lots will be allocated working from accounts with the largest to smallest balance size.

Lot: This method only exists for the Cash allocation method. Lot allocation distributes the master trade lot size to the sub-accounts based on a configuration lot factor that the administrator sets.

Master account allocations have orders pushed from the master account down to the sub-accounts. Cash allocations have all the trades executed under the master account. Profits or losses are then distributed after the trade is closed.

Commission Configurations

Manual management of multiple accounts often comes with the hassles of allocating commissions. The Gold-i MAM allows users to pass on per trade commissions and/or spread costs incurred to the sub-accounts. Additionally, at the end of each month Scandinavian Capital Markets provides a detailed report on each investors performance, and handles performance and management fee payments. This allows a money manager to focus on trading their investor accounts, while Scandinavian Capital Markets handles the back office administration work.

Additional Configurations

While we’ve discussed many of the major configurations, there are several additional ones available as well:

- Number of allocation groups to be used

- Allow for sub account markups

- Full or allocation exclusion type toggle

- Auto-handle sub-client removal

- Daily reporting on master account open positions and account balances as well as for sub-accounts

Ability to close allocated sub account trades independently from the master account

The ability to close sub accounts independently from the master account has been a challenge for other MAMs on the market. This has caused issues when a money manager has investors who would like to leave the MAM while positions are open. As a result many brokers and money managers prevent investors from leaving the MAM while there are open positions, which has caused issues in the past. Gold-i has developed their MAM platform with these issues in mind, and through their seamless allocation methods they are able to flawlessly allow investors to leave a MAM at anytime.

Final Thoughts

Although many MAM tools exist, the Gold-i MAM provides an immediate benefit for all levels of traders and money managers. The ability to work with the MT4 platform makes it unique in its universal capabilities. Given the breadth of configuration options available, everyone from large funds to individual traders will benefit from the Gold-i MAM solution offered by Scandinavian Capital Markets.

Cover photo: Denisismagilov