Forex Carry Trading

Carry trading vanished with the 2008 financial crisis. Fast forward and interest rates were raised at light speed. Starting 2023, carry trading opportunities are stronger than ever.

- Learn about forex carry trading

- See how it generates profit

- Get to know trending positive carry trades and positive swap pairs

- Tips on how to start

What is forex carry trading?

Forex carry trading is a trading strategy that involves buying a high-yielding currency, such as the Czech koruna (CZK), while simultaneously selling a low-yielding currency, such as the Swiss franc (CHF), to profit from the interest rate difference between the two currencies. Carry traders essentially borrow money at the lower interest rate and invest it in the higher interest rate currency. The goal is to profit from the difference in rates without speculating on exchange rates.

How forex carry trading works

Every currency pair consists of two currencies; the base currency and the quote currency. To open a position, you borrow the base currency to buy or sell the quote currency. If you are short CHF/HUF, you borrow and sell Swiss francs to buy Hungarian forints. If the CHF interest rate is lower than the HUF interest rate, traders can receive a positive swap from the broker for holding a position overnight. The larger the interest rate spread, the greater the positive swap payment for the position.

How it generates profit

Swap rates are based on interest rate differences between two currencies in a given forex pair. Carry trade positions generate profit from positive swap payments. For example, suppose the EUR/USD has a long swap of -1.146 pips and a short swap of 0.476 pips. That means a long position for one lot would be charged $11.46 swaps, and a short position would receive $4.76 swaps. However, carry traders look for currency pairs with much larger positive swaps.

Trending positive carry trades

To find viable carry trading opportunities, you need to choose a currency pair consisting of a currency with a low interest rate and a high interest rate. As central banks worldwide have been adjusting their interest rates to cool inflation, many interesting carry trading opportunities have emerged.

| High interest currencies | Low interest currencies | ||

|---|---|---|---|

| Hungarian forint (HUF) | 13% | Japanese yen (JPY) | -0.1% |

| Turkish lira (TRY) | 9% | Swiss franc (CHF) | 1% |

| Czech koruna (CZK) | 7% | Danish krone (DKK) | 1.75% |

| South African rand (SAR) | 7% | Euro (EUR) | 2.5% |

| Polish zloty (PLN) | 6.75% | Swedish krona (SEK) | 2.5% |

Positive swap currency pairs

To take advantage of carry trading opportunities, you need to find currency pairs offering a positive swap, that’s significant enough to generate meaningful returns and offset the exchange rate risk.

| Currency pair | Pip value (1 lot) | Long swap | Short swap |

|---|---|---|---|

| CHF/HUF | 1,000 HUF | -23.054 | 13.938 |

| EUR/CZK | 100 CZK | -5.058 | 1.996 |

| CHF/PLN | 100 PLN | -1.066 | 0.552 |

| EUR/MXN | 10 MXN | -73.062 | 31.943 |

| EUR/TRY | 10 TRY | -124.850 | 72.724 |

| USD/JPY | 1,000 JPY | 1.116 | -2.107 |

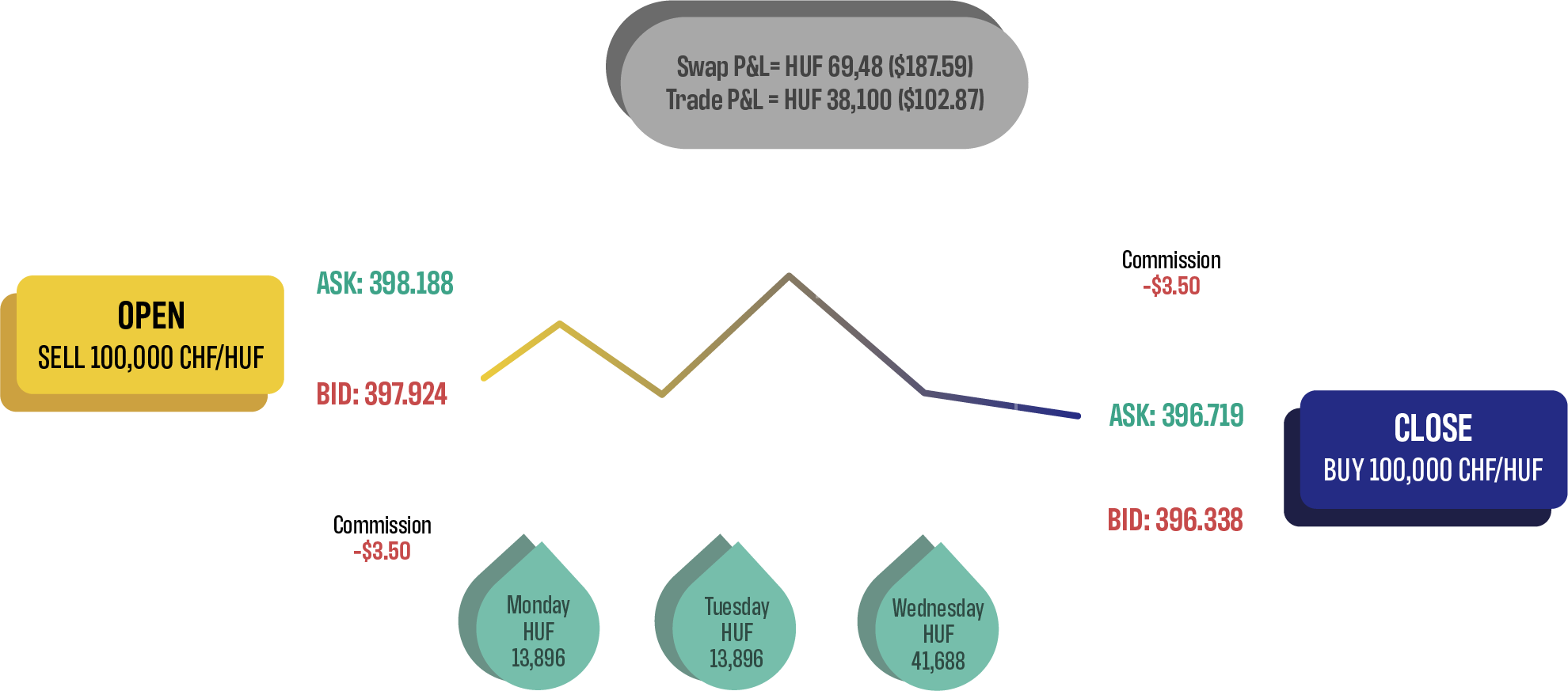

Example of a carry trade

Suppose you open a position to sell 1 lot of CHF/HUF, and the short swap rate is 13.896 pips. You’d earn a positive swap of 13,896 Hungarian forints each day, and on Wednesday, when a triple rollover is applied, you’d earn 41,688 Hungarian forints.

How to start carry trading

To get the most out of a carry trading strategy, it’s important that you have a broker that updates their swaps daily to reflect market conditions. Most forex brokers operate dealing desks, where they offset customers’ orders internally. Therefore, they don’t execute your positions with liquidity providers and therefore don’t earn swaps on your behalf. While dealing desk brokers can be more competitive on spreads for major currency pairs but cannot compete with STP brokers on exotic currency pairs or swap rates.

Open an account and start your journey

Ready to start trading?

Open your Scandinavian Markets trading account for true STP forex trading.