Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

August 4, 2021

August 4, 2021

.7100 might be in play again for NZDUSD. The level has been a pivot since December. It’s also near the 25 line within the channel from the February high. Since the 75 line was support (twice), we should expect resistance near the 25 line (median line symmetry!). .7100 is also the 200 day average.

August 4, 2021

July 21, 2021

July 21, 2021

Yen crosses reversed higher today. Expanding on the implications from the Nikkei bear trap, GBPJPY tagged the 3/24 low today before reversing higher. Price also held trendline support. I’m constructive towards 150.74-151.31 (former lows).

July 21, 2021

July 20, 2021

July 20, 2021

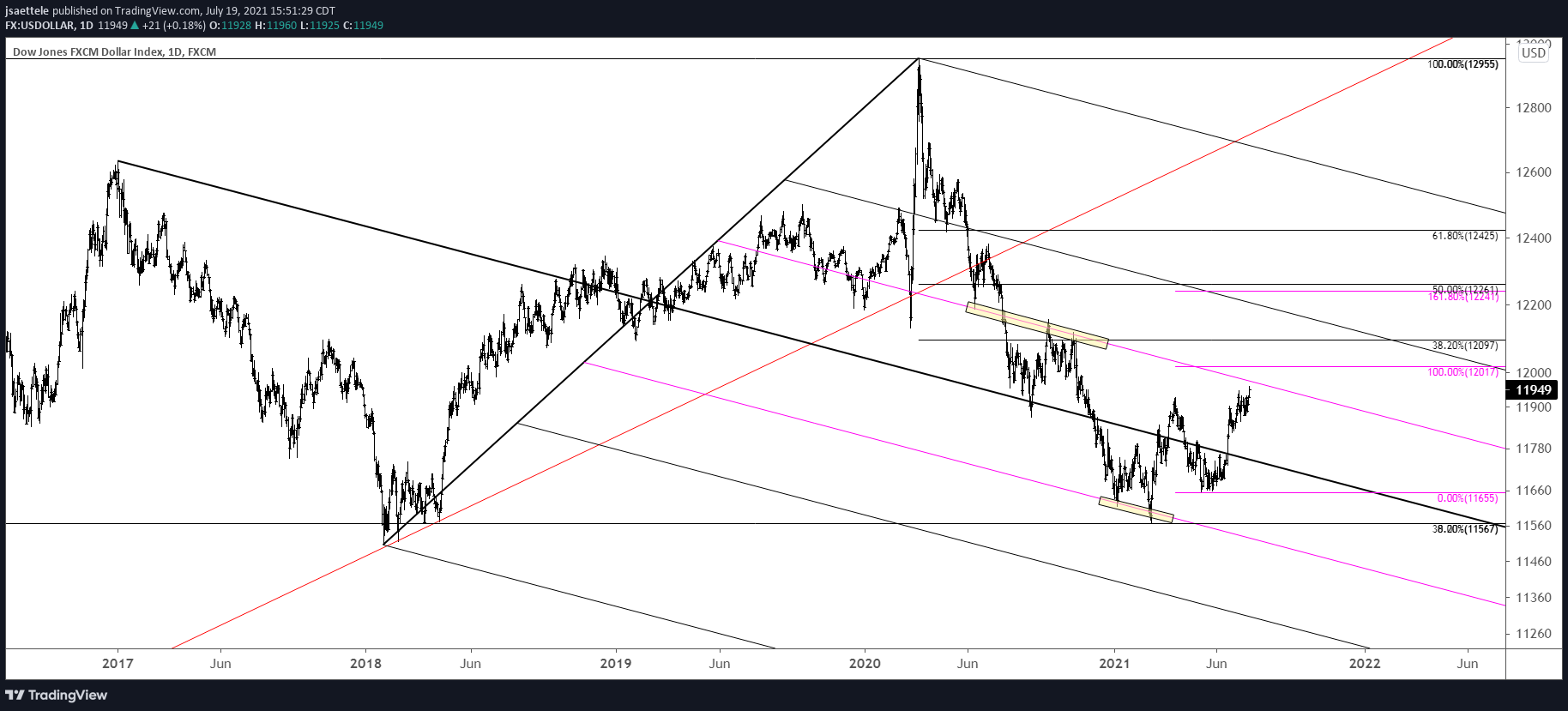

We got the leg up in USDOLLAR and price has entered the a possible resistance zone. My ‘base case’ is that price does pull back before resuming higher. Keep it general for now regarding USDOLLAR.

July 20, 2021

July 16, 2021

July 16, 2021

DXY and USDOLLAR remain in flux (one more push higher as per the 4th wave interpretation?…see yesterday’s post) but EURUSD action from the low is constructive. Price rallied in 5 waves and declined in 3 waves therefore I lean towards the long side against 1.1772. Also, don’t forget that Euro futures are holding VWAP from the March low (see below).

July 16, 2021

July 15, 2021

July 15, 2021

Short term waves suggest that crude has put in a lower high. Specifically, a 3 wave rally followed a 5 wave decline from a high. The implication is that another impulsive decline is underway. The March high at 68 is an initial level of interest on the downside. For context, the longer term chart is reproduced below.

July 15, 2021

July 14, 2021

July 14, 2021

Kiwi continues to play out beautifully. .7000 has provided resistance the last 3 days and focus remains on .6750-.6800. RBNZ is tonight (Wednesday in New Zealand) so it’s possible that we get a flush into .6800 or so before a rebound. For us, this sets up a possible opportunity to flip from short to long.

July 14, 2021

July 8, 2021

July 8, 2021

FOMC minutes were today and the ECB version is tomorrow. Price is just pips from the noted 1.1770 level (remember that’s a possible bounce level). Price is currently at VWAP from the 2020 low, which was support for the March low. Bottom line, EURUSD is into a zone that could lead to a strong bounce. If reversal evidence arises, then I’ll let you know and look to take action.

July 8, 2021

July 1, 2021

July 1, 2021

EURUSD is in the exact opposite position as DXY. That is, the line that extends off of the September and March lows intersects the median line from the fork that originates at the January high. That intersection is about 1.1770. A break below there would be extremely bearish. The red parallel (25 line) is now resistance. That line is currently about 1.1950 about 6 pips per day.

July 1, 2021

June 30, 2021

June 30, 2021

NZDUSD went slightly through the median line (red line) but that line remains proposed resistance near .7020. Downside focus is the long held .6800 level (2 equal legs are at .6795).

June 30, 2021