Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

September 10, 2020

September 10, 2020

GBP/USD fell to its lowest levels since July 28th on Wednesday, extending losses from the recent yearly high made on September 1st. The same day, the UK government published its Internal Market bill, outlining a plan to breach the pledges in the EU Withdrawal Agreement.

September 10, 2020

September 9, 2020

September 9, 2020

QQQ has broken down and the same levels are in focus that were noted yesterday (text below). All I’m adding is that if price bounces from here (a gap up on news tomorrow for example) then 279 is proposed resistance.

September 9, 2020

September 7, 2020

September 7, 2020

GBP/USD extended its losses in early trading on Monday, after sliding for three consecutive days last week. News that UK Prime Minister Boris Johnson is ready to allow negotiations to fail rather than compromise on certain Brexit principles has driven stering lower.

September 7, 2020

September 2, 2020

September 2, 2020

DXY traded 91.75 today before turning (exact midpoint between 91.50 and 92.00 by the way) higher. A daily volume reversal triggered in the process! We now have 2 triggers since 7/31, which is similar to the 2 triggers in January 2018 and summer 2018. Additional signals occurred in May 2016 and May 2014 (these are all circled on the chart below). Strength above 93.04 (high volume level from Powell’s Jackson Hole speech last Thursday) would break a 1 month wedge and suggest that the trend has reversed (hourly chart is below too).

September 2, 2020

August 25, 2020

August 25, 2020

3 lower highs and 2 lower lows since the EURUSD high. I like that strength has failed near VWAP from the high twice and that today’s high is near the high volume level (circled) from 8/19. 1.1880 is still resistance if reached and the big test for the bulls remains the lower parallel, currently near 1.1675 (see below).

August 25, 2020

August 21, 2020

August 21, 2020

The EURUSD drop from Tuesday’s high is in 5 waves and price has retraced 38.2% of the decline so weakness could resume now. If that fails to materialize, then the 61.8% is proposed resistance at 1.1903.

August 21, 2020

August 19, 2020

August 19, 2020

GBP/USD inched higher in early trading on Wednesday, reaching its highest levels since December 31st. The recent surge has been largely attributed to a soft US dollar and rising expectations that a Brexit trade deal will be reached by October.

August 19, 2020

August 18, 2020

August 18, 2020

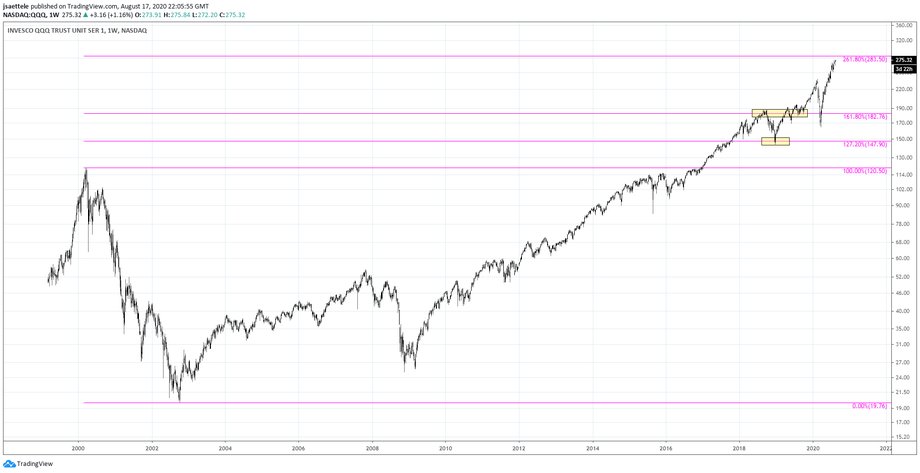

Be aware of the 261.8% expansion of the 2000-2002 decline in QQQ at 283.50 as potential resistance. That’s about 3% higher. The first 2 Fibonacci levels, 127.2% and 161.8%, presented several opportunities (close up view is below). The equivalent level in the Nasdaq Composite Index is 11643.40, which is 4.6% higher than today’s close (2 charts down).

August 18, 2020

August 14, 2020

August 14, 2020

The British Pound remained on the front foot in early trading on Friday amid rising optimism over a Brexit deal and easing lockdown rules in the UK. Sterling remains near a 5-month high and is currently holding above the key psychological level of 1.30.

August 14, 2020