Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

May 20, 2021

May 20, 2021

Since the 5/10 high, AUDUSD has dropped in 5 waves, rallied in 3 waves, and dropped in 5 waves at a lesser degree. An Elliott wave textbook! Resistance should be .7760/70 now. Broader downside focus is .7415 (2 legs down from the February high and the September high…see below). 5/18 – AUDUSD tagged .7814 today. Again, this is the 61.8% retrace of the decline from 5/10 and well-defined resistance since early January. This is a great spot for AUDUSD to roll over. .7730 needs to give in order to ‘open the floodgates’. This level is 2021 VWAP, VWAP from the February high, and VWAP from the March low (see futures chart below).

May 20, 2021

May 5, 2021

May 5, 2021

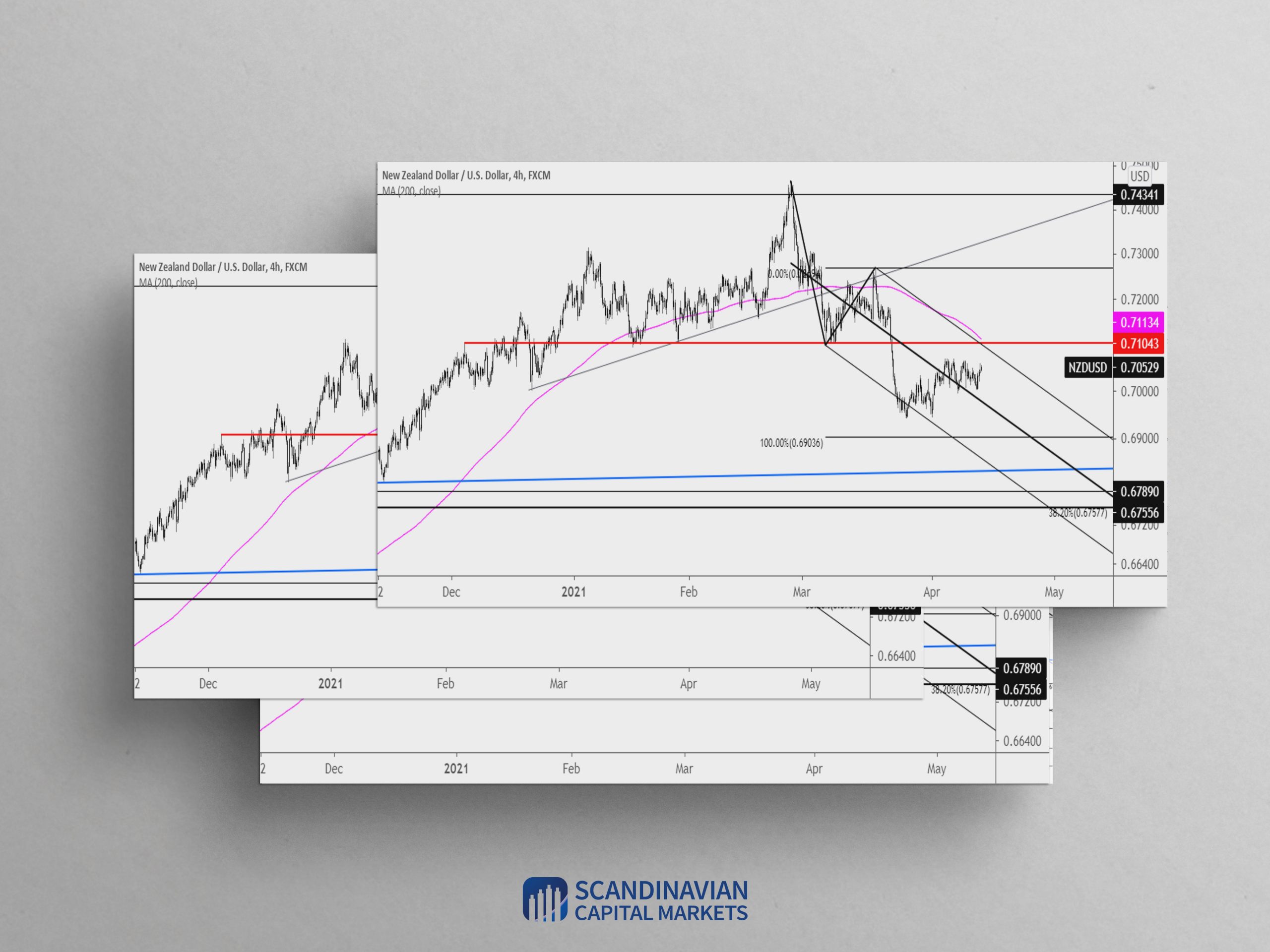

Kiwi has traded in a textbook fashion over the last week or so. Resistance at the channel high…hard break of the center line…center line acting as resistance…and finally the lower channel line holding.

May 5, 2021

May 4, 2021

May 4, 2021

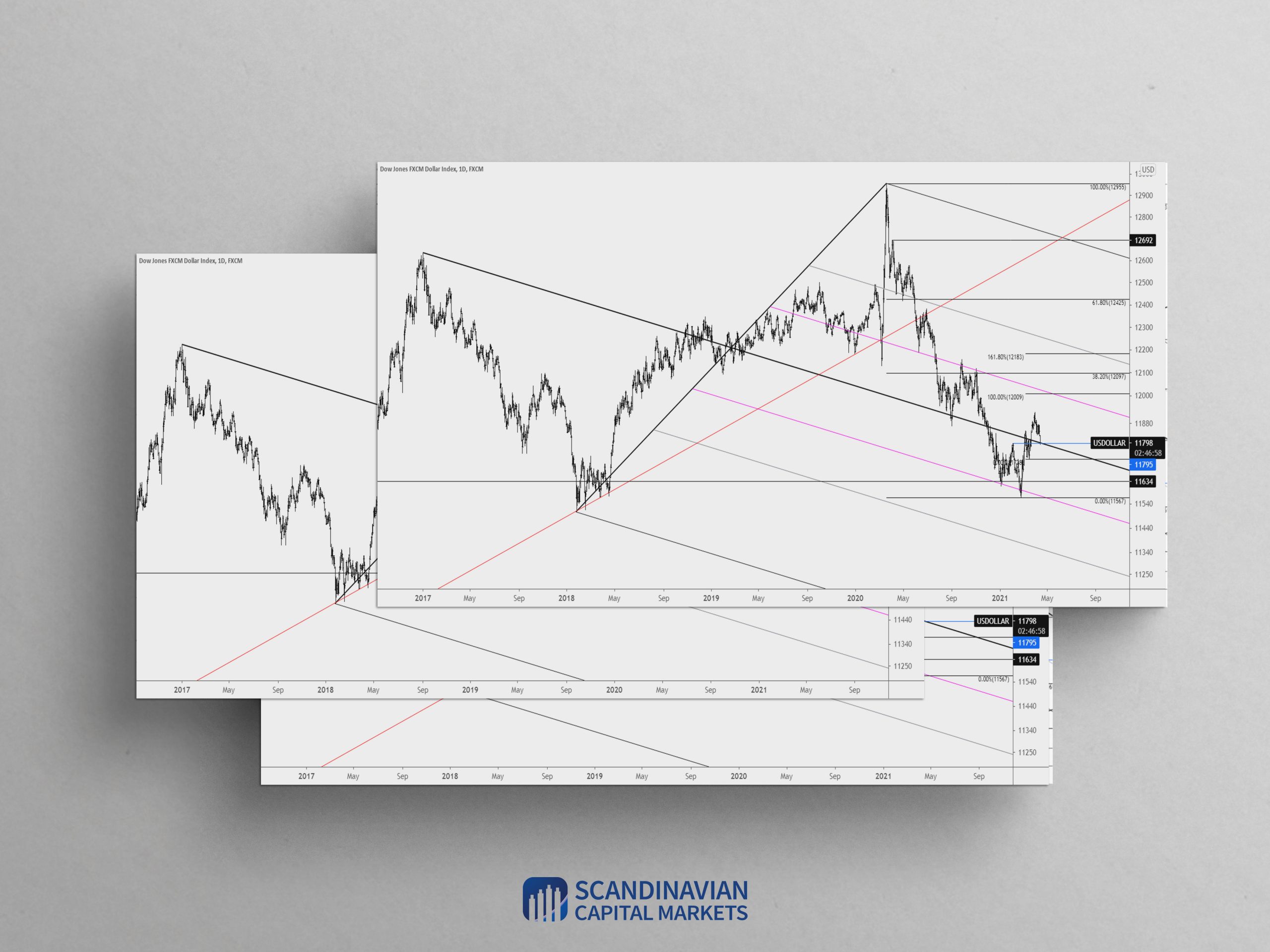

DXY turned sharply higher on Friday but gave back a good portion of those gains today. The rally counts in 5 waves (impulsive) which suggests at least one more leg up while price remains above Friday’s high. 90.79 is proposed support if price slips a bit lower.

May 4, 2021

April 20, 2021

April 20, 2021

The sharp USD drop on Monday makes me neutral at best for now. I had wanted to see USDOLLAR hold the median line from the multiyear structure in order to stay constructive (see below). That said, DXY has reached VWAP from the January low and USDOLLAR has reached the 3/18 low. The 61.8% retrace for USDOLLAR is slightly lower at 11705. Keep an eye on these levels for possible support.

April 20, 2021

April 15, 2021

April 15, 2021

I was wrong to think that the USDOLLAR pullback was complete last week but the long cited 11795 level has been reached. This is a decision point…plain and simple. The level is defined by the early February high and median line of the structure that originates at the 2017 high. The drop also channels in a corrective manner. Bottom line, price needs to turn up now in order to remain constructive on a swing basis.

April 15, 2021

April 14, 2021

April 14, 2021

NZDUSD failed to turn lower from the line that extends off of the February and 3/18 highs. The structure from the February high is now a Schiff fork. The upper parallel intersects with the well-defined .7100 level and 200 period average on the 4 hour chart. If NZDUSD is lower, then .7100 is the price to short.

April 14, 2021

April 13, 2021

April 13, 2021

Copper is once again testing the critical trendline from the March 2020 low. This line is reinforced by the 50 day average, which has been precise support since November. I’m waiting for a break lower in order to turn bearish copper.

April 13, 2021

April 2, 2021

April 2, 2021

The copper/gold ratio is churning at 8 year trendline resistance. A pullback/consolidation of gains over the last year (the ratio bottomed in April 2020) ‘makes sense’ from this level. This is an important ratio to watch for clues on interest rates (Gundlach often references this ratio) and trends in inflationary/deflationary assets (notice the deflationary crash into the 2009 low and recent inflationary rally for example). I prefer to look at the 30 year bond rate rather than the 10 year note because the long end is more indicative of inflation. The copper/gold ratio and U.S. 30 year bond yield are shown in the chart below. So…pullback in the ratio from resistance…and pullback in rates (also from resistance…see 2 charts down)…which may mean a deeper pullback in the ‘inflation trade’. In FX, this would mean higher USD (already underway), lower commodity currencies (getting started), and lower Yen crosses (waiting on the turn).

April 2, 2021

March 31, 2021

March 31, 2021

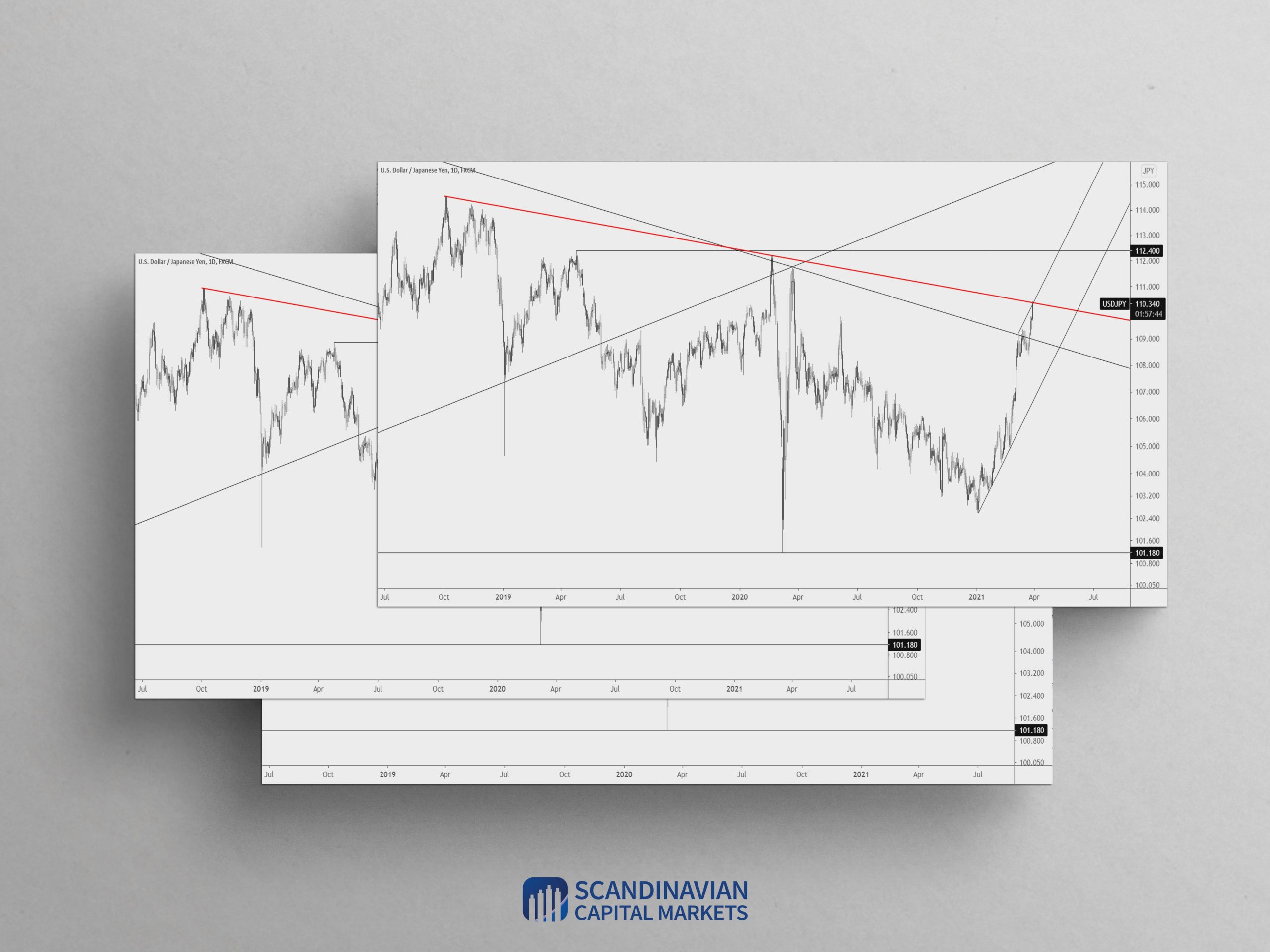

USDJPY continues to rip higher but price has reached an interesting level. The level in question is the line that extends off of the 2018 and 2020 highs. Seasonal tendencies also top this week. This trendline/seasonal combination makes for a great opportunity to fade the move but we need price to suggest that some sort of a top is in place. An intraday volume reversal for example would suffice.

March 31, 2021