Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

December 10, 2021

December 10, 2021

NZDUSD has lagged AUDUSD on this bounce, which is interesting because AUDUSD reached it’s key level (.6990) but the key level for NZDUSD is slightly lower at .6700. Recall that this is the 38.2% retrace of the rally from March 2020 and the line off of lows since March. The November 2020 low has been reached at .6756 but I love the confluence at .6700. Watch for a possible non-confirmation with AUDUSD and NZDUSD. This would occur if NZDUSD drops to a new low but AUDUSD makes a higher low. This non-confirmation tends to occur at turns. .6860 remains an important overhead barrier.

December 10, 2021

December 3, 2021

December 3, 2021

We got a prediction headline. The following is courtesy of the WSJ. Whether Omicron Wreaks Havoc or Not, the U.S. Dollar Is a Buy

Prediction headlines indicate extreme confidence in the direction of the trend. This is the same psychology that led to Powell capitulating on inflation. I’m extremely bearish the USD. Whether or not we get a spike higher following NFP is a complete guess but pay attention to this short term channel in USDOLLAR. A break below would serve as the ‘all clear’ that the USD is about to dump.

December 3, 2021

December 1, 2021

December 1, 2021

The DXY high is right on the trendline that was pointed out last week (see chart below for the full picture)…we may have just seen a major top. Trading wise, I’m looking towards 93.30/50 with 95.20s as a possible bounce level. The lower zone is channel support. That will be the big test. If DXY is a bear then 96.20s should provide resistance.

December 1, 2021

November 4, 2021

November 4, 2021

Crude traded up to 84 (a bit above) and has gone straight down since. 82.20 is now proposed resistance if crude bounces. Downside focus is the July high at 76.98 and possibly the top side of the LONG TERM former resistance line (now support) near 73. The weekly chart below shows the this long term chart in its entirety.

November 4, 2021

October 28, 2021

October 28, 2021

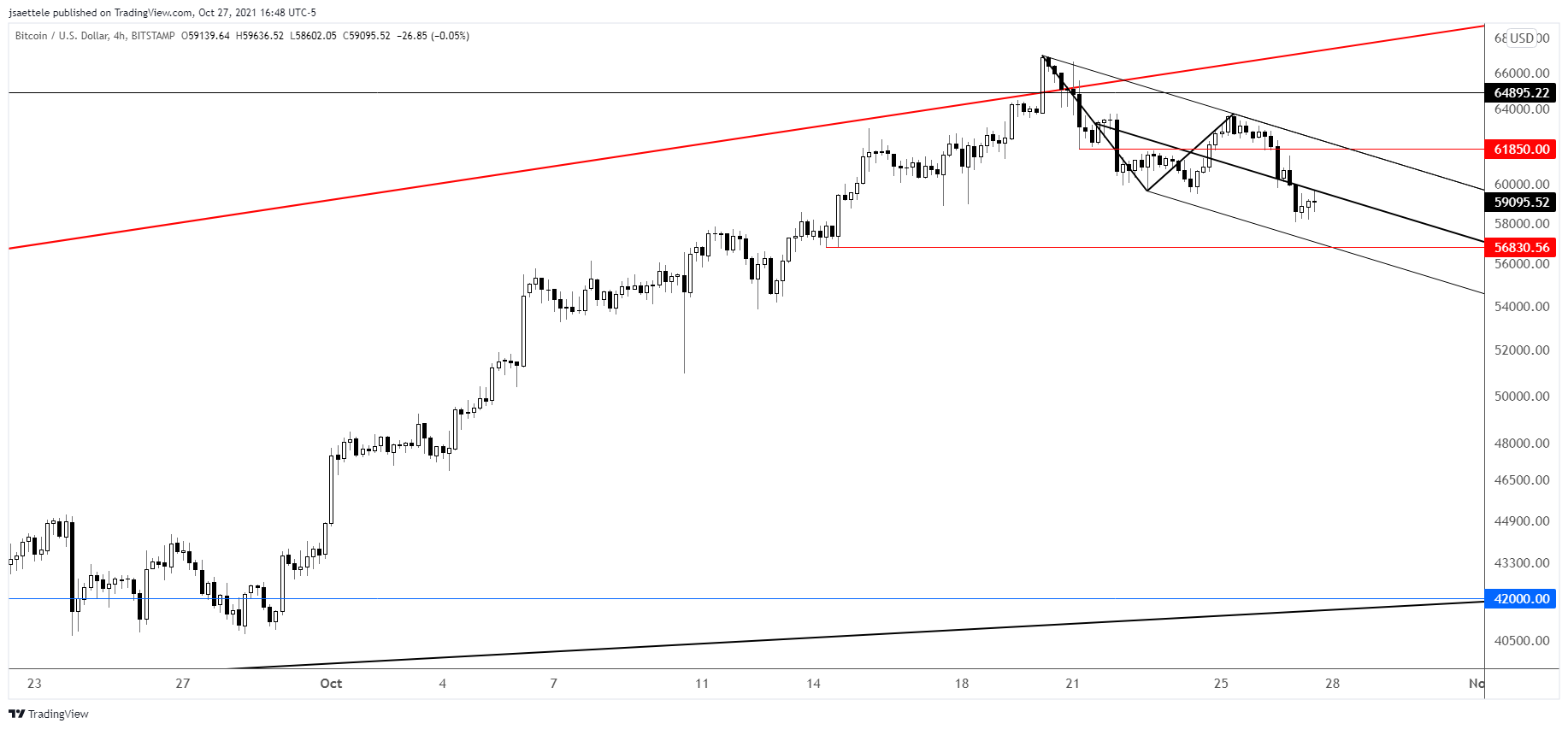

BTCUSD is off 13% since the top last week. If price drops under the short term lower channel line near 56830 then weakness will be considered impulsive and ‘waterfall’ weakness would be on the table. Watch for resistance near 61850. The weekly chart is shown below. This looks ‘toppy’ to me. Yes, ‘toppy’ is an official technical term. Former trendline support has provided resistance on the way up, a doji candle formed last week, and the rally failed after taking out the prior high. Seems bearish. Finally, is BTCUSD trying to tell equities something (see 2 charts down)

October 28, 2021

October 26, 2021

October 26, 2021

Gold broke above trendline resistance and the 200 day average today. The top side of the trendline (blue) is now proposed support near 1790. Upside focus is the line off of the August 2020 and June high. That’s about 1840.

October 26, 2021

September 3, 2021

September 3, 2021

AUDUSD is closing in on the well-defined .7415. Interestingly, this is the September 2020 high. It’s also support from July and resistance from August. I’ll be on the look for a turn down between .7415 and .7050 (short term channel and bigger picture neckline…see below for a zoomed in chart).

September 3, 2021

August 19, 2021

August 19, 2021

GBPJPY did indeed roll over from the 50 day average and price is testing the well-defined trendline from the March 2020 low. A massive head and shoulders pattern is evident and the target on a break would be near 140. Watch for resistance near 151.80 (see 4 hour chart below).

August 19, 2021

July 15, 2021

July 15, 2021

Short term waves suggest that crude has put in a lower high. Specifically, a 3 wave rally followed a 5 wave decline from a high. The implication is that another impulsive decline is underway. The March high at 68 is an initial level of interest on the downside. For context, the longer term chart is reproduced below.

July 15, 2021