Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

September 29, 2020

September 29, 2020

We looked at DXY yesterday, remember that the neckline is 93.50 and proposed support for that index. USDOLLAR is nearly identical with the neckline near 12040. I’m in the re-test of the breakout level (neckline) and then higher for the USD.

September 29, 2020

September 28, 2020

September 28, 2020

Silver broke the trendline from the March low last week and is bouncing from short term oversold conditions. It would be quite a bounce but the underside of the noted trendline intersects the well-defined 26.10/28 zone late this week.

September 28, 2020

September 22, 2020

September 22, 2020

USDOLLAR finally broke above the upper parallel from the Schiff fork off of the March high. The top side of this line should now provide support near 12010. The next upside level of interest is the March low at 12129. This level intersects corrective channel resistance on Wednesday.

September 22, 2020

September 17, 2020

September 17, 2020

AUDUSD continues to bang against the center line of the channel from the 6/15 low. Action since the 9/9 low is overlapping, brutal, and clearly corrective. Below .7250 would now constitute a bearish break of the channel from the 6/15 low and shift focus to the full channel extension, which intersects the key .7064 level in the middle of next week.

September 17, 2020

September 1, 2020

September 1, 2020

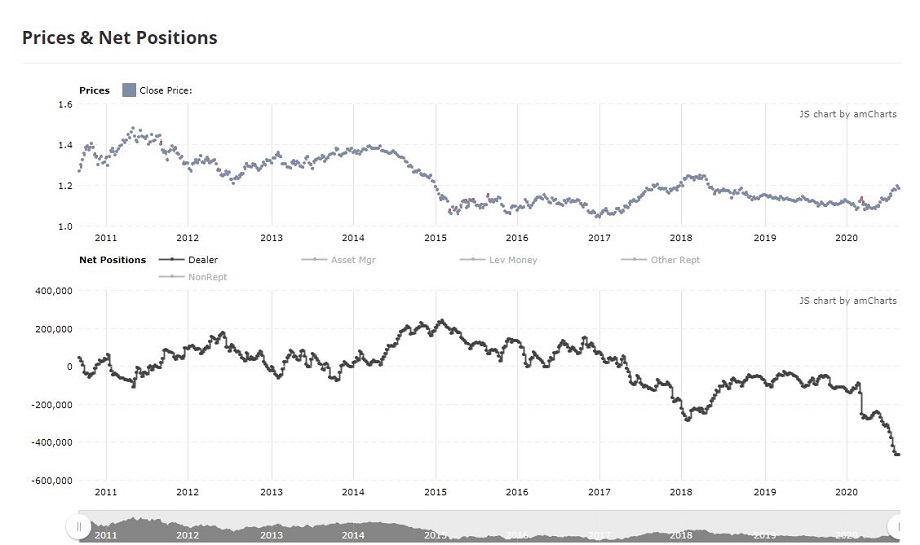

In financial futures, dealers are considered the ‘smart money’. They tend to be bearish at the top and bullish at the bottom. So, it usually pays to pay attention when their position becomes extreme. Well, the dealer short position in Euro is basically off of the bottom of the screen. In fact, the dealer short position in early 2018 (last big EURUSD high) pales in comparison to the current position. Price wise, pay attention to the levels noted yesterday.

September 1, 2020

August 28, 2020

August 28, 2020

The Australian dollar climbed to its highest levels against the greenback since December of 2018 in early trading on Friday. The Aussie has been lifted by recent positive Sino-U.S. trade developments and better than expected economic data.

August 28, 2020

August 27, 2020

August 27, 2020

Since the 8/6 high in gold, I’ve been closely tracking GLD. The rally from 8/12 found resistance at the 61.8% retrace and a short term bearish channel is confirmed following the median line touch. If GLD has turned lower, then resistance should be 185.00 (38.2% retrace and VWAP from the high).

August 27, 2020

August 25, 2020

August 25, 2020

3 lower highs and 2 lower lows since the EURUSD high. I like that strength has failed near VWAP from the high twice and that today’s high is near the high volume level (circled) from 8/19. 1.1880 is still resistance if reached and the big test for the bulls remains the lower parallel, currently near 1.1675 (see below).

August 25, 2020

August 6, 2020

August 6, 2020

Expanding on yesterday’s gold chart (remember that the Fibonacci measurement is 2095…today’s high was 2070…), daily RSI is now 89.8. The indicator has been this high just twice before; January 1980 (twice) and September 1999.

August 6, 2020