Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

June 19, 2020

June 19, 2020

***Happy Phi (6/18) Day! Another day of quiet for the most part (GBP was down big) but tomorrow could get interesting intraday due to June expiration.***

June 19, 2020

June 18, 2020

June 18, 2020

TradingView attracts forex, CFD, cryptocurrency, futures, options and stock traders from every corner of the market.

You might wonder, why TradingView is so popular amongst different categories of traders. How is it possible to cater to them all?

June 18, 2020

June 18, 2020

June 18, 2020

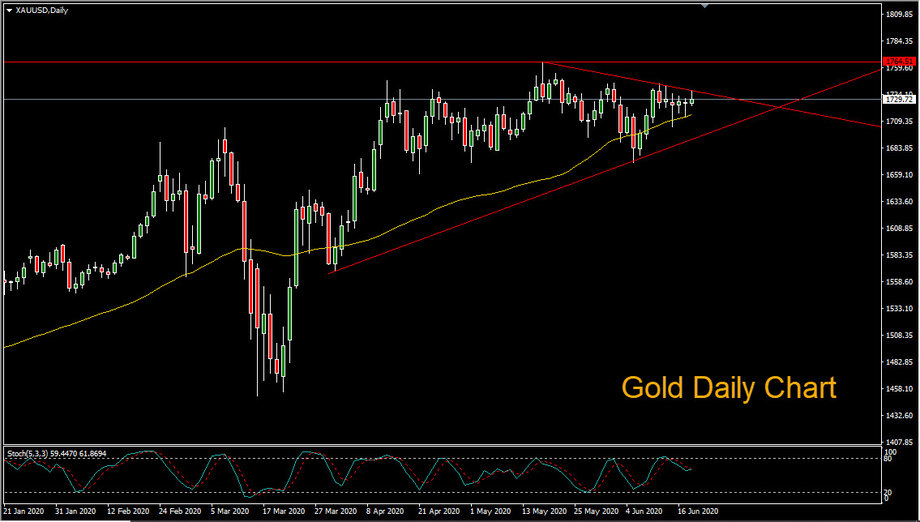

Gold prices inched higher in early trading on Thursday, as an increase in coronavirus cases threatened to derail economic recovery from the pandemic. A more dovish than expected June FOMC meeting has also bouyed the yellow metal.

June 18, 2020

June 18, 2020

June 18, 2020

Today was extremely quiet and as a result I don’t have much to update. Australian employment is tonight however so it’s worth another look at AUDUSD. If the flat interpretation is correct, then a lower high is in place at .6977 (and price shouldn’t move much above .6900). The ‘cleanest’ downside level is .6685-.6700. This has been a major level since July (almost a year), 2 equal legs down, and the 200 period midpoint on the 4 hour chart (magenta line).

June 18, 2020

June 17, 2020

June 17, 2020

Scand.Ex is pleased to present the next video with trading analysis by Jamie Saettele, our Chief Technical Analyst.

June 17, 2020

June 17, 2020

June 17, 2020

USDOLLAR focus remains towards 12428. In fact, 2 equal legs up from the low would be 12418. The upper parallel of the Schiff fork and short term bullish channel intersect 12418/28 on Thursday/Friday. The level is also marked by the 4/30 low.

June 17, 2020

June 16, 2020

June 16, 2020

Risk appetite returned to the market on early on Tuesday as the US Federal Reserve prepared to begin purchasing up to $250 billion in individual corporate bonds. In addition, a report from Bloomberg stating that the Trump administration is preparing a nearly $1 trillion infrastructure proposal helped to lift investors spirits.

June 16, 2020

June 16, 2020

June 16, 2020

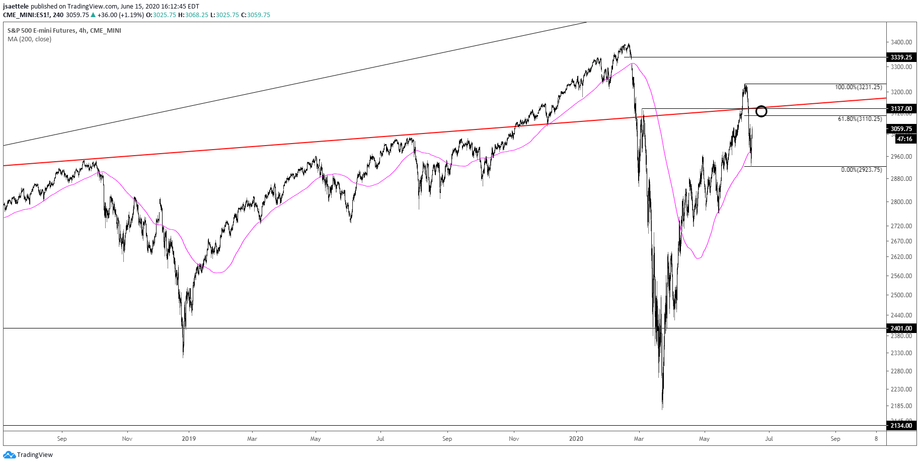

I’m thinking that ES carries into 3110/37 before encountering stronger resistance for another leg lower. The zone is defined by the 61.8% retrace and underside of the line that crosses pivots (high and lows) since 2018 (red line).

June 16, 2020

June 15, 2020

June 15, 2020

My view is that the USDOLLAR bounce is counter trend but it should carry higher before rolling over. The upper parallel of the Schiff fork is a candidate for resistance along with the 61.8% retrace of the decline from 5/18 at 12428. Watch for support from 12304 (more or less now).

June 15, 2020