Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

July 11, 2020

July 11, 2020

Scand.Ex is pleased to present the next video with trading analysis by Jamie Saettele, our Chief Technical Analyst.

July 11, 2020

July 10, 2020

July 10, 2020

The US dollar and other safe haven assets were supported in early trading on Friday amid concerns over the spread of the conoravirus pandemic and a slower than expected economic recovery.

July 10, 2020

July 10, 2020

July 10, 2020

No change to the 7/7 comments and ‘view’ of reversal risk in the Nasdaq. I’m simply pointing out that NQ made another 8 hour volume reversal today.

July 10, 2020

July 9, 2020

July 9, 2020

Scand.Ex is pleased to present the next video with trading analysis by Jamie Saettele, our Chief Technical Analyst.

July 9, 2020

July 9, 2020

July 9, 2020

I remain broadly constructive GBPUSD but price could pull back from the current level, which is defined by 2020 VWAP (see 2 charts down). I’m showing 2 technical interpretations. An Elliott interpretation is that 5 waves up are complete or nearly so and that price should pull back towards the area of the prior 4th wave.

July 9, 2020

July 8, 2020

July 8, 2020

Risk’ may have put in an important high today. The following charts ‘explain’ why.

July 8, 2020

July 7, 2020

July 7, 2020

The EURUSD drop from 6/10 to 6/19 retraced exactly 38.2% of the rally from 5/7. 4th waves often retrace 38.2% of 3rd waves. The implication is that EURUSD is headed higher in a 5th wave. A possible target is where wave 5 would equal wave 1 at 1.1460. The high volume level at 1.1261 is a good spot for support (the year open is 1.1260 by the way). Be aware of the current ownership profile however (see below). Speculators are the most long since the 2017 high.

July 7, 2020

July 2, 2020

July 2, 2020

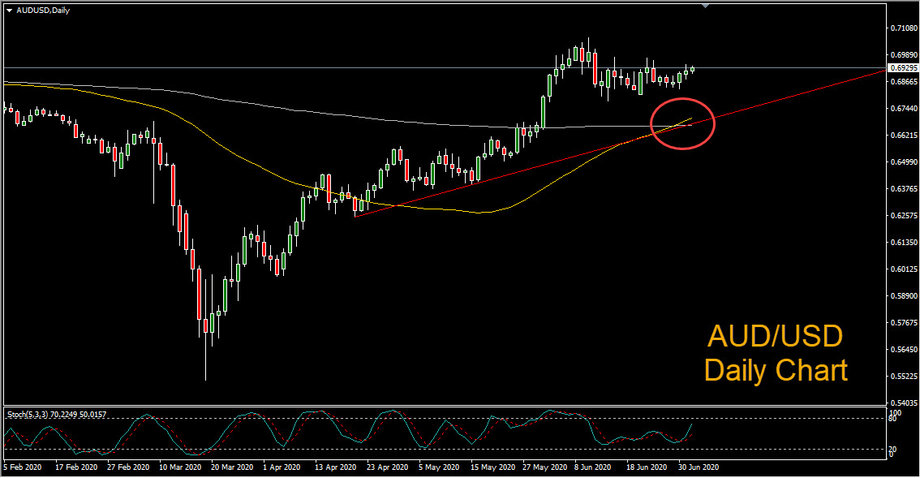

A bullish golden cross (50-period SMA crossing above the 200-period SMA) has formed on the AUD/USD daily chart. The Aussie has been supported by upbeat Chinese and Australian data, while the US dollar lost some of its safe haven appeal amid positive US and European economic data.

July 2, 2020

July 2, 2020

July 2, 2020

USDJPY completed its flat and reversed from the well-defined 108.00/08, carving a bearish outside day today. 108.00 is the 61.8% retrace of the February-March decline. 108.08 was high print a number of days in April and May. The fractal nature of markets is on display in the chart below. The pattern from 6/5 to today is the same shape as the pattern from 3/24 to 6/5. That’s a fractal! Finally, I like that Yen futures held 2020 VWAP and VWAP from the February low. Very short term focus is on 106.92 although significant downside potential exists in USDJPY as long as price is under today’s high.

July 2, 2020