Education

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- About

- Accounts

- Articles

- Company News

- Cryptocurrency

- Education

- Forex

- Funding

- HFT

- Institutional

- Interviews

- Money managers

- MT4

- News and Analysis

- Partnerships

- Uncategorized

- White label

- All

- $GME

- Abe Cofnas

- account

- ADA/USD

- ADP

- alert

- Alpesh Patel

- Analysis

- Andrew Pancholi

- Apple

- Arif Alexander Ahmad

- ASHR

- asset manager

- AUD/CAD

- AUD/JPY

- AUD/USD

- AUDDollar

- Aussie

- australian dollar

- Automated Trading

- Bank of England

- Bitcoin

- Bitcoin Halving

- Boris Schlossberg

- Bow Sailing

- bradley Rotter

- Brexit

- BRITISH POUND FUTURES

- BritishPound

- broker

- BTC/USD

- CAD/JPY

- CANADIANDOLLAR

- capital

- charity

- Charting

- China

- CLDR

- Client Service

- Commodities

- Commodity

- community

- Company News and Events

- Copper

- Copy Trading

- Coronavirus

- corporate responsibility

- corporate social responsibility

- COVID

- COVID-19

- Crude Oil

- CRYPTOCOIN

- Cryptocurrencies

- CTA/USD

- cTrader

- currency

- Currenex

- Cycles

- Daily Analysis

- Dan Blystone

- Daniel Hunter

- DDQ

- DIA

- DJI

- DJIA

- DOCU

- DOG/USD

- Dogecoin

- Dollar

- DOT

- DOT/USD

- Dow

- DUTCH

- DXY

- Employment Report

- ES

- ETF

- ETH/USD

- Etienne Crete

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/USD

- Euro

- event

- fake

- Family Offices

- FED

- Federal Reserve

- Fibonacci

- Finance Magnates

- firm

- Fiscal Stimulus

- FIX API

- FOMC

- Forex

- Forex Education

- Forex Investment

- Forex Market

- Forex Mentor

- Forex Scam

- Forex Valhalla Initiative

- ForexCrunch

- ForexLive.com

- Francesc Riverola

- Francis Hunt

- fraud

- fund manager

- Fundamental Analysis

- funded

- funded trader

- funded trading

- FXCopy

- FXE

- FXStreet

- FXY

- GameStop

- Gaming

- Gann

- GBP

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/USD

- GLD

- Gold

- hedge fund

- high net worth individuals

- High-frequency trading

- Hugh Kimura

- Ideas Stream

- Inflation

- institutional traders

- Interest rates

- Interview

- investment

- investor

- James Glyde

- Jamie Saettele

- JapaneseYen

- Jim Rogers

- JJC

- journey

- JPY

- Kiana Danial

- KIWIDOLLAR

- leadership

- Lifestyle

- Liquidity

- London

- Lumber

- MAM

- Market Analysis

- Market Update

- Median Line

- Medium

- MetaQuotes

- MetaTrader

- Michael Buchbinder

- mindfulness

- Money Manager

- MT4

- MT5

- Myfxbook.

- NASDAQ

- news

- NFP

- NIKKEI

- NIKKIE

- NOK/JPY

- NZD

- NZD/JPY

- NZD/USD

- NZDDOLLAR

- Oil

- Online Education

- Pandemic

- performance

- Podcast

- Polkadot

- Pound

- pro trader

- Professional Trader

- professional traders

- prop

- prop firm

- prop trader

- prop trading

- Psychology

- QQQ

- Regulation

- Risk Management

- Russia

- S&P

- S&P 500

- S&P 500 Futures

- Sanctions

- Scandex

- Scandinavian Capital Markets

- Scandinavian Exchange

- security

- Short Squeeze

- Silver

- Simon Ree

- SLV

- SOL/USD

- SPOT

- SPOTSILVER

- SPX

- SPY

- Steve Ward

- Stock Market

- Stockholm

- Stocks

- Stop Loss

- Sweden

- Swedish Broker

- The Economist

- Thought Leadership

- Tim Racette

- tips

- TLT

- Trade War

- trader

- Traders

- traders community

- Trading

- Trading Analysis

- Trading Career

- Trading Journal

- Trading Pairs

- Trading Psychology

- trading Signals

- Trading Strategies

- Trading Strategy

- Trading Technology

- Trading WTF

- Tradingview

- Transparency

- Trump

- Trust

- TULIP

- Turkish Lira

- U.S. 30 YR

- US Dollar

- US10YR

- USD

- USD/CAD

- USD/CHF

- USD/CNH

- USD/JPY

- USD/MXN

- USD/NOK

- USD/RUB

- USD/SEK

- USD/TRY

- USD/ZAR

- USDOLLAR

- USO

- UUP

- Valhala

- Valhalla

- Valhalla Alumni

- Volatility

- War

- wealth

- wealth management

- webinar

- White Label

- Women traders

- Wood

- XAG/USD

- XAU/USD

- XLK

- XLY

- Yen

- Young Traders

February 24, 2021

February 24, 2021

The recent GameStop ($GME) short squeeze situation dominated the news cycle for a few days in January and February this year and has been a recurring topic in the business and finance news journals.

February 24, 2021

February 24, 2021

February 24, 2021

NZDUSD has entered a massive zone (.7370-.7550). The bottom of the zone is defined by the November 2011 low and where the rally from the March 2020 low divides into Fibonacci proportion (2nd leg of the rally equals 61.8% of the first leg). The top of the zone is defined by the July 2017 high (also the 61.8% retrace of the decline from the 2011 high). RBNZ is tonight, which brings forth the potential for volatility and a reversal (or the beginning of a reversal process) from significant price levels.

February 24, 2021

February 22, 2021

February 22, 2021

Crude made a weekly key reversal last week at a defined level (underside of the trendline off of the 2016 and 2018 lows). This is also the level that provided resistance in 2015 before the plunge into the early 2016 low. The trend in the inflation trade (basically USD down) is strong but crude could come off from the current level.

February 22, 2021

February 18, 2021

February 18, 2021

1.2000ish remains a possible bounce level for EURUSD but I’d keep an eye on 1.2090-1.2100 for resistance now too. The level is defined by VWAPs from the November and February lows. These VWAPs were previously support. Now broken, watch the lines for resistance.

February 18, 2021

February 17, 2021

February 17, 2021

The Sortino Ratio shares many similarities with the Sharpe Ratio, except the Sortino Ratio offers much more insight into the risk associated with a given strategy or asset.

February 17, 2021

February 17, 2021

February 17, 2021

TLT has been tanking but is nearing a possible pivot from the center line of the channel from the March high. Daily RSI is 25.5. Magenta dots on the chart below show when RSI has been 25.5 or lower. Also, the 2016 is 143.36. This is an extremely important chart given the ‘inflation trade’ narrative. A bounce in TLT would indicate a pause/pullback in the in the nearly year long ‘inflation trade’.

February 17, 2021

February 17, 2021

February 17, 2021

Scandinavian Capital Markets joins forces with TradingView to take advantage of the popular charting platform’s new streaming feature. Michael Buchbinder hosts trading WTF (Where to Focus), […]

February 17, 2021

February 16, 2021

February 16, 2021

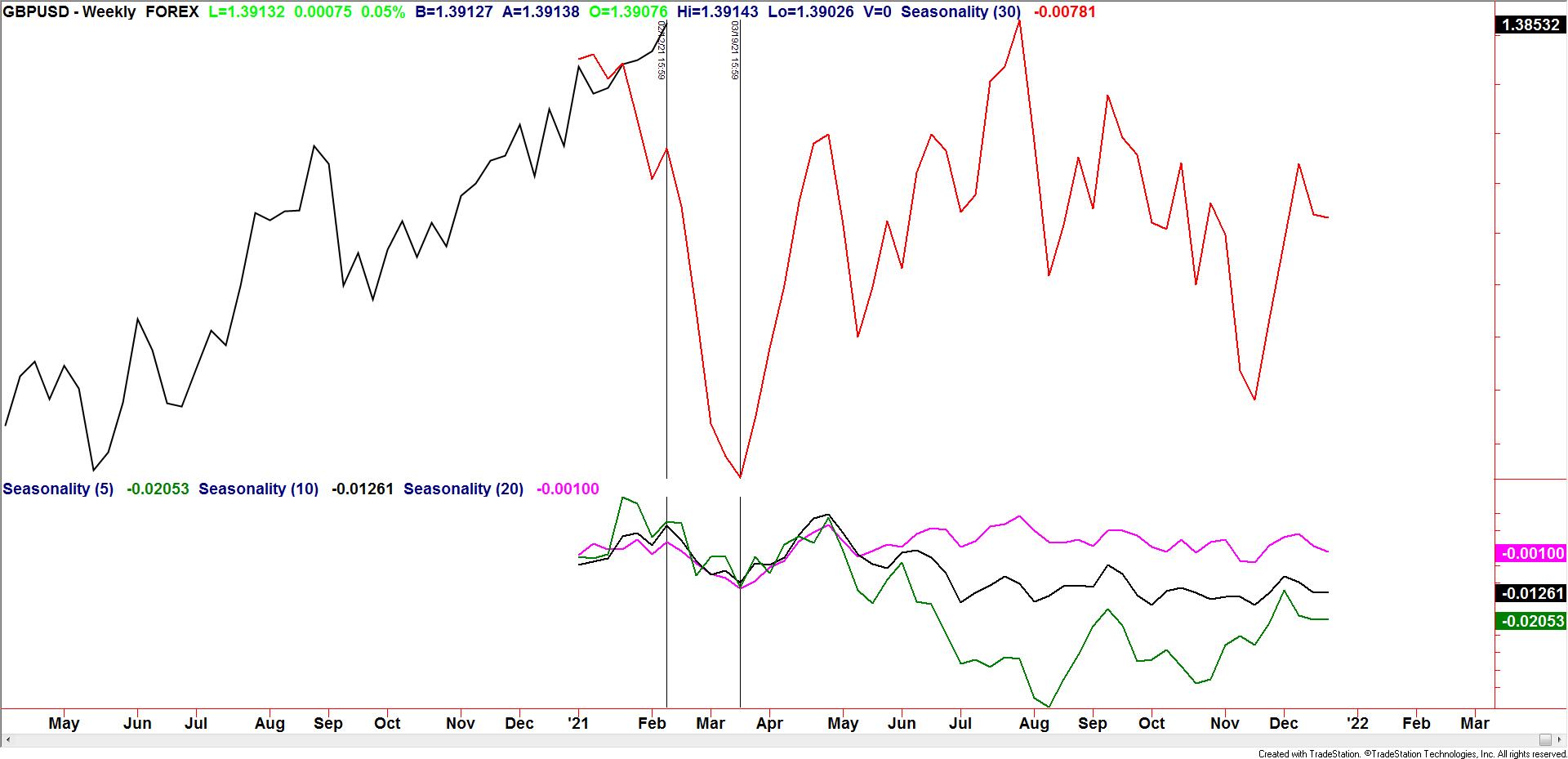

GBPUSD is nearing the critical 1.4000. The trendline off of the 2007 and 2014 highs is slightly above the BIG figure (see below). 2007…2014…2021 (7 year cycle)? Again, seasonal tendencies are extremely bearish through until the Vernal Equinox. I’m on alert for signs of a top near 1.4000.

February 16, 2021

February 14, 2021

February 14, 2021

In this episode of Trading WTF, Steve Ward, Jamie Saettele and host Michael Buchbinder dig into the overlaps and differences between gambling, betting and trading.

February 14, 2021