Where trading meets Swedish precision.

We built a platform designed to handle your growth. From raw spreads to unrestricted execution, discover the ecosystem where top traders thrive.

Institutional liquidity. Real market execution.

Trading tech

Forex trading platforms

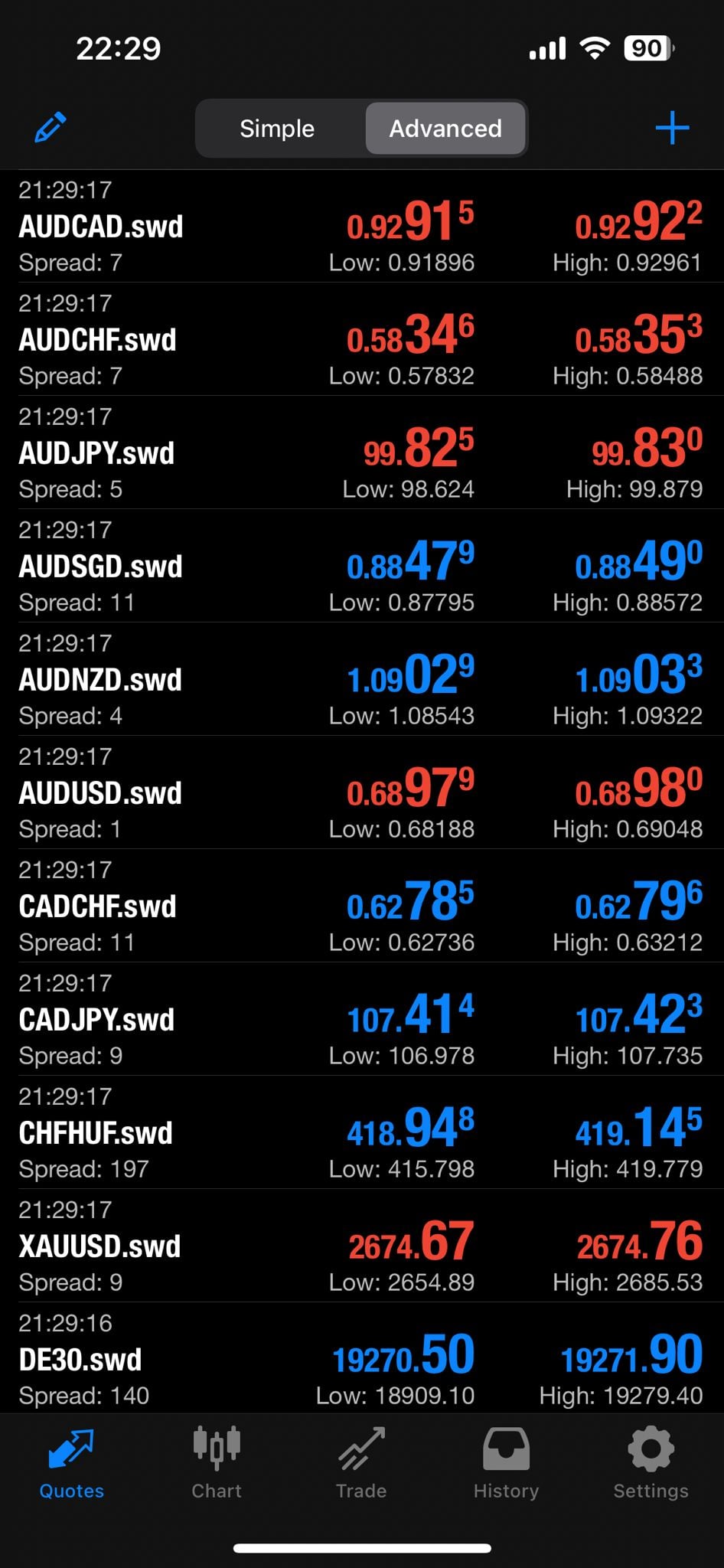

MetaTrader 4

The world’s most popular Forex platform, used by millions of traders across the globe

MetaTrader 5

The new and improved MetaTrader 5 offers more features and a fresher experience

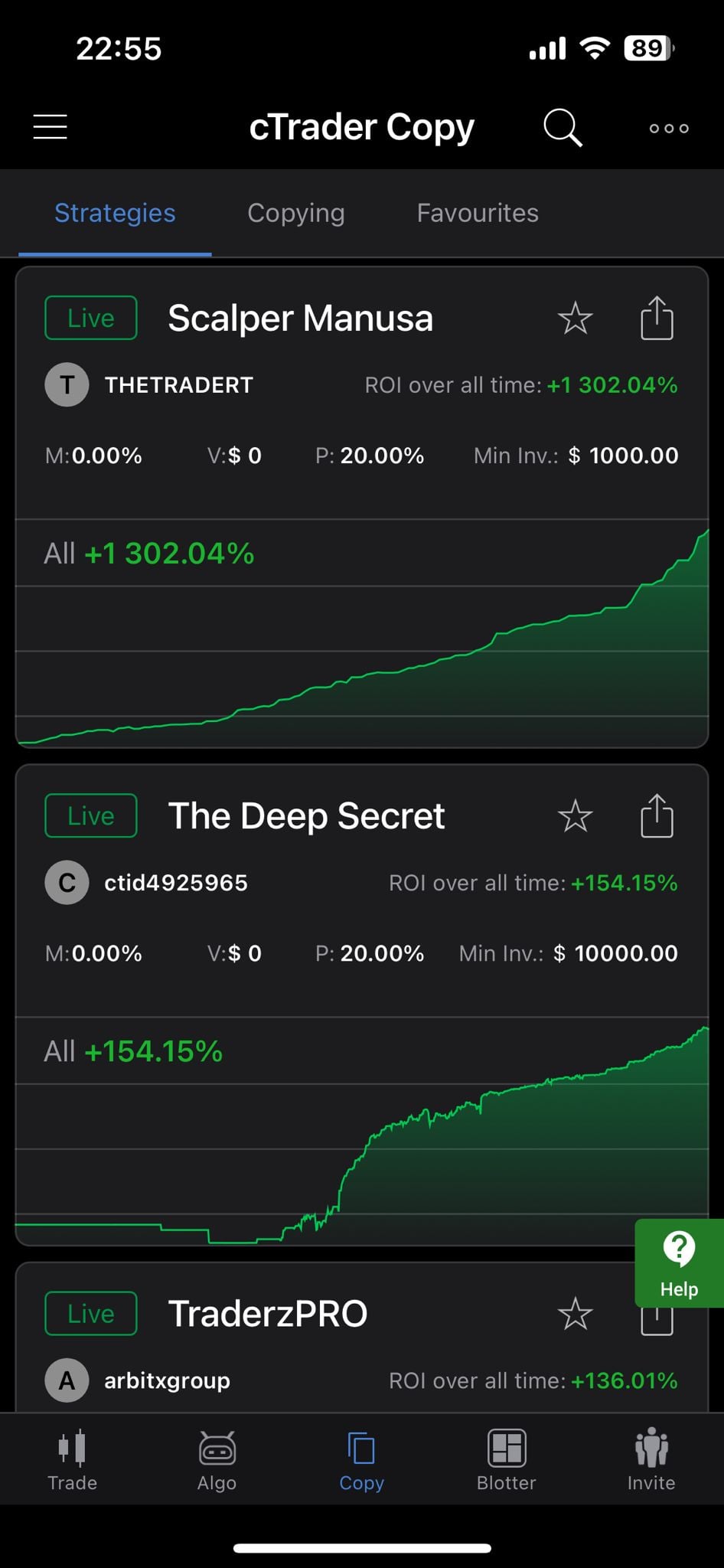

cTrader

Advanced trading platform with features geared towards sophisticated traders

Swedish heritage

Why Scandinavian Markets

Our modern business model is rooted in Scandinavian traditions, upholding the values of security, transparency, and honesty.

- LD4 & NY4 ECNs

- Direct market access enabled by ultra-fast, low-latency servers.

- Tier 1 banking

- Funds are maintained in segregated accounts within leading European banks.

- Premium support

- Our team of experienced FX professionals goes above and beyond to assist you with any queries.

- Advanced security.

- We adhere to stringent security protocols, including PCI DSS compliance and SSL-256 encryption.

- Powerful API.

- Access our liquidity directly via FIX API through MT4, MT5, or cTrader.

- Reporting database.

- Gain access to risk, liquidity, and trading reports.

Pricing

Transparent pricing

Every account we offer incorporates raw spreads and price feeds directly sourced from large banks and prime brokers.

Free foreverPlan

The essentials to test your strategy and our execution.

per lot RT

- Raw spreads

- 10 lot monthly threshold

GrowthPlan

Competitive market conditions for experienced traders.

per lot RT

- Raw spreads

- Unlimited volume

- Premium support

- FIX API

InstitutionalPlan

Dedicated trading infrastructure for financial institutions.

- Custom liquidity build

- Advanced analytics

- 1-hour, dedicated support response time

Discover how we can

improve your execution

Book a free 15-minute call with our analysts, to see how we can enhance your execution compared to your current broker.

.png)

.jpeg)

.jpeg)