Market Update 11/2 – USD Confused before FOMC

Market Update 11/1 – EURJPY Elliott Pattern and Trade Idea

November 2, 2021Market Update 11/3/2021 – Crude Breaks Down

November 4, 2021

Do you have what it takes to manage a $1,000,000 trading account?

Put your skills to the test and try out for the funded trader program.Do you have what it takes to manage a $1,000,000 trading account?

Put your skills to the test and try out for the funded trader program.USDOLLAR 4 HOUR

Clarity is lacking ahead of FOMC as it pertains to general USD direction. The ‘break’ lower in the USD last week proved false but one can make the case that action since September high is 5 waves down and 3 waves up. The rally has retraced 61.8% of the decline too so it’s possible that price resumes lower now. Confidence in direction is extremely low right now. Hopefully, this clears up post-FOMC.

EURUSD WEEKLY

The near term picture for EURUSD is a mess but don’t forget that price continues to hold the 200 week average and a well-defined long term horizontal zone. As such, any near term developments would be viewed with increased interest. At this point, that would mean establishing above 1.1700. For now, I see nothing to do.

USDCHF DAILY

USDCHF reversed higher as long as price is above this week’s low. .9200 could provide resistance now so it’ll be important to reassess when/if that level is reached.

11/1 – USDCHF is testing an important level right now. The level in question is the bottom of the channel that originates at the January low. Tops this year were made right at the center line. That’s usually a good indication that channel support will hold. If it does hold, then resistance is probably near .9200.

AUDUSD 4 HOUR

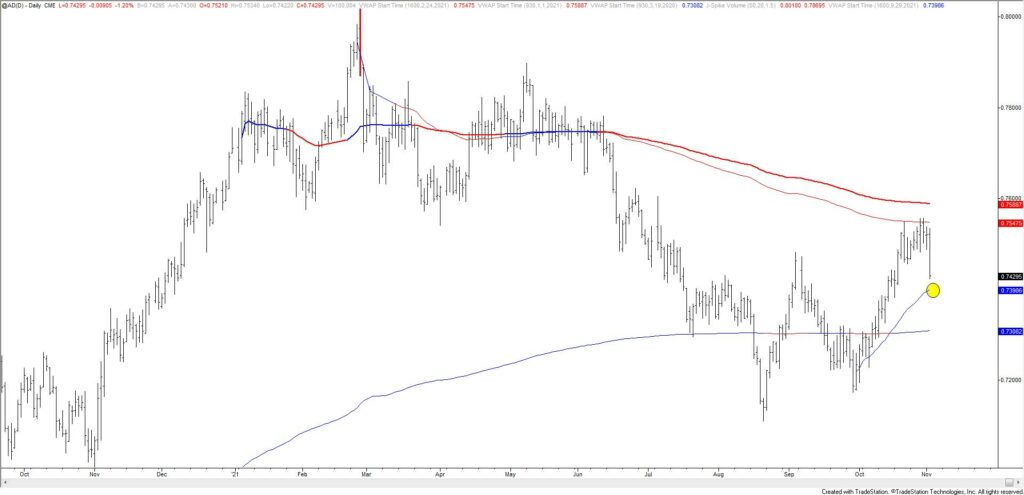

Aussie has pulled back sharply from the well-defined .7530/60s zone (too bad we didn’t get one more push higher before this drop). Pay close attention to .7400 for possible support. This is an important slope confluence and VWAP from the September low (see below).

10/26 – AUDUSD continues to drift sideways following the rally into 2 equal legs from the August low at .7542. Another push higher may be in store in order to tag the upper channel line near .7570. Note the February low at .7564 and 200 day average at .7558. Bottom line, I’m keen on the short side into in the event that Aussie tags and reacts near .7570 (or so).

AUSTRALIAN DOLLAR FUTURES DAILY

NZDUSD DAILY

I’m paying closer attention to Kiwi right now than Aussie due to the top side of the line off of the February and May highs. This line was resistance in September and is now in line for support near .7050. Essentially, the top side of the trendline is the re-test level in order to position to a much bigger upside move.

10/19 – NZDUSD has broken out. Similar to AUDUSD, price tagged the September high today so we could see a pause in the relentless move higher. If that happens, then watch for support near .7070-.7100. The next important level proposed resistance and a possible short is .7225/40s. This is 2 equal legs from the August low and channel resistance.