Education

October 29, 2020

October 29, 2020

The USDCNH, DXY non-confirmation nailed the turn again. Upside is favored for the USD over the next few weeks but there are reasons to suspect that the USD pulls back slightly (so maybe a bounce in equities too). USDCNH pattern is one of those reasons. The rally from the low is in 5 waves so expectations are for a 3 wave pullback. That pullback is underway. The proposed support zone is 6.6690-6.6880.

October 29, 2020

October 29, 2020

October 29, 2020

An announcement from the Australian Securities and Investment Commissions (ASIC) has confirmed new ASIC leverage restrictions in australia.

October 29, 2020

October 28, 2020

October 28, 2020

Bitcoin made a volume reversal today. The high was right at the top of a channel too. The longer term chart is extremely bullish but price could drop to back to 10,000 or just below and still be bullish on a longer term basis. Near term, the BTCUSD reversal lower doesn’t bode well for ‘risk assets’ in general. No, BTCUSD is not a ‘safe haven’. It’s been moving with everything else all year. The ONLY safe haven in the current environment is the USD (maybe Yen and US treasuries too).

October 28, 2020

October 28, 2020

October 28, 2020

It’s not just well-capitalised firms that can benefit from a tailormade price feed. Access to the best forex liquidity feed shouldn’t be exclusive to large institutions churning hundreds of lots per day.

October 28, 2020

October 27, 2020

October 27, 2020

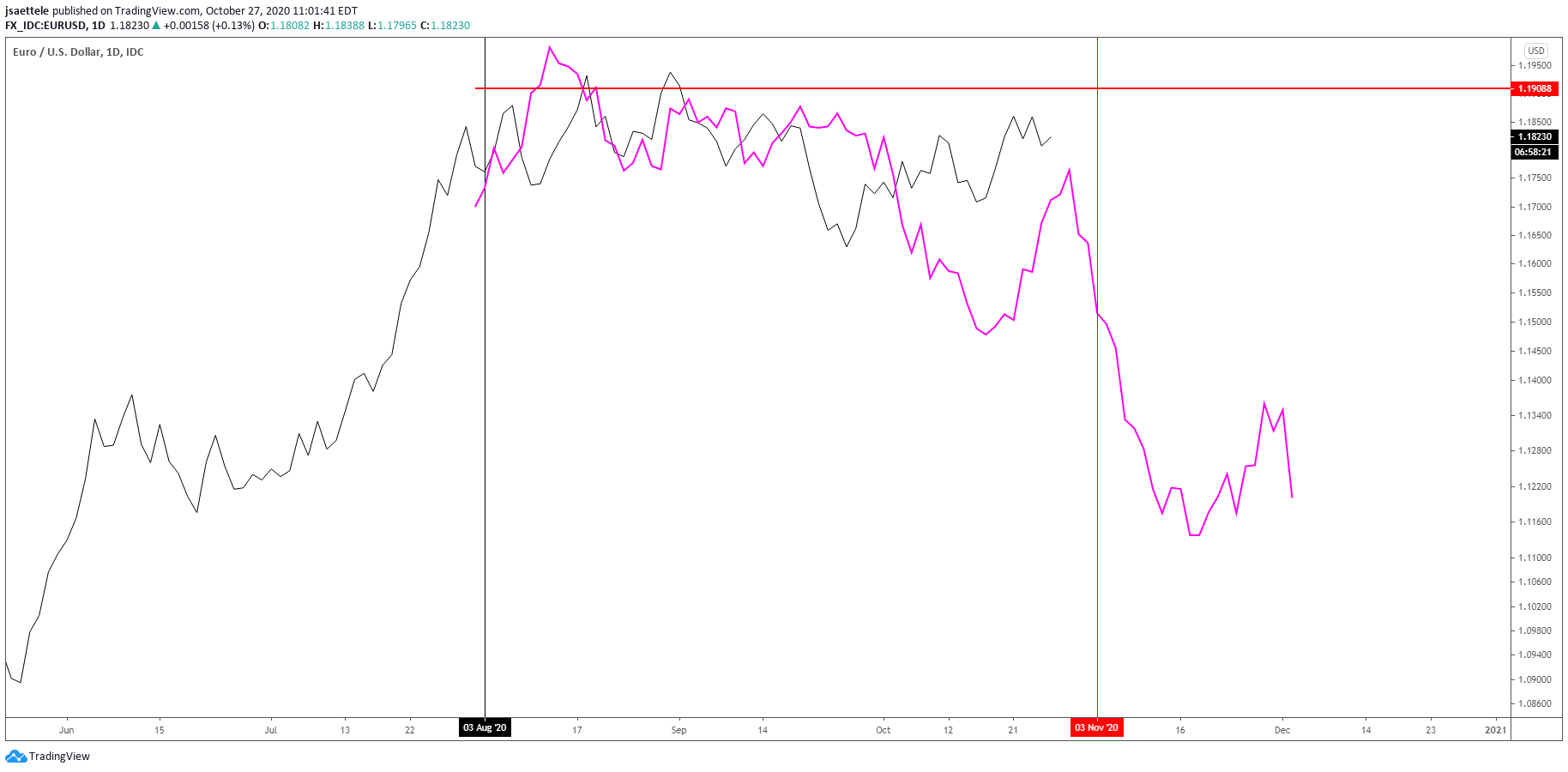

In case you haven’t heard, there are elections (president, congress, senate) in the U.S. next Tuesday, November 3rd. Do markets, notably the U.S. Dollar, tend to trade a certain way before and after U.S. presidential elections? In an attempt to answer this question, I plotted DXY in the 3 months leading up to and one month after every election since 1972 (blue for a Democratic win and Red for a Republican win). Each time series is compared to current DXY (in black). The vertical black line indicates election day. You’ll find these charts at the end of this report.

October 27, 2020

October 26, 2020

October 26, 2020

I’m treating the area around 11600 as near term bull/bear dividing line for Nasdaq futures. As long as price is below this level, I am looking lower. 10989 is a level to be aware of within the range with broader focus on 10300-10442. This is the 7/24 low and 2 equal legs down from the September high.

October 26, 2020

October 26, 2020

October 26, 2020

Brexit will render many capital markets laws obsolete. In particular cross-border passporting rights no longer allow access to EU markets.

October 26, 2020

October 23, 2020

October 23, 2020

2011-2014 trendline support in DXY held in September. Focus is higher as long as price is above that level. 96-97 is a general zone to look towards. This zone includes the 200 week average and center line of the channel from the 2011 low.

October 23, 2020

October 22, 2020

October 22, 2020

Bonds have been the big mover leading up to the U.S. election. TLT is under the 200 day average for the first time since December 2018. The next critical level to pay attention to is 153-154. This is the bottom of a short term channel, the June low, and the long term upper parallel from the channel that originates at the 2007 low (magenta line). The upper parallel nailed tops in 2012, 2015, and 2016 and the low in June. A long term chart is below. Expect the level to act as support BUT a break below would indicate a major behavior change in TLT (and bonds generally).

October 22, 2020