Education

June 16, 2020

June 16, 2020

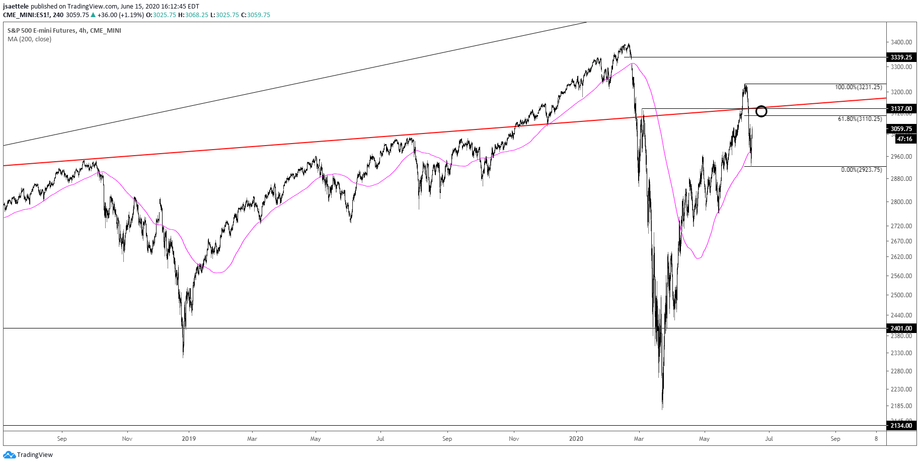

I’m thinking that ES carries into 3110/37 before encountering stronger resistance for another leg lower. The zone is defined by the 61.8% retrace and underside of the line that crosses pivots (high and lows) since 2018 (red line).

June 16, 2020

June 15, 2020

June 15, 2020

My view is that the USDOLLAR bounce is counter trend but it should carry higher before rolling over. The upper parallel of the Schiff fork is a candidate for resistance along with the 61.8% retrace of the decline from 5/18 at 12428. Watch for support from 12304 (more or less now).

June 15, 2020

June 13, 2020

June 13, 2020

Scand.Ex is pleased to present the next video with trading analysis by Jamie Saettele, our Chief Technical Analyst.

June 13, 2020

June 12, 2020

June 12, 2020

Finally something else besides ‘melt-up’. Index action in 2020 is basically straight up or straight down. Once the market picks a direction, it goes quickly in that direction without much of a counter reaction. In ES, pay attention to 2976 for a bounce. If it does bounce, then note 3065 for resistance. IF a larger reaction materializes (which would be a change) then 3137 should provide resistance.

June 12, 2020

June 11, 2020

June 11, 2020

Every trade can be quantified in the degree of their being Good Trades or Bad Trades. Read this article by our guest blogger Abe Cofnas to understand how to evaluate your trade.

June 11, 2020

June 11, 2020

June 11, 2020

The US dollar advanced against risk-sensitive currencies including the Australian dollar, New Zealand dollar and Canadian dollar in early trading on Thursday. The move came after a gloomy economic forecast from the Fed and reports of rising coronavirus cases in the US.

June 11, 2020

June 11, 2020

June 11, 2020

QQQ is running into lines that extend off of highs over the last 9 years. A close-up view is below. The red line extends off of the December 2014 and March 2018 highs. That line was resistance for the August 2018 and February tops. It was reached today. The line that originates at the February 2011 high is slightly higher…about 251.70 in QQQ.

June 11, 2020

June 11, 2020

June 11, 2020

Scand.Ex is pleased to present the next video with trading analysis by Jamie Saettele, our Chief Technical Analyst.

June 11, 2020

June 10, 2020

June 10, 2020

Stephen Roach, former Morgan Stanley economist and currently employed by Yale, published A Crash in the Dollar Is Coming yesterday. He may be correct but these types of articles are usually published at near term price extremes (in this case a USD low). Technically, this is the perfect spot (December low) for a bounce. Also, DXY made a slight new low today but EURUSD did not make a new high. This non-confirmation is typical at turns. Back to 98.27 or so wouldn’t be a surprise. Finally, consider the extreme short term sentiment readings (DSI readings from Monday) in front of FOMC on Wednesday. The narrative heading into FOMC is that there is no limit to the Fed’s balance sheet. What else can they say that would ‘surprise’ markets in that direction? Risk for tomorrow seems like a classic ‘sell the news’ event.

June 10, 2020