Gold Advances Ahead of FOMC Meeting

Market Update – June 9

June 9, 2020Market Update – June 10

June 10, 2020

Gold crept higher in early Tuesday trading, lifted by a weaker US dollar as investors eye the Federal Reserve meeting set to conclude on Wednesday. Meanwhile, increased risk appetite and robust equity markets threaten to keep a lid on the yellow metal’s price.

US stocks rallied on Monday, with the S&P 500 entering positive territory for 2020 and the Nasdaq reaching a record high. The surge in equities was fueled by optimism over a faster than expected economic recovery from the fallout of the Covid-19 pandemic and a better than anticipated US employment report on Friday.

The economic highlight of the week is the two-day Federal Open Market Committee (FOMC) meeting. On Wednesday, the policy statement will be announced and followed by a virtual press conderence with Fed Chair Jerome Powell. Analysts expect that the US central bank will keep interest rates on hold, between 0% to 0.25%. Low interest rates make gold, a non-yielding asset, more appealing as an investment.

The US dollar index remained near a 3-month low on Tuesday, following a long string of losing days starting in late May. The US dollar typically has a negative correlation with gold over the long term and when the dollar is weak it makes gold cheaper in other currencies.

Data from Johns Hopkins University indicates that coronavirus COVID-19 global cases have risen to 7,121,700 with 406,615 fatalities. Hopes were lifted after the World Health Organization (WHO) said that asymptomatic spread of coronavirus is ‘very rare.’ On Monday, Maria Van Kerkhove, the WHO technical lead for coronavirus response said: “From the data we have, it still seems to be rare that an asymptomatic person actually transmits onward to a secondary individual.”

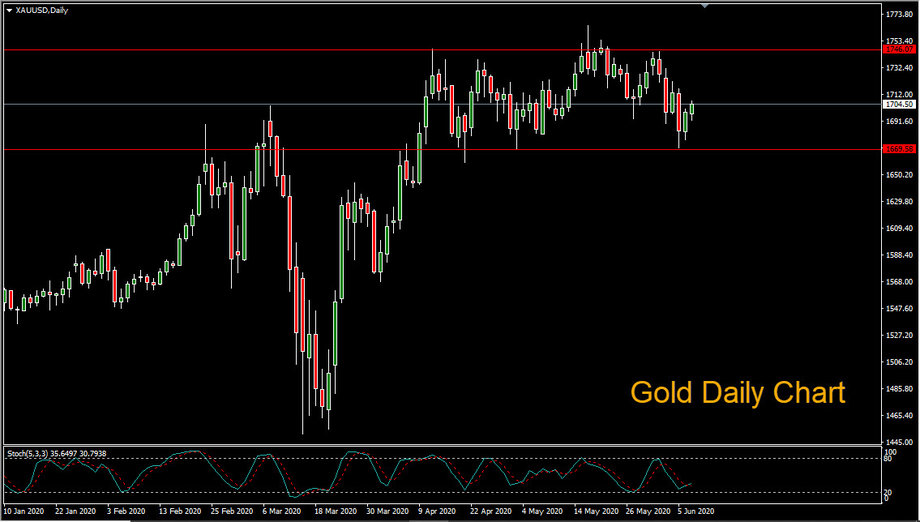

Looking at the gold daily chart we can see that horizontal support lies below at 1,669 and horizontal resistance sits above at 1,746. Bulls look to the recent high of 1,765 and gold currently holds above the key psychological level of 1,700.