Education

April 23, 2020

April 23, 2020

Chief Technical Strategist Jamie Saettele takes a deep dive into the gold market, going back to the end of the Bretton Woods era.

April 23, 2020

April 23, 2020

April 23, 2020

Resistance was hit today in gold. Futures printed a high of 1742.40 and spot traded 1718.70 at its best level. I obviously don’t know for certain if that was the end of the rally but it is a good sign (for a bear) that price reacted where it should have. I am bearish but not yet short. A break below the line that connects lows since 4/21 (not shown here but can be drawn on an intraday chart) would serve as the signal to short.

April 23, 2020

April 22, 2020

April 22, 2020

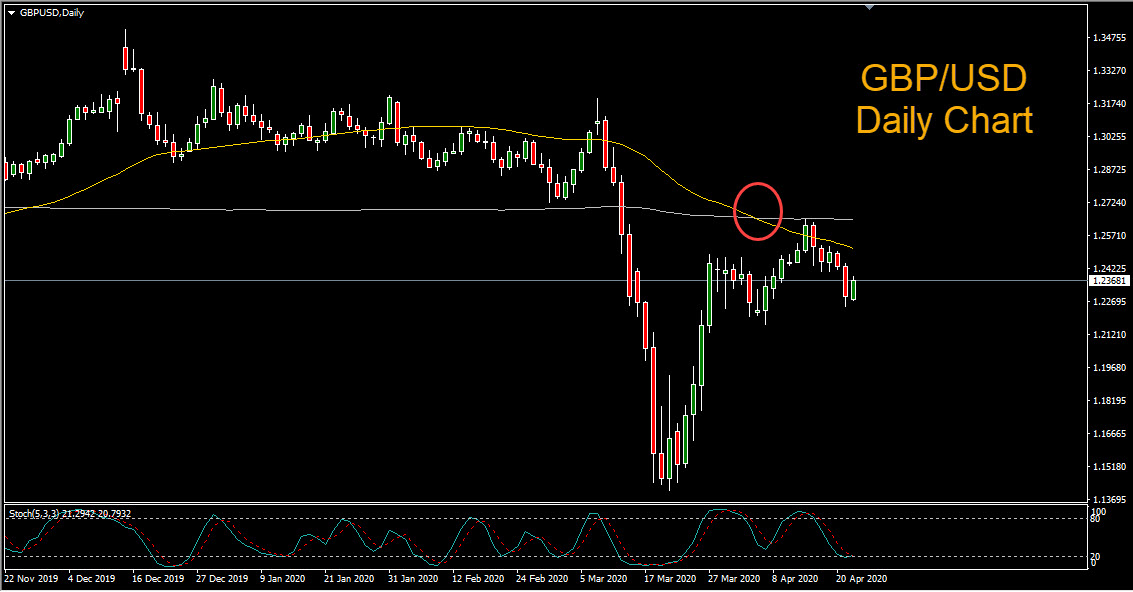

Cable staged a modest rebound in early trading on Wednesday, after falling to a two week low on Tuesday. The US dollar was broadly boosted by […]

April 22, 2020

April 22, 2020

April 22, 2020

Today’s ES break confirms the rally from the March low as a wedge. The implication is that the March low will eventually be re-tested. Near term, I’d still watch for a bounce from 2600/30. Proposed resistance is now the underside of the broken wedge line at 2808.

April 22, 2020

April 21, 2020

April 21, 2020

Remember the 4 hour volume reversal on 4/9? ES failed to follow through on that reversal but price is back to that level. 2923/48 wasn’t reached but the rally from the March low consist of 2 equal waves…exactly. So, there is reason to ‘think’ that a countertrend rally is complete. Pay attention to 2770, which is the trendline from the low and VWAP from the February high. A break below there would also leave the rally from March as a bearish wedge, which would suggest an eventual re-test of the low. The next immediate spot to watch then would be 2600/30 (VWAP from the low and recent resistance and support).

April 21, 2020

April 20, 2020

April 20, 2020

Gold reversed from massive resistance last week (long term parallel is shown on the weekly chart below). I am bearish…at least near term. If the decline from last week’s high unfolds in 5 waves, then I’d be confidently bearish against the high and look to short a rally. For now, just know that levels to watch are 1672.50 for support (keep in mind that this is futures and not spot) and 1724.20 for resistance.

April 20, 2020

April 17, 2020

April 17, 2020

Adam Button is the Chief Currency Analyst and Managing Editor at ForexLive.com, which stands among the most visited forex websites online. The site is popular among both retail and professional traders for its 24 hour coverage of news and astute market analysis.

April 17, 2020

April 17, 2020

April 17, 2020

Traders and investors across the globe need to understand what to look for in their partners. With plenty of scams out there, you can protect yourself with a little bit of knowledge.

April 17, 2020

April 17, 2020

April 17, 2020

Scand.Ex is pleased to present a video format of Trading Analysis to empower traders and equip them with the latest updates and first-hand knowledge from leading market experts.

April 17, 2020